Research Briefing

| Nov 14, 2024

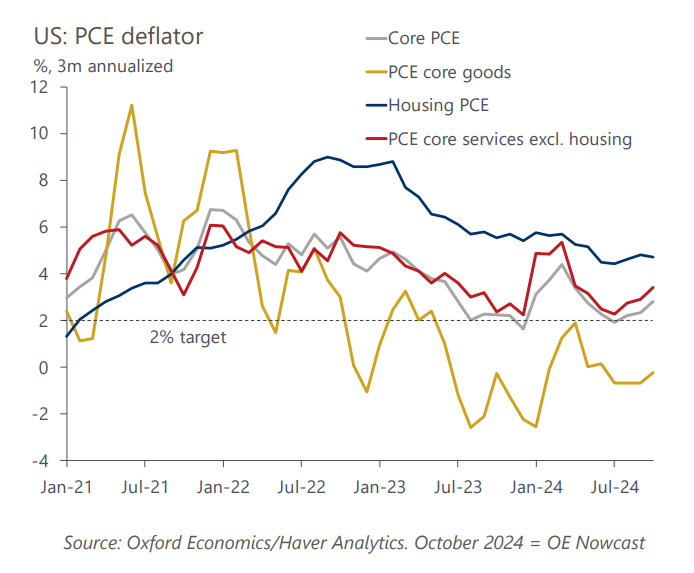

Nowcast shows strongest rise in PCE prices in six months in the US

Our nowcast suggests October’s headline and core PCE inflation will be at their fastest monthly pace in six months and above the Fed’s most recent forecasts. The renewed upside risks to inflation from tariffs and looser fiscal policy mean the Fed may opt for a slower pace of rate cuts.

What you will learn:

- We estimate the headline PCE rose 0.23% m/m and the core index grew 0.27%, almost in line with the gains in CPI. While the large gains in shelter prices are a smaller factor in the PCE data, that was offset by the surge in portfolio management costs, which rise and fall with the stock market.

- Our estimates imply that headline PCE inflation rose to 2.3% from 2.1% and core PCE inflation to 2.8% from 2.7%. Base effects mean inflation will likely rise in November and December.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More