Markets have soured on the UK Budget, but calm should return

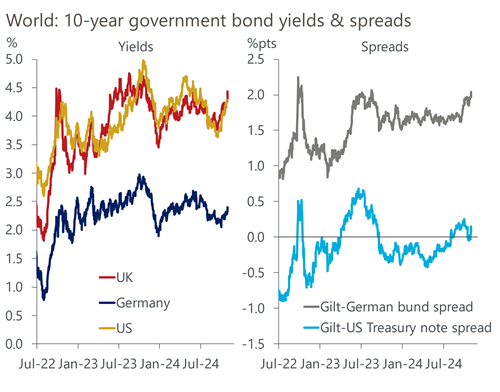

Following Wednesday’s UK Budget, gilt yields have risen sharply as financial markets appear concerned over the scale of the extra borrowing, that some of it will fund current spending rather than investment, and the narrow headroom it leaves.

What you will learn:

- These valid concerns suggest spreads may remain elevated, but we don’t expect them to widen.

- The government will still tighten fiscal policy and has replaced implausibly tight spending assumptions with tax hikes, which we think is a more credible plan. Shorter timeframes for the fiscal rules should bolster that credibility.

- Repricing at the shorter end of the curve means markets now expect fewer rate cuts next year. This is a response to the Office for Budget Responsibility’s view that the package will offer a sizeable boost to growth next year. But we think the OBR is too optimistic on the growth impact.

Don’t miss our UK Budget reaction webinar (1 November) available here

Tags:

Related Services

Service

UK Macro Service

Track, analyse, and react to macro events and future trends in the United Kingdom.

Find Out More

Service

UK Region and LAD Forecasts

Regularly updated data and forecasts for UK regions and local authority districts.

Find Out More

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More