Blog | 05 Mar 2025

Office employment in cities is resilient, but risks remain

Daniel Nandwani

Economist, Cities & Regions

Office sectors remain vital for city economies

Despite subdued economic activity across European cities in 2024, office-based sectors* outperformed total GDP last year, and this growth premium is also seen in employment. This is a trend we expect to continue over the medium term across most major cities, underlining the importance of these sectors.

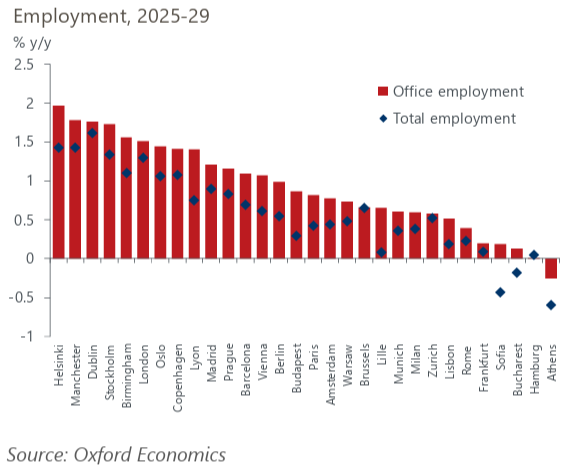

We forecast northern European cities to see the fastest growth in office employment over the next five years, with Helsinki and Manchester leading the pack. Elsewhere in Europe, Prague will lead growth in central and eastern Europe (CEE) and Madrid is set to be a standout city in the south, while Lyon and Vienna are the strongest performers in core Europe.

Chart 1: Office-based employment growth will continue to outpace total employment

Europe’s office-based employment is highly concentrated within its 100 major cities; in 2024, these cities accounted for almost 50% of office jobs across the continent and employed 24.8 million people. By 2029, we expect 1.1 million additional jobs in the office sector, and a further 2.4 million jobs by 2050. London, Paris, and Madrid will remain at the top of the office employment rankings in 2050, but with an additional 770,000 office jobs by 2050, London will see by far the largest increase during this period. Berlin is set to overtake Milan and Barcelona to become the fourth-largest city for office employment.

The office market faces a prolonged period of adjustment

While the outlook for office-based employment is healthy, workspaces must adapt to evolving work practices. Hybrid working has become more popular, enabled by more advanced technology and accelerated by the Covid-19 pandemic. The increased prevalence is noticeable across Europe, with homeworking rates stabilising at a much higher level than before Covid-19. It is most widespread across UK and Nordic cities, with 60% of all workers in London working from home on an occasional or regular basis, and Stockholm and Amsterdam reporting similarly high rates.

Although homeworking data are not yet available for 2024, other high-frequency indicators can give us a more up-to-date picture. Data show that public transport use in London and Paris during 2024 was comparable to 2023. Therefore, we think hybrid work patterns persisted in 2024, and this is likely to be indicative of broader European trends.

While the evidence on the impact of hybrid working on productivity is still inconclusive, it has affected office real estate markets, and it is an important factor to consider when evaluating future demand. To allow vacancy rates to return to previous levels, office space in some regions may need to be repurposed for alternative uses.

