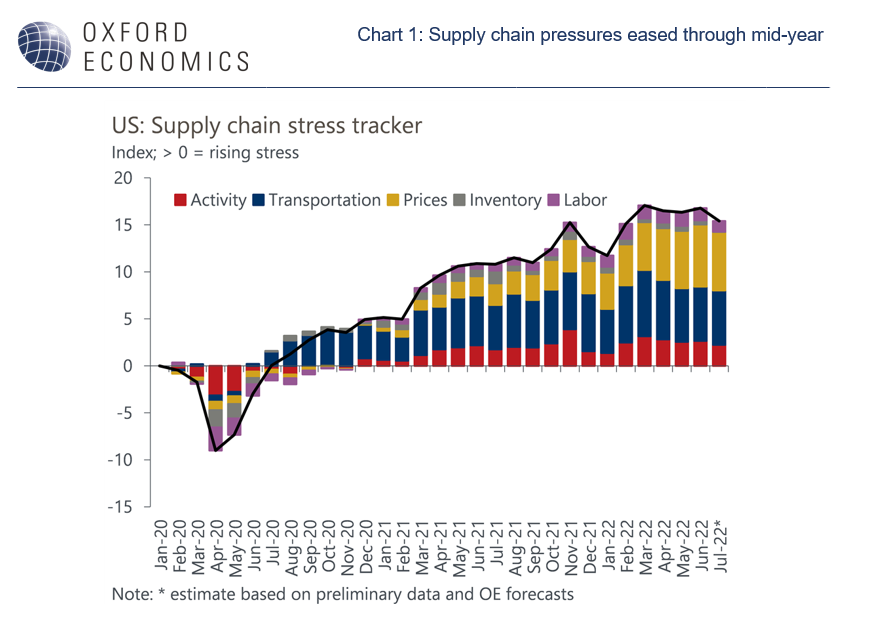

Improving supply chain conditions kick off H2 in the US

Supply-chain conditions in the US offered encouraging signs to start Q3, according to our supply chain tracker. Inflationary pressures ebbed and logistics challenges eased. Labor market dynamics improved while inventories maintained their ascent. Cooler activity resulted in a healthier balance between demand and supply.

What you will learn:

- Commodity prices declined 8% on average in July, and regional Fed and ISM surveys signaled lower price pressures. Costs will remain high in H2 2022, but we should see inflation prints start to come down as demand begins to align with supply.

-

Cargo ship backlogs in Southern California declined for the sixth straight month, and other modes of transport also signaled reduced stress. Shipping prices were flat or fell. Conditions are improving, but geopolitical risks continue to cast a shadow over logistics.

-

Labor market conditions were heartening as the economy created a robust 528k jobs, and overtime hours fell again. We look for reduced consumer demand, high costs, and lower profitability to bring worker demand and supply into greater equilibrium.

Tags:

Related Services

Post

Global industry braces for mixed impact from Trumponomics’ triple whammy

Fundamental forces including demographics, Ai, geopolitics and climate change play a key role in building resilience into long-term CRE investment strategies. Our research shows that advanced economies are generally better positioned for the critical megatrends. Australia, Singapore and the UK are the top three most resilient CRE markets, each with unique strengths.

Find Out More

Post

Reuters: Sharp downgrades to US unit labor costs bode well for inflation outlook

"The labor market and wage growth are receding as a source of inflationary pressures," said Nancy Vanden Houten, Lead US Economist at Oxford Economics.

Find Out More

Post

Euro-dollar has hit the floor, but don’t expect a bounce

We expect the euro to stabilise against the dollar and trade around its current levels over the next year. Economic fundamentals point to some support to the currency after the sharp, recent depreciation, but heightened uncertainty continues to pose a key downside risk.

Find Out More