Opportunities in Singapore could mitigate hit from US trade barriers

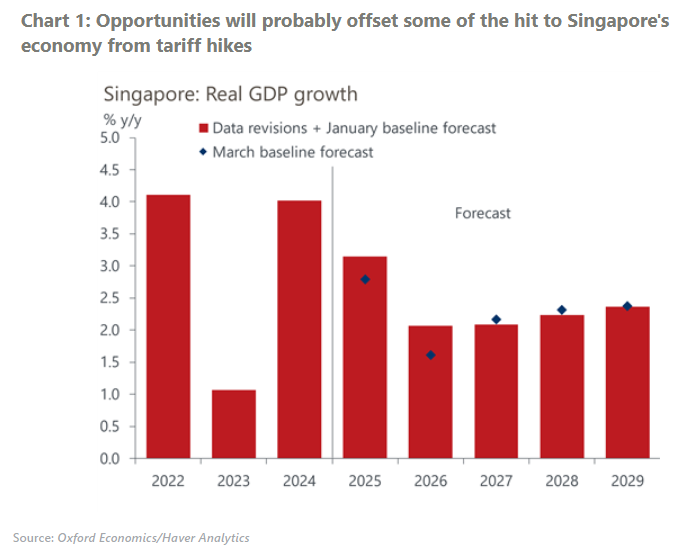

The slew of tariff proposals coming out of the US has added much uncertainty to the highly export-reliant Singapore economy. Given its status as a major shipping hub, potential gains from trade rerouting will probably offset some of the negative impacts of increased tariffs. The upshot is that although Singapore’s prospects are dimmed, they remain relatively promising.

What you will learn:

- Singapore runs a trade deficit with the US and imposes lower tariffs on US imports due to the US-Singapore Free-Trade Agreement, meaning the threat of reciprocal tariffs is low. However, if Trump disregards the FTA, US tariffs on Singapore imports could rise to 0.71%, with specific goods like semiconductors and pharmaceuticals facing an additional 0.75%, bringing the total to 1.5%.

- Indirect effects could pose a greater risk to Singapore, as potential tariffs may impact trade and business decisions. Second-round effects from higher tariffs on trade partners could reduce demand for goods, affecting trade flows through Singapore.

- On the upside, the US’ competitive disadvantage in chip production may lower semiconductor tariff risks, while Singapore could benefit from trade rerouting away from China. Singapore is likely to gain US import share over the next decade as other countries lose theirs.

Tags:

Related Posts

Using economics to improve business dialogue with governments in Asia

In Oxford Economics’ Singapore office, overlooking the historic Singapore river, we count as our neighbours the Asian headquarters of most the world’s major multinational companies.

Find Out More

Asia Key Themes 2025: Global shocks and domestic resilience

Most likely, 2025 could well be a year of slower growth and more stubborn inflation for Asia than most believe.

Find Out More

The future of the middle class in emerging markets

Our latest whitepaper reveals that the middle class population in emerging markets is set to double over the next decade, expanding from 354 million households in 2024 to 687 million households by 2034.

Find Out More