Research Briefing

| Aug 1, 2024

Margins muscle through US supply chains

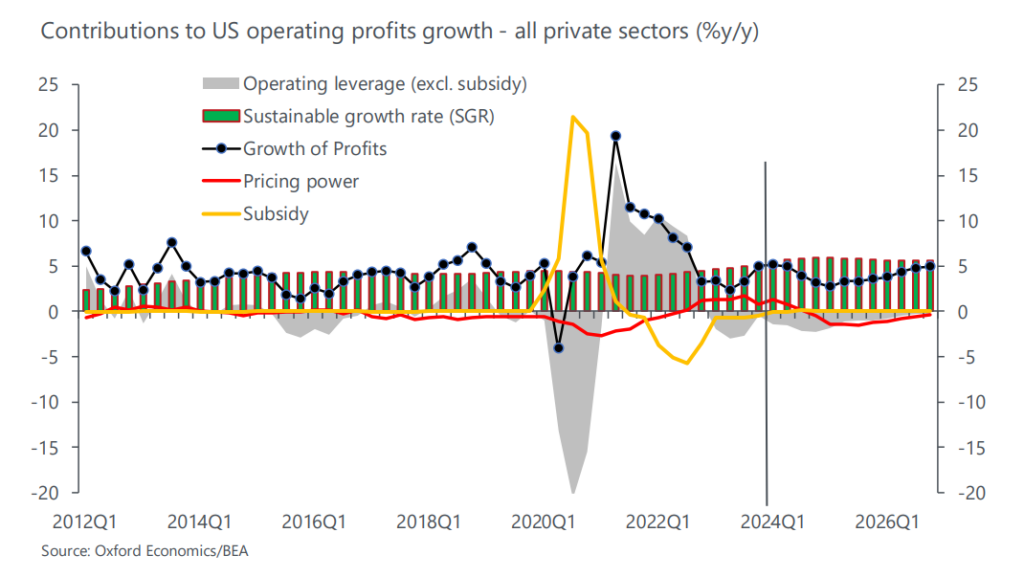

US business profit margins will remain elevated through 2025, with a boost from higher investments of recent years, despite challenges from slowing growth, less pricing power, and increasing debt cost.

What you will learn:

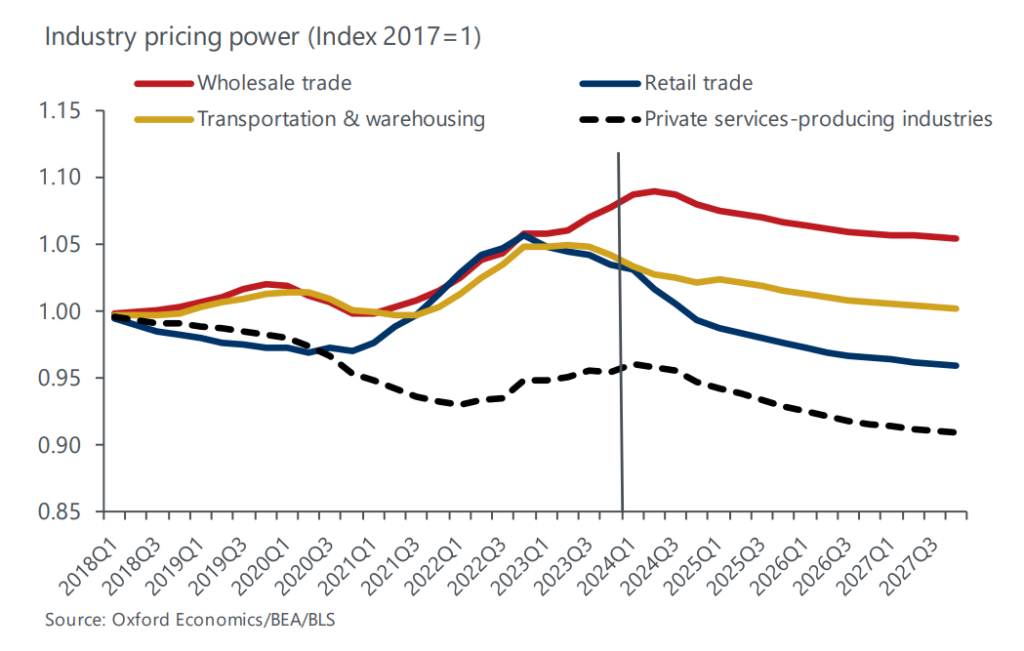

- Stability on the surface of the economy-wide margins masks movement along product supply chains. For example, many upstream producers and those in mid-stream transportation/ distribution have raised and kept margins well above their pre-Covid averages, such as in energy, metals, and food—often at the expense of customer margins in manufacturing and construction.

- However, several with elevated margins have likely seen a peak and their margins will now drift lower as their supply-chain counterparts reclaim a portion of their previous losses, leaving the larger overall composites largely unchanged.

- Aggressive reinvestment has boosted profits growth but with growing risks from fixed cost and interest payments, which drives a wedge between operating margins versus those from “net operating profits after tax and depreciation” (NOPAT) used by investors to value securities.

Tags:

Related Services

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

Global Industry Service

Gain insights into the impact of economic developments on industrial sectors.

Find Out More

Service

Global Industry Model

An integrated model covering 100 sectors across 77 countries and the Eurozone.

Find Out More