Japan’s older households to support spending under higher rates

The resilience of consumption is essential to support sustained wage-driven inflation and the Bank of Japan’s rate hikes. We see little risk of spending faltering due to the projected gradual rate hikes to 1% because the ageing of society has made households’ balance sheets less vulnerable to rate increases.

What you will learn:

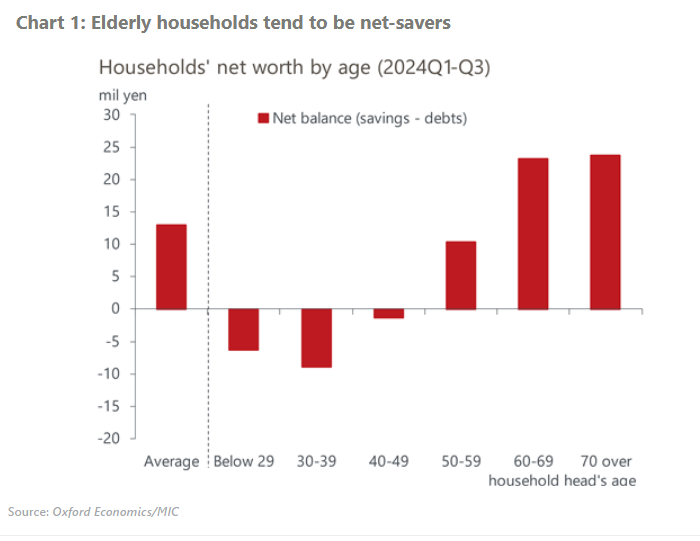

- Today, 35% of the Japanese population is older than 60, while their share of the consumption market is about half. We think their consumption will remain firm, given they tend to be net savers, implying that higher interest rates will have positive impacts on their balance sheets. For retired households, stable gains in pension benefits are also supportive.

- In contrast, households in their 30s and 40s tend to be net debtors due to large mortgage balances that are overwhelmingly floating rate loans, making them vulnerable to higher rates. At the same time, they benefit from pay rises which will likely outweigh the increased interest expenses in our baseline projection.

- We think that risks to consumption outlooks are tilted toward the downside. Supply-driven inflation could hamper households’ real income recoveries, if it proves more persistent than projected. Uncertainly about inflation and interest rates could increase precautionary savings by younger generations, which have been on a trend rise in the past years.

Tags:

Related Posts

25% auto tariffs especially painful in Japan and South Korea

US tariffs of 25% on all automobile and auto parts will weigh heavily on the Japanese and South Korean automotive sectors. A GTAP analysis suggests Japanese and South Korean automotive production will each shrink by approximately 7%. The impact is larger than suggested by bilateral trade data, because vehicles assembled in other countries before being shipped to the US will also be affected, dampening domestic auto parts production.

Find Out More

‘Liberation Day’ 24% tariff will limit Japan’s growth

The 'Liberation Day' tariffs, together with separately announced higher tariffs on auto imports to the US, will lead us to cut our growth forecast for Japan. The direct impact of the tariffs will end the modest growth we projected in March, and we now think the economy will barely grow in 2025-2026. This initial estimate does not consider the indirect impact from high trade policy uncertainty and retaliation from other economies.

Find Out More

Japan’s on course for July rate hike, but risk of June increases

The Bank of Japan (BoJ) kept its policy rate at 0.50% at Wednesday's meeting, as expected. Despite a marginally higher increase in pay than last year at the first round of the spring wage negotiations, our baseline view is for the BoJ to hike its policy rate only gradually due to concerns about the capacity of small firms to raise wages and the lacklustre rate of consumption.

Find Out More