Indonesia likely to miss fiscal target in 2023

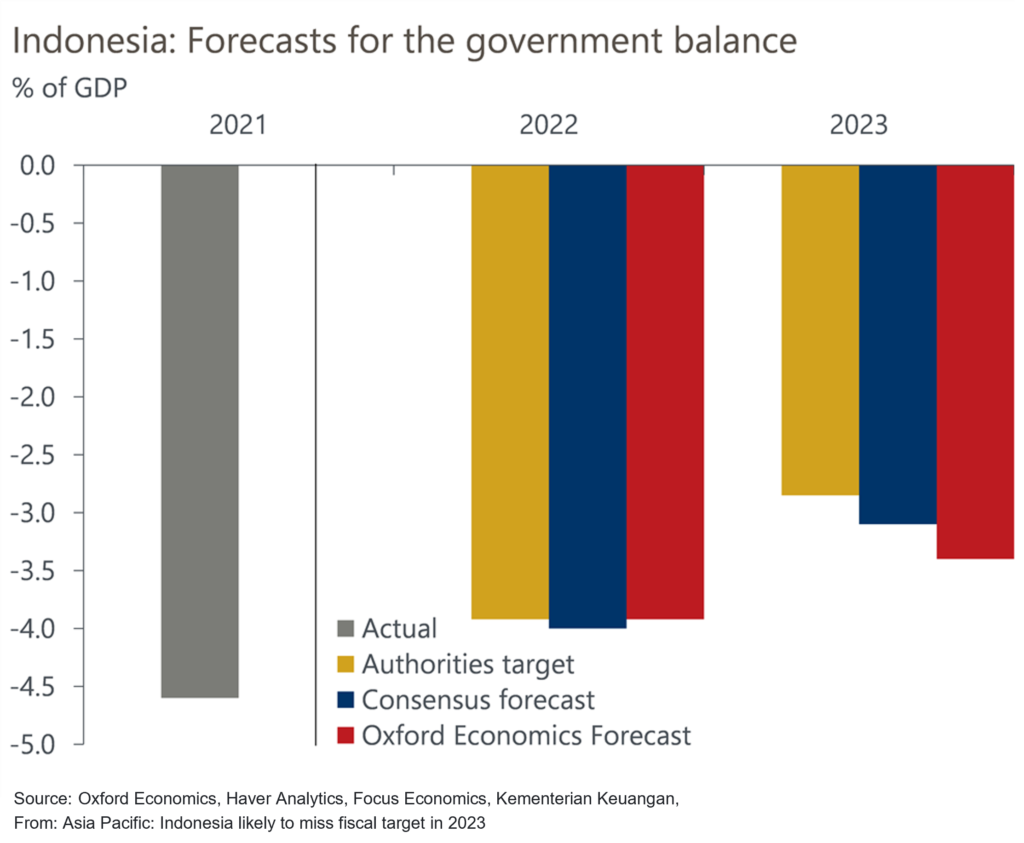

We expect Indonesia’s budget balance to show a large deficit in H2 of this year as the cost of fuel subsidies is finally reflected in the fiscal accounts. And we forecast the budget deficit to narrow to 3.4% of GDP in 2023 from 3.9% this year, versus the government target of 2.85%.

What you will learn:

- This year, Indonesia recorded its first H1 budget surplus since 2011 with recent figures showing continued surplus in July and August. The marked turnaround in the fiscal position so far this year is down to both soft expenditure and soaring revenues. But the data do not give a full picture of the underlying fiscal situation.

- The issue is that much of the cost of fuel subsidies is yet to be reflected. In Indonesia, most subsidies are delivered through administered prices. The state-owned distributors are then reimbursed by the government for their losses, usually at the end of the year or in the following year.

- We believe Indonesia’s government fiscal consolidation in 2023 likely to fall short of plans. The subsidy bill is likely to fall more slowly than the government is expecting in its 2023 budget, based on our higher assumption for global oil prices. In addition, the government’s revenue projections look too optimistic, with tax collection forecasts not fully reflecting the likely negative impact of the recent fuel price hike on GDP growth.

Tags:

Related Resouces

Post

Using economics to improve business dialogue with governments in Asia

In Oxford Economics’ Singapore office, overlooking the historic Singapore river, we count as our neighbours the Asian headquarters of most the world’s major multinational companies.

Find Out More

Post

Helping Us Help Them: Lessons from Five Years Consulting with Asia-based Clients

This “winter” marks my fifth year in Asia, after moving from London to Singapore to help build Oxford Economics’ consulting business in the Asian market.

Find Out More

Post

Asia Key Themes 2025: Global shocks and domestic resilience

Most likely, 2025 could well be a year of slower growth and more stubborn inflation for Asia than most believe.

Find Out More