Research Briefing

| Mar 20, 2024

QE makes a difference – and it’s here to stay

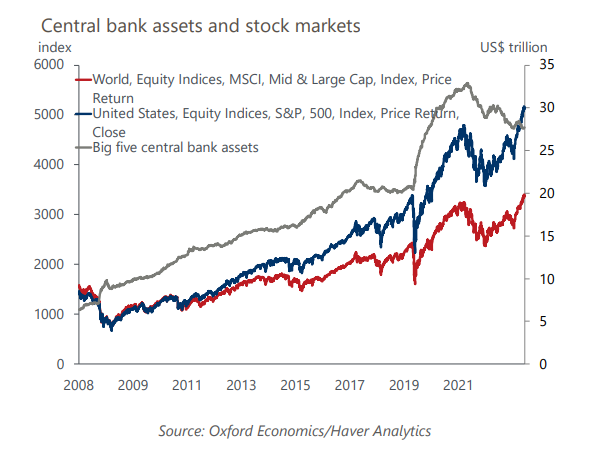

The West’s major central banks are well into their quantitative tightening programmes, reducing their combined balance sheet by $5.1 trillion. Central bank assets are still at extremely high levels though, resulting in excess liquidity in the banking system. This means QT can still hurt asset prices, even if these losses have been recuperated in recent rallies.

What you will learn:

- The Federal Reserve has reduced its balance sheet by 15.3% since the start of QT-II in 2022 – more than double the size of the reduction it undertook in QT-I in 2017-2018. Its assets are still above the pre-pandemic maximum and although falling, are still adding excess liquidity (in the form of reverse repo operations).

- Based on our modelling, we estimate that $1tn of quantative easing can boost the US stock market index up to 15%, suggesting that up to 60ppts of the 80% rally in the S&P500 during the pandemic recovery might be attributable to monetary expansion. The 25% correction in 2022 was slightly larger than what our modelling would expect as a consequence of QT-II; the current rally seems to have shrugged off the possibility of future rounds of QT.

- The same is true in Europe. Up to 37.5ppts of the 55% Stoxx50 rally during the post-pandemic recovery might be attributable to monetary expansion. The current rally has again overrun what the ongoing round of QT there would warrant.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

We think the environment of strong US demand coupled with still ample global liquidity, should be positive for US risk assets.

Read more: Strategy Key Themes 2025: Opportunities amid heightened uncertainty

Gold rush will lose steam, but still a good strategic bet

We close out our tactical long position on gold that we re-opened in July 2024. Still, we remain bullish on a strategic horizon.

Read more: Gold rush will lose steam, but still a good strategic bet

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers