Looser labour market could pave the way for faster rate cuts

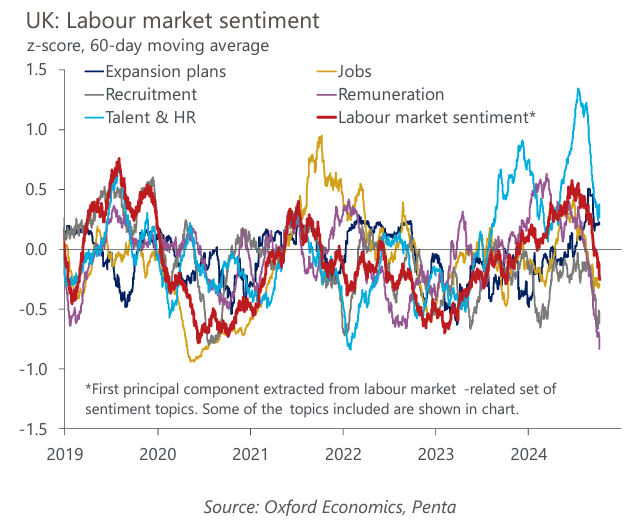

Our sentiment data, developed with Penta, suggests that labour market conditions have loosened and pay growth has slowed abruptly through the summer. If this trend is reflected in official data, it could motivate some Monetary Policy Committee members to join Swati Dhingra in voting for rate cuts at successive meetings.

What you will learn:

- Most of the individual sentiment indicators for labour market-related topics used in our nowcasts have fallen sharply in recent months. The one exception is talent and HR, suggesting firms continue to place a high value on retaining staff.

- Though official data shows much lower unemployment and higher employment in recent months, we think this is misleading, and is symptomatic of the data volatility problems that the Office for National Statistics continues to battle.

- In our view, the picture painted by our nowcasting model is a more accurate depiction of current labour market conditions.

Tags:

Related Services

Post

The economic impact of bp in the UK

This report quantifies the economic impact that bp supported in both the UK national and regional economies in 2023.

Find Out More

Post

UK households are willing to pay for greater energy efficiency

For homes with an Energy Performance Certificate (EPC) – a measure of a home's energy efficiency – energy spending for an F-rated property was on average £2,000 more since the start of 2022 than for a B-rated property.

Find Out More

Post

The growing importance of energy efficiency in home buying decisions

Our proprietary analysis shows that that homes with a higher Energy Performance Certificate (EPC) rating sell at a premium.

Find Out More

Post

A lacklustre recovery for the Eurozone’s lukewarm economy

We expect stronger activity in the eurozone in 2025, but growth will remain lacklustre as the consumer recovery lacks momentum. Monetary policy will become less restrictive, but fiscal policy will continue to drag on growth. External demand is set to improve, but prospects are prone to risks from rising protectionism. We anticipate GDP growth of 1.3% in 2025, slightly below consensus.

Find Out More