Blog | 03 Jul 2024

Risks in our Q2 IFRS 9 and CECL scenarios more evenly spread reflecting monetary policy and geopolitical uncertainty

Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

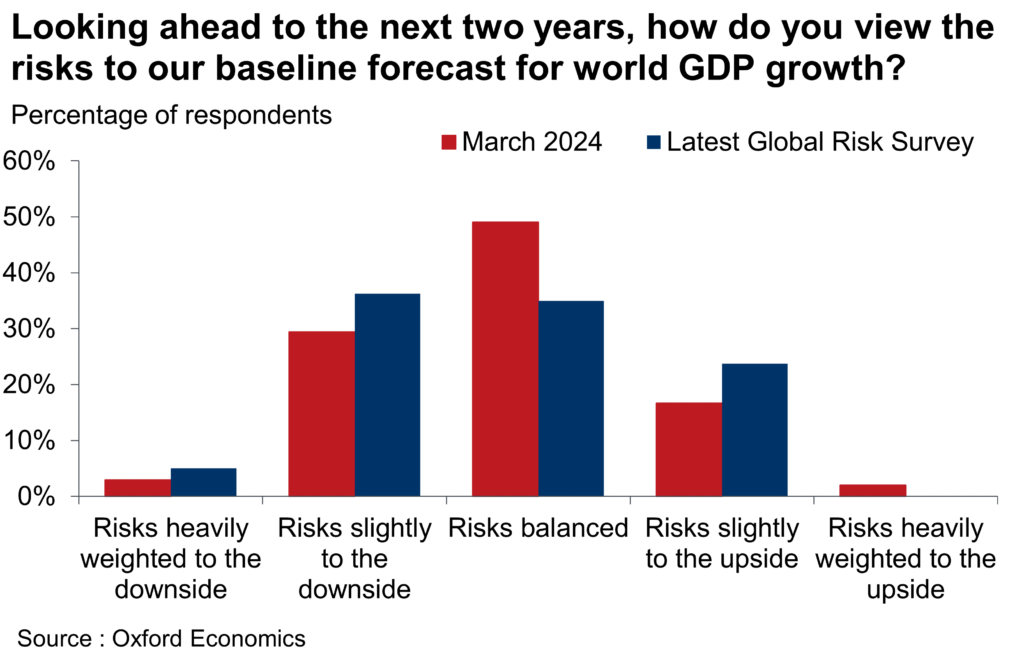

The Q2 update of our IFRS 9 and CECL scenarios services continues to see a moderate downside weight to risks around our baseline forecast. The direction of risks around the baseline forecast is informed by our Global Risk Survey which is compiled each quarter by a representative sample of our clients spread around the world.

Capturing the current benign economic environment and low volatility in financial markets, clients responding to the survey remain relatively upbeat in their risk assessment. However, compared to the March survey, the number of respondents seeing risks as balanced has fallen in the latest results. Interestingly, the portion of respondents seeing risks as skewed to the upside has risen by around the same amount as those seeing risks as more skewed to the downside.

This increase to either side of the distribution may reflect heightened uncertainty around various near-term risks, as shown in the responses to the thematic questions asked in our survey. For example, one of the top downside risks cited by clients is that of further monetary policy tightening. But at the same time substantial monetary policy loosening is the top upside risk for 38% of respondents.

In addition to the lingering uncertainty around the near-term direction of monetary policy, respondents to our survey also diverge in their view of the probable effects of a second Trump presidency. Around one in ten respondents list this as their top downside risk, whilst the same proportion list it as their top upside risk.

This two-sided uncertainty around the possible impacts from key risks captures the underlying spirit of why the IFRS 9 and CECL accounting standards were introduced. In practice, these set of rules require lenders to explore risk to both sides of the baseline and to base the level of their capital provisions on the average across these projections.

