Blog | 01 Jun 2023

Leading indicators are flashing red for recession in Canada

Michael Davenport

Senior Economist, Canada

After stalling in Q4, the Canadian economy rebounded strongly in Q1 – blowing past the expectations of most forecasters at the start of this year. Consumers seemed to shrug off high interest rates and elevated inflation, while improved supply chains allowed for an increase in auto spending and a pick-up in exports. Labour markets have also shown impressive resilience, with the economy adding jobs at an average pace of 62,000 m/m so far this year, helping hold the unemployment rate at a near-record low 5%.

But just because the economy outperformed expectations in Q1, doesn’t mean it will continue to do so. Labour markets are a lagging indicator and say more about where the economy was in late 2022, rather than where it’s heading this year.

As the great Canadian hockey player Wayne Gretzky famously said “A good hockey player plays where the puck is. A great hockey player plays where the puck is going”. Along the same vein, we put more stock in leading indicators than lagging or coincident ones to help guide our forecasts, and several key leading indicators are flashing red for recession.

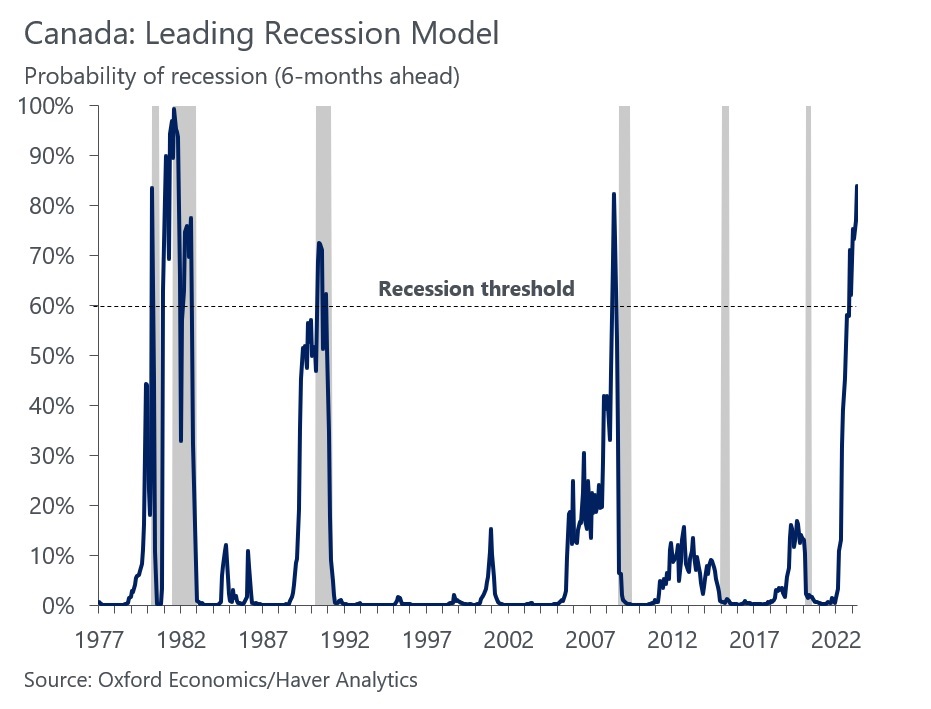

Our recession probability model has an excellent track record of predicting recessions, and points to very high odds of a downturn within the next six months. As of April, our Canada leading recession model (CLRM) suggests an 84% probability of a recession in the next two quarters. This is the highest since 1981, and well above the 60% threshold breached before four of the last five recessions. The CLRM has now been above this critical threshold for nine straight months. On average, recessions begin four months after our recession model rises above 60%, suggesting a recession is imminent.

