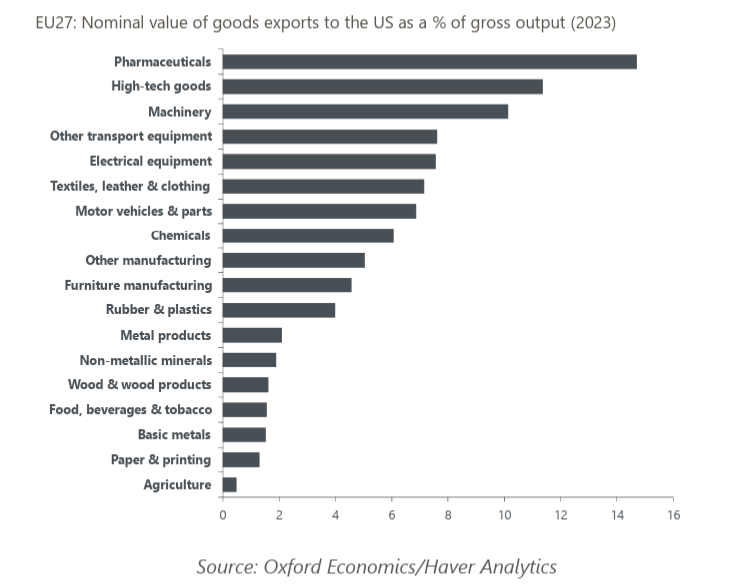

European pharma, high-tech, and machinery most exposed to US trade war

European pharmaceuticals, machinery, and high-tech goods are heavily exported to the US, making them vulnerable to across-the-board US tariffs. However, European pharmaceuticals make up a sizeable share of total US consumption of this product, so the imposition of tariffs on the sector would be harmful to US households and businesses.

What you will learn:

- Neither the EU nor the US have much supply chain reliance on one another. This may make tariffs more justifiable from President Trump’s perspective and embolden the EU to retaliate against them. Tariffs on the EU would only have a minimal impact on US industrial production and final producer prices through higher input costs. Our modelling shows that no sector would see more than 1% increases in producer prices as a result of 25% tariffs on all EU goods.

- Denmark, which may be singled out by President Trump if the country refuses to sell Greenland, is potentially vulnerable to tariffs on pharmaceuticals because of the success of its new weight loss drug products. While exports to the US account for a small proportion of recorded total pharmaceutical sales in the export data, we think that tariffs could deliver a blow to the sector in the short term.

- We see potential for the EU to offer to increase their imports of US LNG to head off tariffs. Despite an expected decline in overall EU natural gas demand, we estimate that by 2030 imports could increase by 18% if US LNG regains its late-2023 market share.

Tags:

Related Content

China coastal tech exporters vulnerable to new Trump tariff

The United States has introduced an additional 10% levy on Chinese imports as part of the opening round of the Trump 2.0 tariff regime. While certainly not as severe as some of the tariff threats made against China by President Trump in the run up to his inauguration, we nevertheless expect the additional tariffs to affect the country’s economic performance—with coastal tech manufacturing hubs particularly vulnerable.

Find Out More

Autos and machineries in Japan are most vulnerable to US tariffs

Our analysis of industry and trade structure between the US and Japan reveals the auto and non-electrical machinery sectors are most vulnerable to tariffs by the US. For both sectors, the US accounts for a sizeable share of total exports as well as gross output, and particularly so for auto.

Find Out More

Lower-income states and metros face the greatest burden from impending tariffs

Tariffs act as a regressive tax on households as they are applied to imported goods, many of which fall into the category of non-discretionary spending on such things as clothing, food, and energy—necessities most households cannot go without.

Find Out More

Eurozone is likely next in the tariff war

We have incorporated a 10% blanket tariff by the US and immediate retaliation by the EU in our forecast for Eurozone GDP growth, which is now 0.3ppts lower for 2025 and 2026.

Find Out More