Major cities driving job growth over the medium term

By City Services team

- 2024 has been a year of cooling labour markets for most of the world’s major cities, a trend we expect will persist through to 2028.

- However, within this theme of global cooling, there are several bright spots, including Delhi, Calgary, Melbourne, and Dublin.

Employment growth has slowed across most of the world’s major cities in 2024, marking the end of the Covid-19 recovery for some while others face the effects of demographic constraints. However, cities are still anticipated to outperform their national averages over the medium term (2024–28), and there are several bright spots to be found in the cities able to leverage their strengths.

Our baseline forecast highlights:

| Ranking 2024-28 | City | Employment growth, 2024-28 (% pa) |

| 1 | Bengaluru | 3.2 |

| 2 | Delhi | 2.9 |

| 3 | Calgary | 2.8 |

| 4 | Hyderabad | 2.3 |

| 5 | Melbourne | 2.2 |

| 6 | Toronto | 2.1 |

| 7 | Halifax | 2.0 |

| 8 | Edmonton | 2.0 |

| 9 | Dublin | 1.8 |

| 10 | Ho Chi Minh City | 1.6 |

European cities to see employment growth slow over the medium term

European employment growth has started to exhibit signs of cooling, after remaining remarkably robust for the past three years. Slowing to 0.2% in Q2 2024, job growth across the continent has been pulled down by low confidence, weak demand, falling profitability, and structural shifts. Coupled with declining working-age population, we expect employment growth in the EU to slow over the medium term, before turning negative in 2028.

Many of the larger cities will be able to defy this trend, thanks to their industrial structures and ability to attract workers. Specifically, Dublin, Manchester, London, Copenhagen, and Stockholm are forecast to lead employment growth in the medium term—but there are notable differences in the factors driving these changes.

Unlock exclusive economic and business insights—sign up for our newsletter today

In London, we expect the business services sector to be the largest contributor to employment growth. However, in Stockholm and Dublin, public services sector is forecast to be the predominant sector; although generally associated with slower growth (at least compared to office-based sectors), its large size often means that absolute changes can have a big impact.

Weak demographics are beginning to weigh on employment growth across US metros

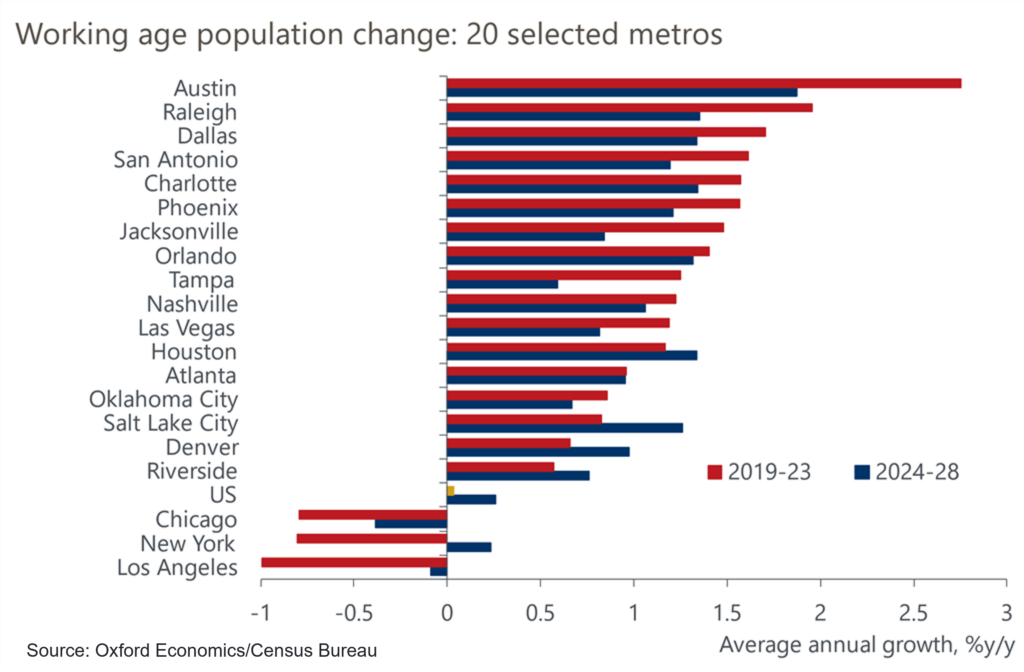

Across the pond, job growth in the US was positive in the first half of 2024 in all but a few metros; a trend that is anticipated to persist throughout the rest of the year. Austin, Las Vegas, Raleigh, Orlando, and Phoenix are set to lead over the medium term, due in large part to strong demographics, with these metros particularly benefitting from strong in-migration in recent years.