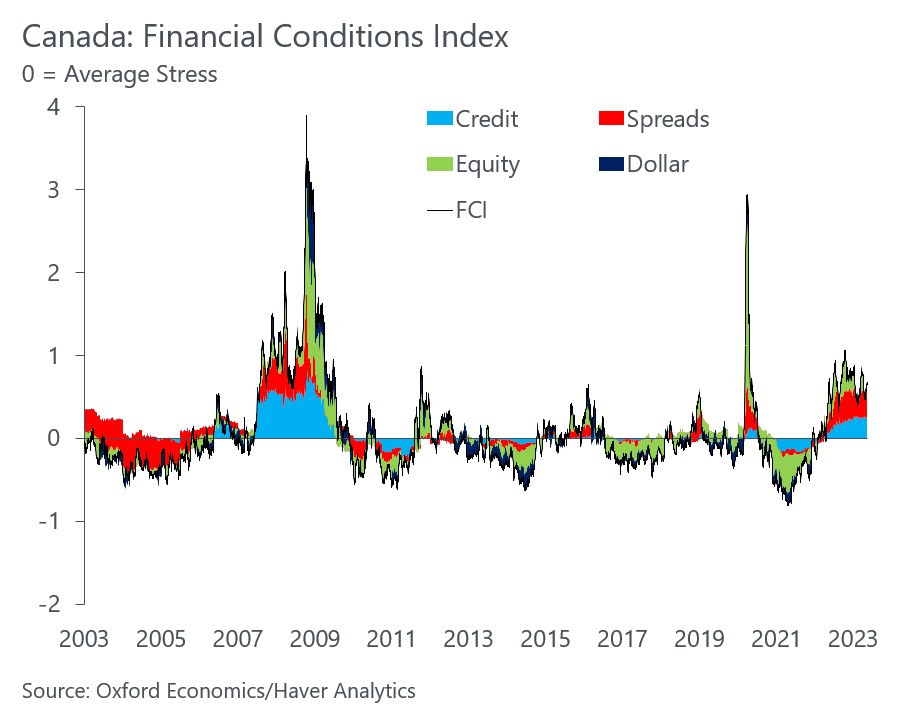

Following the BoC’s aggressive rate hiking campaign, Canada’s financial environment is the most restrictive it has been since the Global Financial Crisis (GFC). Over the past year, our Financial Conditions Index (FCI) has risen to the highest level since the GFC, aside from the pandemic. Like monetary policy, tighter financial conditions impact the economy with a lag, which makes them a useful leading indicator for economic growth. The deterioration in financial conditions is a key reason why we think the Canadian economy will slip into recession this year.

Our analysis has found that it takes about four to six quarters for the full impact of tighter financial conditions to work through the economy, meaning the full impact of the past years worsening in financial conditions won’t be felt until later this year. Canada’s economy is also expected to experience a quicker and larger hit from tighter financial conditions than other advanced economies, as elevated household debt and a more vulnerable housing sector make the economy sensitive to higher interest rates.

The Bank of Canada’s senior loan officer survey also shows lending standards are tightening for both households and businesses – a bad omen for credit growth. We expect lending conditions will tighten further as global banking stress lingers and the full impact of last year’s aggressive monetary policy tightening continues to flow through to the Canadian economy. This will constrict business investment, help drive another leg down in house prices, and restrain household spending, particularly for durable goods.

What’s more, our own survey of businesses shows over half of business’s view a major tightening of credit supply or financial crisis as the top risk to the global economy in the near term. Respondents foresee a 1-in-3 chance of a GFC-like financial crisis in the near term, and a third of businesses view a marked tightening in credit supply as the top near term risk to the global economy.

Finally, the OECD’s composite leading indicator, which has very good track record of identifying turning points in the economy, suggests a downturn is likely in 2023. The OECD’s CLI for Canada has steadily deteriorated since late-2021 and is now the lowest since the depths of the pandemic, and before that, the GFC.

Author

Michael Davenport

Senior Economist, Canada

Michael Davenport

Senior Economist, Canada

Toronto, Canada

Michael is a Senior Economist with a particular focus on the Canadian economy. He primarily supports the Director of Canada Economics in producing macroeconomic research and forecasts, monitoring the Canadian economy, and liaising with clients and the media.

Michael first joined Oxford Economics Canada as an Economic Research Analyst Intern in the Toronto office in early 2019 and has since been promoted to a Senior Economist. Michael holds a Bachelor of Arts in Economics and Financial Management from Wilfrid Laurier University and a Master of Arts in Economics from the University of Toronto.

Tags:

You may be interested in

Post

A deep dive into USMCA compliance, US tariffs and Canada

Early insights into US tariffs and their impact on Canadian goods

Find Out More

Post

The Future of Trade: Tariffs, Taxes, and Economic Trends

Amid ongoing global trade uncertainty, business leaders are struggling to plan ahead as new tariffs continue to reshape the market. Even so-called “locked-in” tariffs are proving to be temporary, adding to the unpredictability. Firms are cautious, waiting for clarity before committing to major investments. As global trade volumes decline, the importance of understanding every relevant trade tariff and accurately applying the correct HS code to imported goods becomes even more critical for managing costs and compliance.

Find Out More

Post

Tariffs and tensions are reshaping city economies

Tariff policies, rising geopolitical tensions and unprecedented uncertainty are putting pressure on cities and regions across the world.

Find Out More