Blog | 29 Apr 2021

In the 5th Industrial Revolution, creativity must meet technology

Kiki Sondh

Economist

The health crisis has wreaked havoc on global supply chains. Lockdowns, restrictions on movement and quarantine regulations have disrupted conventional working practices and put pressure on manufacturers to adapt industrial processes to stay afloat. The tables have turned from survival of the fittest to survival of the quickest—those who wish to remain competitive must embrace the latest technologies, adjust their business models, and innovate.

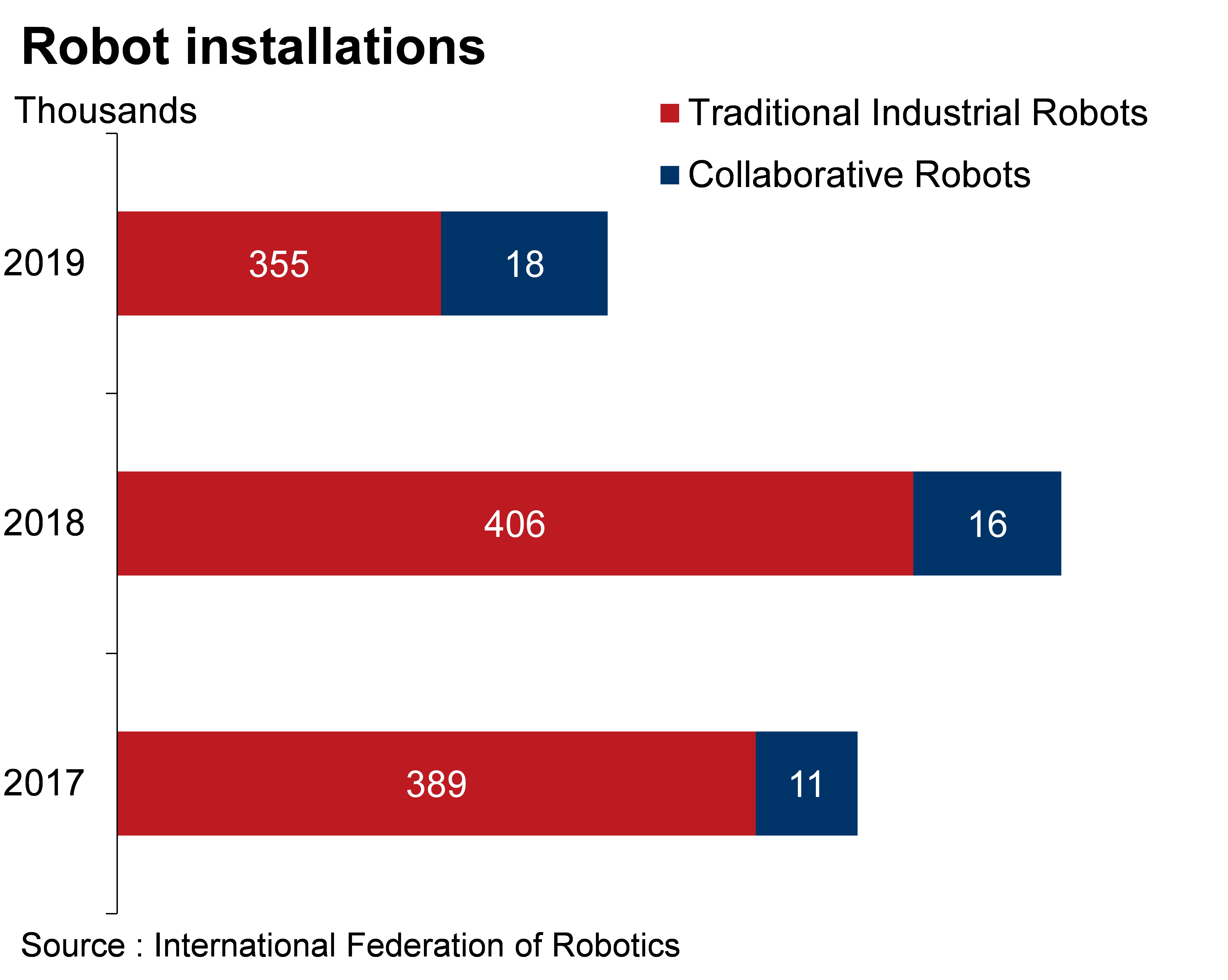

The pandemic has accelerated the rise of robotics, digitalisation and the onset of Industry 5.0. Like Industry 4.0, which focusses on the use of Artificial Intelligence (AI), Big Data and the Internet of Things (IoT), Industry 5.0 embodies these systems and incorporates greater human intelligence. The main difference between the 4th and 5th industrial revolutions is that Industry 5.0 seeks to foster a more balanced working relationship between increasingly smart technologies and humans. Rather than humans competing with robots for jobs, as feared with the arrival of Industry 4.0, humans are now envisioned to collaborate with them. These cobots—collaborative robots—are to be integrated into industrial processes for more repetitive and mundane tasks, providing humans with greater opportunities to use their creative flair.

Creativity has been crucial amid the pandemic, especially due to the rise in e-commerce. Businesses have had to think of and find means to connect with consumers in ways they have not done so before. The concept of personalisation—with big data at its heart—is set to become a key driver in transforming the online shopping experience. By understanding data on consumers’ needs and preferences, employees have the ability to create personalised solutions, implemented with the help of smart technologies. This can already be seen across certain industries: in cosmetics, for example, L’Oréal will soon introduce Perso—a handheld mobile device that uses AI technology to assess the complexion of the user. Personalised beauty and skin care blends are then generated and produced with the help of a small 3D printer.

