Metro-level implications of a second Trump administration

The three major policy proposals planned for the second Trump administration—expansionary fiscal policy, lower immigration, and tariffs—will have mixed implications for the US economy over the next few years, and the impacts on metro areas will vary significantly. High-income metros will benefit most from the fiscal stimulus—primarily the extension of tax cuts—urban centers could suffer from lower immigration, and manufacturing-heavy metros face the biggest impacts from tariffs.

What you will learn:

- Nearly all US metros will benefit from the fiscal expansion and extension of tax cuts, which will boost short-term consumer spending. However, the tax cuts are regressive and will boost metros with the highest concentration of wealthy households where discretionary spending is highest, including many in Florida and California, as well as Midland (TX) and Boulder (CO).

- Efforts to stem immigration will likely negatively affect metros such as New York, Miami, Houston, Los Angeles, and Washington (DC). Several industries in these metros, such as leisure and hospitality, stand to see labor force disruptions from the pullback in immigration.

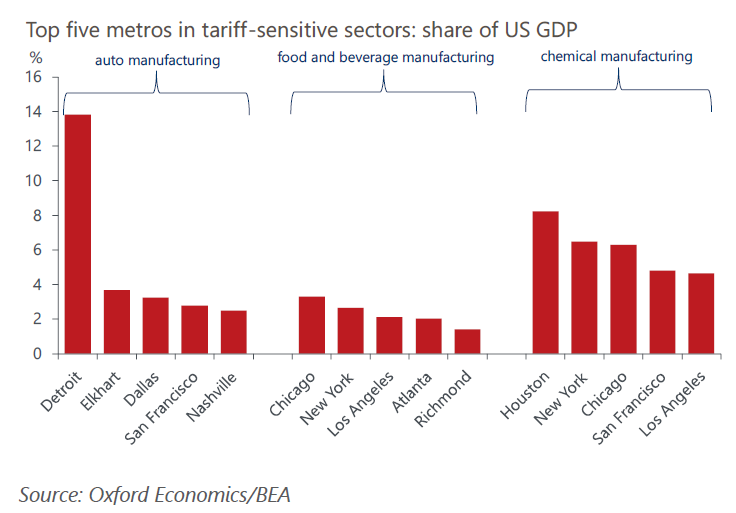

- Manufacturing-heavy metros are most exposed to impacts from the proposed tariffs in the short term, but the impacts over the long term are mixed. Smaller metros that rely heavily on their major manufacturing sectors are more likely to see significant impacts. Metros with the largest electrical manufacturing sectors—Chicago, Milwaukee, Louisville, Los Angeles, and Nashville—should benefit from tariffs over the long term. So too should those with significant tech—San Jose, San Francisco, Los Angeles, New York, and Seattle—as well as auto sectors—Detroit, Elkhart (IN), Dallas, San Francisco, and Nashville.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

Global Cities Service

Make decisions about market and investment strategies with historical data and forecasts for 900 of the world’s most important cities.

Find Out More