May you live in interesting times in US

The first release of the November baseline incorporated the election outcome, but in interesting and uncertain times, our baseline assumptions require more frequent updates to stay current with the evolving balance of risks.

What you will learn:

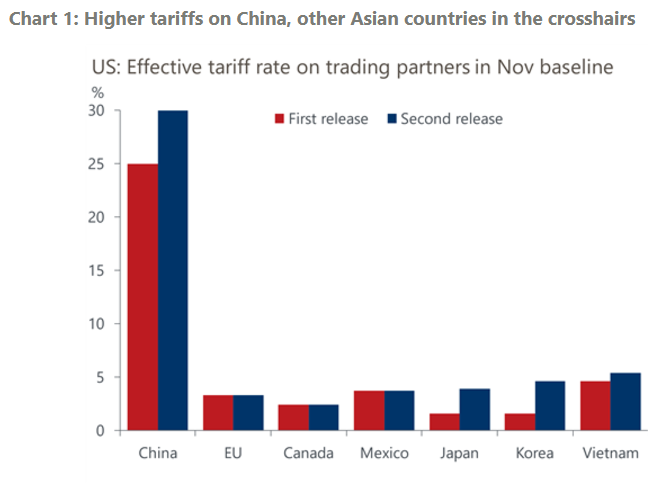

- We adopted more protectionist measures in the second release of the baseline. We assume 30% blanket tariffs on China with additional Asian countries in the crosshairs. In our view, risks to our tariff assumptions are now in better balance than before.

- To the upside, tariffs may end up lower than expected if the president-elect remains attuned to the stock market, and the leading candidate to head the Treasury Department pushes back against Donald Trump’s protectionist instincts.

- To the downside, tariff hikes could easily be more severe and swifter than anticipated as history is rife with examples of presidents erecting trade barriers early in their terms. Also, the politics of tariffs seem favorable.

- Record container activity at the Port of Long Beach speaks to a strong consumer and jitters ahead of a potential port strike in mid-January. We will monitor this metric to gauge whether firms are actively preempting potential changes to trade policy under the new administration.

- Upside risks to inflation from medical care seem less glaring over the medium term as labor constraints are becoming less binding in the sector.

Tags:

Related Posts

Post

Forecasting the Growth of Millennial Wealth in the U.S.

Consulting Report May you live in interesting times in US You might be interested in

Find Out More

Post

Growth outlook cut further for the Eurozone amid tariff turmoil

Given the unique nature of the hike in US tariffs, the size of these supply and demand shocks and the speed at which they are arriving make the precise economic implications particularly hard to pin down. Overall, however, we expect GDP growth in the US and world economy to slow sharply, but we don't anticipate recessions in either.

Find Out More

Post

What the US tariff hikes mean for the global economy

We expect GDP growth in both the US and world economy to slow sharply due to the tariff hikes, but we don't anticipate recessions in either.

Find Out More