Creativity has been crucial amid the pandemic, especially due to the rise in e-commerce. Businesses have had to think of and find means to connect with consumers in ways they have not done so before. The concept of personalisation—with big data at its heart—is set to become a key driver in transforming the online shopping experience. By understanding data on consumers’ needs and preferences, employees have the ability to create personalised solutions, implemented with the help of smart technologies. This can already be seen across certain industries: in cosmetics, for example, L’Oréal will soon introduce Perso—a handheld mobile device that uses AI technology to assess the complexion of the user. Personalised beauty and skin care blends are then generated and produced with the help of a small 3D printer.

Over the past year, where patient information has been available, the healthcare industry has increasingly incorporated such technologies to provide personalised care to patients. The end of last year saw Covvi, a bionic prosthetics company, enter into a partnership with Glaze Prosthetics with the aim to expand into a range of customisable 3D printed limbs. This trend will likely continue in the sector, with healthcare professionals using their expertise to examine patient records and then turning to smart technologies for custom treatments such as individualised artificial organs.

As Industry 5.0 develops we are sure to see many more innovations across industries. But it will not be enough to merely automate tasks or digitize processes—the best and most successful companies will be those that can marry the twin forces of technology and human creativity.

Tags:

You may be interested in

Post

KPMG M&A Outlook 2026: Between Uncertainty, Resilience, and Seizing Opportunities

Discover how Germany’s M&A landscape is evolving – with a focus on growth, AI and post-merger value creation.

Find Out More

Post

Silver, the next generation metal

This report highlights the critical role silver plays in data centres and artificial intelligence (AI), automotive and electric vehicles (EVs), and solar energy photovoltaics (PVs). With these sectors expected to expand significantly over the coming years, we expect future silver demand to be strong.

Find Out More

Post

Powering the UK Data Boom: The Nuclear Solution to the UK’s Data Centre Energy Crunch

The UK’s data centre sector is expanding rapidly as digitalisation, cloud computing, and artificial intelligence (AI) drive surging demand for high-performance computing infrastructure.

Find Out More

Post

Are humanoid robots creepy?

Some very smart people are betting that machines shaped like humans will do much of our household and factory work for us in the near-ish future. But hurdles remain.

Find Out More