Indian and Australian cities to outpace rivals over 2024-28

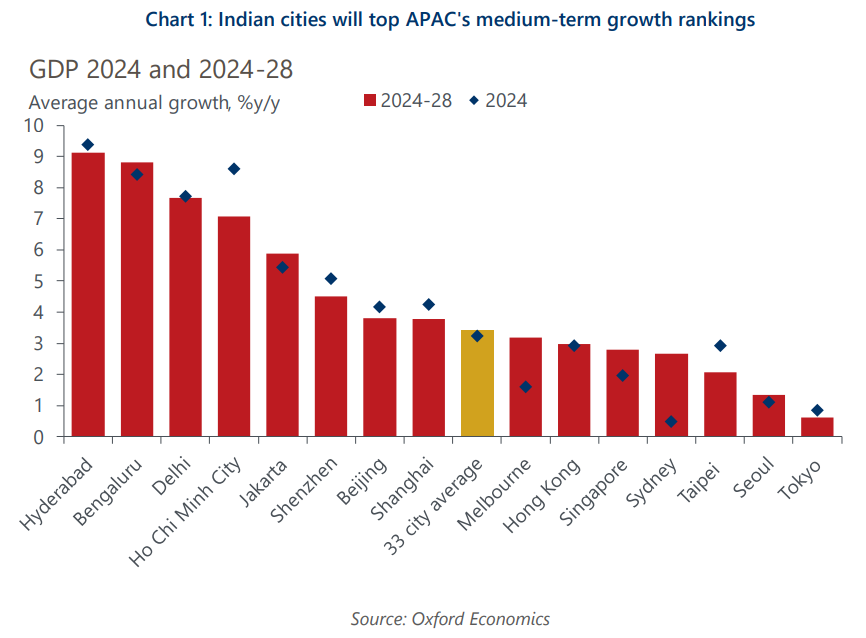

We forecast Indian cities to outpace the rest of APAC in terms of GDP growth over the medium term (2024-28). Southeast Asian cities such as Ho Chi Minh City and Jakarta will come close to matching Indian cities and will outperform Chinese ones. Among advanced APAC cities, we expect that Australian ones will fill the top two positions in terms of medium-run GDP growth.

What you will learn:

- We think leading Southeast Asian cities will achieve faster GDP growth rates than China’s key ones. This break from the past is driven by Chinese cities’ downshift in growth, but also by the rise of Southeast Asian cities as regional growth engines.

- In Australia, we forecast Perth and Melbourne’s economies to grow at high rates. That reflects the strong medium-term prospects of Perth’s mining sector and of Melbourne’s business services sector, but also momentum in healthcare due to the rapidly expanding populations in both cities.

- For some APAC cities, GDP gains should translate into sustained employment growth, thanks to migration. We forecast Bengaluru will continue to attract skilled workers from the rest of India, while Melbourne should benefit from resilient foreign migrant inflows.

- However, in some cities, such as Seoul and Taipei, declining working age populations will pose an increasing challenge to employment, causing the latter to fall in 10 major cities over 2024-28.

Tags:

Related Posts

Post

All US metros worse off from recent tariff announcements

President Trump's recent tariff announcements, and the global response, have meant a fast-changing policy landscape with significant effects on our global, national, and subnational outlook.

Find Out More

Post

US tariffs drag on growth prospects for Asian cities

Cities and regions where we expect the largest downgrades to GDP growth over 2025–2026 are those with higher concentrations of economic activity in export manufacturing—especially those facing targeted US tariffs and those vulnerable to the second-round effects of lower global demand. Lower global trade and industrial activity will also affect regional logistics and transport hubs.

Find Out More

Post

Which regions are most exposed to the 25% automotive tariffs?

While the automotive tariffs will likely lead to some production being reshored to US plants, they will also raise costs for US manufacturers and households.

Find Out More