From a sectoral standpoint, healthcare, leisure and hospitality, state and local government, and construction added the largest number of jobs in 2024 and are expected to keep doing so over the medium term. The office sectors are anticipated to see the weakest level of growth, partly as they are the most exposed to AI.

But just like in the European cities, medium-term employment prospects in the US metros will be dragged down by a general weakening of working-age population growth across the nation as a whole. The number of baby boomers set to exit the labour force is expected to be greater than the number of young workers entering it, and this shift in demographics will curtail the rate of job growth. Major metros will see some of the sharpest declines in working-age population over the medium term, and nearly all these are in the Midwest and Northeast. Chicago and Detroit, in particular, are both expected to post annual average job growth rates of 0.4%, which is below the national average of 0.9% per annum.

Emerging cities will be the star performers across APAC

Employment growth has cooled across the APAC region, marking the end of the recovery from Covid-19. Employment growth across the 33 largest cities in the region is estimated to have averaged 1.8% in 2024, representing a near one percentage point decline from the growth rates posted in 2023 (2.6%). This deceleration is likely to be broad-based across most cities, and much can be attributed to a tapering of consumer, travel, and tourism dependent sectors.

While employment growth has slowed in 2024 across both advanced and emerging economy cities, the performance is likely to be divergent between the two subsets over the medium term.

Labour market growth is set to keep declining in advanced APAC cities from 2024 to 2028, as deteriorating demographics put pressure on the growth potential of cities. Busan, Seoul, Taipei, and Singapore are all expected to see significant declines in their working-age population over this period, constraining both employment and GDP growth.

Still, there a few bright spots over the medium term: Tokyo, Auckland, and the major cities of Australia are all forecast to have positive job growth rates, thanks to favourable international immigration (in the case of Australia) and ability to attract workers.

Job growth prospects in emerging cities, on the other hand, are much brighter than in advanced cities, with Indian ones outshining the rest. Bengaluru, Delhi, and Hyderabad take the top three spots for employment growth across the APAC region in both 2024 and over the medium term, thanks to the rapid development of their office-based sectors and their favourable demographics.

Download our Research Briefings for an in-depth analysis, including insights into Canadian metros and Chinese cities:

The analysis and forecasts in this blog are backed by our city services. Covering over 8,000 locations worldwide, our city services provide you with consistent measures of economic performance and in-depth analysis of underlying growth drivers. Click here to request a demo and discover more.

Subscribe to our newsletters

Subscribe to our newsletter to get our insights straight to your inbox. Additionally, you can check ‘Talk to us’ box to have our team contact you about a free trial of our services and how we can support you.

Tags:

Related Reports

All US metros worse off from recent tariff announcements

President Trump's recent tariff announcements, and the global response, have meant a fast-changing policy landscape with significant effects on our global, national, and subnational outlook.

Find Out More

US tariffs drag on growth prospects for Asian cities

Cities and regions where we expect the largest downgrades to GDP growth over 2025–2026 are those with higher concentrations of economic activity in export manufacturing—especially those facing targeted US tariffs and those vulnerable to the second-round effects of lower global demand. Lower global trade and industrial activity will also affect regional logistics and transport hubs.

Find Out More

Which regions are most exposed to the 25% automotive tariffs?

While the automotive tariffs will likely lead to some production being reshored to US plants, they will also raise costs for US manufacturers and households.

Find Out More

Parsing US federal job cuts by metro

Cuts to the Federal government workforce, which we estimate to be 200,000 in 2025, will have a modest impact nationally, but more significant implications for the Washington, DC metropolitan economy as it accounts for 17% of all non-military federal jobs in the US.

Find Out More