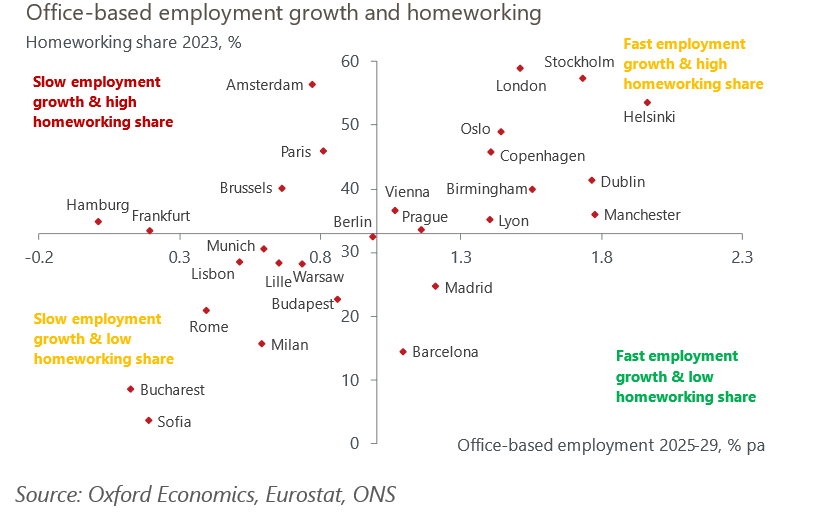

Homeworking trends can be used together with our forecasts for office-based employment to provide an indication of the future demand for office real estate markets. While we expect Helsinki and Manchester to lead office-based employment growth, Madrid and Barcelona have lower homeworking shares, so these office markets are likely to see stronger demand. However, weaker office-based employment growth for Amsterdam, Paris, and Brussels, combined with their high homeworking shares, will likely result in more muted demand for office space. Homeworking trends are rapidly evolving, so there is an upside for London office demand if more companies start to demand additional days spent in the office. Conversely, Madrid offices could suffer if homeworking shares catch up to European averages.

Chart 2: Spanish cities look favourable when combining employment growth and share of homeworking

Another challenge facing the real estate sector is the changing nature of demand. Companies are opting for high-quality premises in prime locations to meet higher energy-performance standards and to provide an attractive work environment for employees. Consequently, well-located, modern buildings that comply with environmental, social, and governance (ESG) standards are expected to outperform other assets. This trend will accentuate the dispersion between premium and lower quality assets, pushing prime rental growth higher, but at the expense of secondary assets where rental depreciation will be greatest. The resulting increase in repurposing and removing floorspace from the office stock will be vital over the medium term to keep vacancy rates contained.

Rapidly advancing generative artificial intelligence (generative AI) will also influence economies through its ability to assist or automate workplace tasks. Oxford Economics conducted a study to assess and forecast the economic impact of generative AI in the US over the next 10 years and we can use these results to approximate the impact across sectors in Europe. We expect office-based sectors to be the most affected by 2032, in particular the ICT sector, as occupations in these sectors have greater potential to automate tasks, and businesses here are also likely to have a higher adoption rate. These results are reflected in our forecasts, with productivity growth strongest in these sectors. As the technology continues to develop, a more streamlined workforce may further reduce demand on office space.

- The office sector is defined here as the aggregation of the following industries: information & communication; financial & insurance activities; real estate activities; professional, scientific & technical activities; and administrative & support activities.

Author

Daniel Nandwani

Economist, Cities & Regions

Private: Daniel Nandwani

Economist, Cities & Regions

London, United Kingdom

Tags:

Key Themes for 2025

UK Key Themes 2025: Worrying debt dynamics shift into focus

The UK has several long-running structural problems to solve and there's much the new government needs to do.

Find Out More

Industry Key Themes 2025: Industrial landscape at a critical juncture

Following prolonged weakness in 2022 and 2023, industrial growth is now regaining momentum.

Find Out More

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

We think the environment of strong US demand coupled with still ample global liquidity, should be positive for US risk assets.

Find Out More

Outlook for cities in 2025: Identifying opportunities and risks

On average, cities from across the world, with the exception of China, will see GDP growth either increase or maintain pace in 2025.

Find Out More

Key climate and sustainability themes for 2025

We expect economic growth to remain modest in 2025, although we don’t think a substantial slowdown is on the way either.

Find Out More

Real Estate Key Themes 2025: A tentative revival for CRE growth

After a year of transition in the commercial real estate cycle in 2024, we believe CRE is poised for a tentative revival in values.

Find Out More

Cities Key Themes 2025: Cautious optimism

In 2025, on average we expect cities in most regions, except China, will see GDP growth accelerate or maintain pace.

Find Out More

Tourism Key Themes 2025: Growth continues amid greater uncertainty

Travel demand will continue to grow in 2025, despite heightened uncertainty in key demand drivers and markets.

Find Out More