US Recession Monitor – Slow does not imply terrible

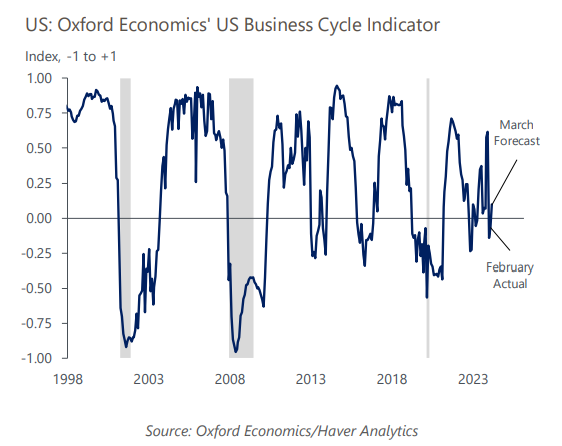

Our business cycle indicator shows the economy hit a rough patch at the start of the year but there is not an immediate cause for concern as the economy’s main economic engine is fine and threats to the expansion do not appear overly threatening. The weakness in the economy in Q1 may be a little hangover after the economy grew rapidly in the second half of 2023.

What you will learn:

- The recent tightening in financial conditions has been subdued thanks to narrow corporate spreads, which remain well below levels seen throughout 2023. Higher mortgage rates do pose a downside risk to the housing and residential investment outlook, but past gains in equity prices are still a support for consumer spending via the wealth effect.

- Even with the escalation of geopolitical tensions in the Middle East, global oil prices have not made a noticeable break higher. This is good news, as a significant and sustained increase in oil prices would be a net drag on the economy because the hit to consumer spending would be larger than the lift to business investment in oil, shafts, and wells. Higher oil prices would also bleed into core inflation via higher transportation costs and push market-based measures of inflation expectations higher, giving the Federal Reserve plenty of ammunition to keep rates higher for longer than assumed in the baseline.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More