Philippines concerns about future real income drag on consumption

Private consumption growth in the Philippines has slowed to its lowest rate since 2010 outside the pandemic period. The main culprit is worsening confidence, which has been hit particularly hard by persistent inflation. Although inflation should subside later in the year, the impact on consumer sentiment will take time to feed through, so we don’t expect a substantial boost in spending this year.

What you will learn:

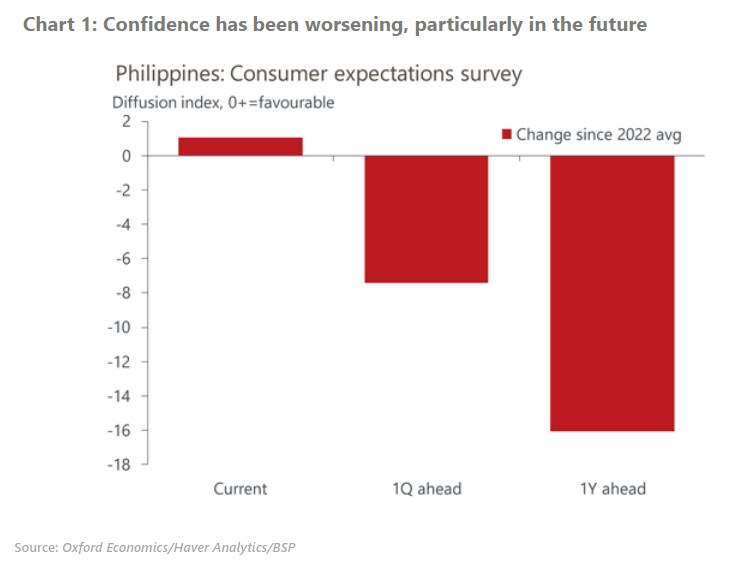

- Consumer confidence has been worsening since mid-2022, particularly in the outlook component. Even though confidence in the current quarter has held up expectations about the future affect the present, as consumers tighten their wallets in anticipation of worsening economic conditions.

- Surveys show the uncertainty stems from concerns about future inflation. The nature of recent food-driven inflation also has implications for confidence, as households tend to feel the price impact from nondiscretionary daily items more acutely.

- We expect inflation to moderate after the summer given favourable base effects. However, disinflation is unlikely to boost spending substantially, and any uplift will take time due to the lagged nature of inflation expectations formation.

Inflation expectations are also downwardly rigid and could stay elevated for longer because households care most about price levels, rather than annual growth rates.

Tags:

Related Posts

Post

The costs and eventual benefits of smooth decarbonisation in ASEAN

Reaching net zero carbon emissions by 2050 would likely have a larger impact on economic activity initially in ASEAN5 countries than more gradual decarbonisation. But our modelling suggests the gap would narrow in later years and turn positive in most places approaching 2050.

Find Out More

Post

CNN: BSP keeps key interest rate steady at 6.25%

Makoto Tsuchiya, Assistant Economist at Oxford Economics joins CNN to discuss interest rates in Philippines.

Find Out More

Post

Long-term interest rates to trend down in the Philippines

We expect the Philippines' 10-year government bond yield to trend down in 2023-2024, after rising continuously since Q3 2020.

Find Out More