Global Key Themes 2024 – Few opportunities in a gloomy landscape

Global GDP growth and inflation will slow in 2024 and central banks will begin to pivot in H2 – at least that seems to be the broad agreement among markets, policymakers, and forecasters. For the most part, we concur and have identified three key themes that will be key to the precise path that economies and financial markets take next year.

This 6-page research report expands on these key themes:

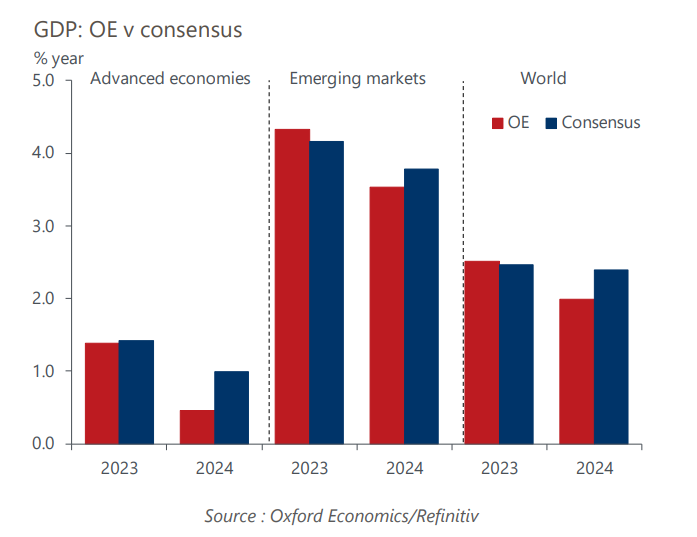

- Risks to the consensus growth view are skewed to the downside. Our baseline global GDP growth forecast for 2024 is below consensus. One key risk factor is ‘payback’ next year for US and Chinese households front-loading spending in early 2023.

- Another factor is the likely ebbing next year of the surprise strength of some interest-rate sensitive sectors, in part due to monetary policy taking longer to feed through to the real economy. Fiscal policy also is on track to tighten in 2024 and will start to push in the same direction as monetary policy.

- Inflation trends will diverge more. Despite being more pessimistic on the growth outlook, we expect inflation in most economies to remain sticky and fail to deliver any positive downward surprises. The key exception is the eurozone. There we think inflation will fall more sharply than others expect, driven mainly by weaker energy and food inflation.

Tags:

More Research

Post

Economic Outlook Conference 2025: Shaping tomorrow: Economic growth pathways and a net zero future

It was fantastic to welcome our esteemed clients and guests to our economic forecasting conference in Sydney, Melbourne and online.

Find Out More

Post

Broad based rise in exports lifts trade balance in November in Australia

The solid rise in the trade balance in November was largely driven by stronger export values.

Find Out More

Post

Unemployment rate ended 2024 lower than it started in Australia

The rise in the unemployment rate in December does little to change the fact that the labour market is incredibly tight.

Find Out More