Research Briefing

| Oct 10, 2024

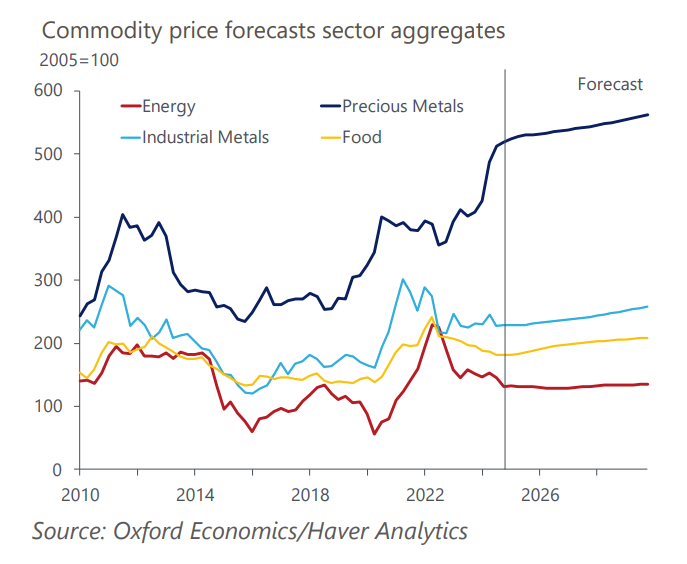

Commodity Price Forecast: Middle East escalation presents upside risks

What you will learn:

- Oil: Fears of a substantial escalation in the Middle East last week prompted the largest swing in the oil price in over a year. We view the price impact as transitory, although the conflict remains an upside risk. Overall, we have downgraded our Brent forecast for 2025 to US$72.60/bl as a review of our supply forecasts has resulted in our forecast market balance shifting from a deficit to a surplus in 2025. Weak demand persists in the US and China ensuring a bearish market next year.

- Copper: China’s central bank approved more monetary stimulus last month, boosting market exuberance. Consequently, we have raised our base metal price forecast slightly this month, but less than spot and futures prices. The monetary stimulus alone will not improve fundamentals, and more substantial fiscal stimulus is required. Therefore, we see prices pulling back from current highs.

- Gold: Gold prices will consolidate lower before year-end, but we think after that bullish fundamentals will prevail again. Solid demand from emerging market central banks and private investors – pushed by falling yields – are the main bullish demand forces.

To learn more about our price forecasts for energy, base metals, precious metals, battery raw materials and agricultural commodities, please submit the form to download the full report.

Tags:

Related Services

Service

MENA Forecasting Service

Monitor the implications of economic and market developments in the MENA region.

Find Out More

Service

Global Commodity Service

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More

Service

African and Middle Eastern Cities Forecasts

Comprehensive data and forecasts for major cities in Africa and the Middle East.

Find Out More[autopilot_shortcode]