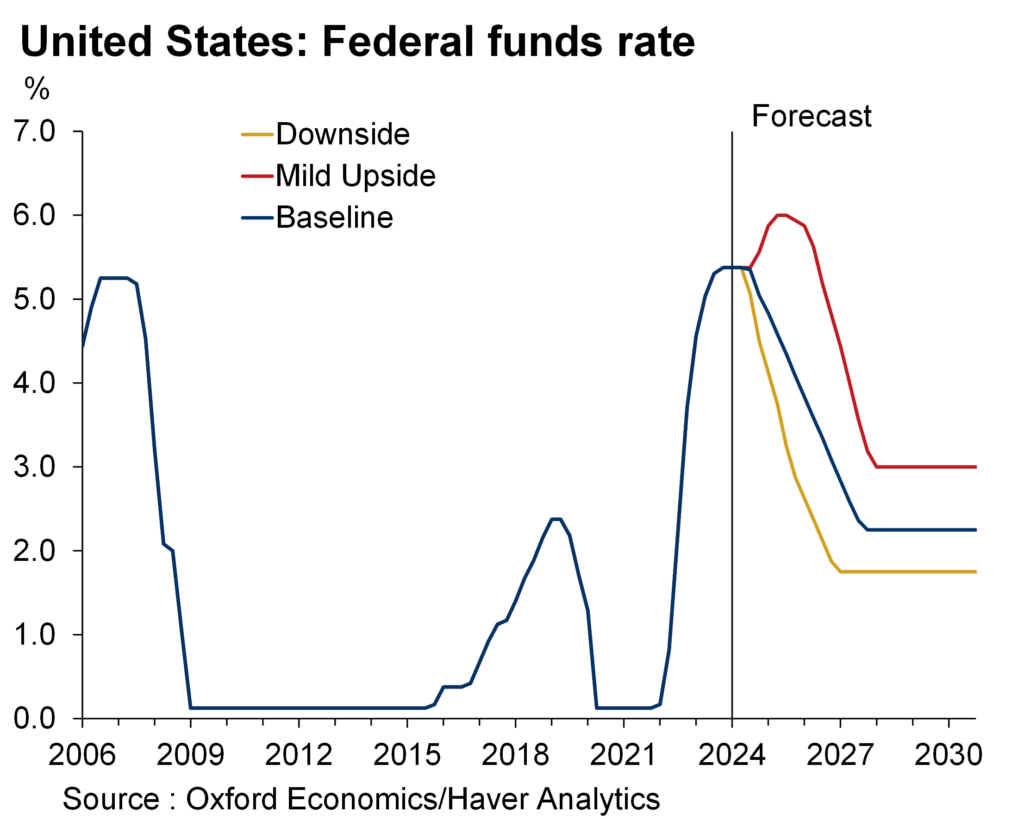

In our upside scenarios, a surge in demand reinvigorates inflationary pressures. In response, the Federal Reserve and other central banks across the world tighten policy even further. However, the additional increase in policy rates is countered by robust employment and income growth supporting confidence levels and thus asset prices. Conversely, in our downside scenarios, central banks start lowering their policy rates much faster than expected in our base case to counter a broadening economic downturn. Despite the reduced pressure from currently elevated borrowing costs, the resulting fall in asset prices still leads to a sharp tightening in financial conditions.

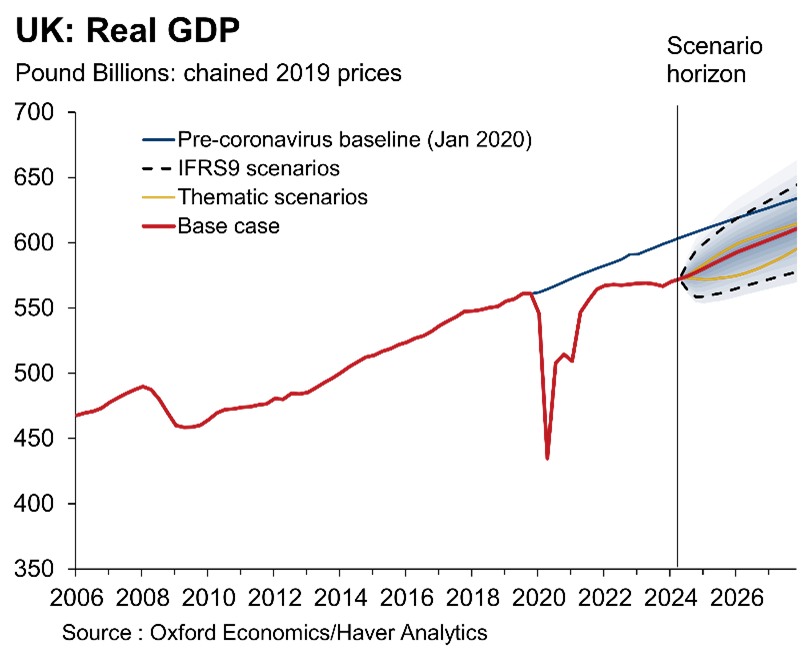

In current narrative-based risk scenarios the direction of change in interest rates is generally the opposite to the above description. This is because higher rates are seen as a downside risk to the outlook, if not met with a corresponding strengthening of demand and labour markets remaining tight. But when we compare our IFRS 9/CECL scenarios to such narrative-based downside scenarios, we can see that the severity of the impacts to key macroeconomic indicators such as GDP, unemployment rates, and a broad range of asset prices is much greater.

This is because our quarterly IFRS 9 and CECL scenarios are developed from uncertainty distributions based on nearly three decades of forecast errors. This sample includes several periods of heightened global uncertainty, such as the dot-com bubble, Global Financial Crisis and the Covid-19 pandemic, which helps to ensure that our uncertainty distributions are representative of the risks around the forecast. Using specific percentile points in the distributions of several key metrics such as GDP, unemployment, house prices and equity prices we construct five alternative scenarios at a globally consistent level to help clients assess local and global risk over the expected lifetime of assets.

Click here if you want to learn more about our IFRS 9 service and here for our CECL service.

Author

Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

+44 (0) 203 910 8138

Private: Marc Pacitti

Lead Economist, Scenarios and Macro Modelling

Oxford, United Kingdom

Tags:

You may be interested in

US Rolls Up Welcome Mat for International Travel

Research Briefing Risks in our Q2 IFRS 9 and CECL scenarios more evenly spread reflecting monetary policy and geopolitical uncertainty Trump tariffs set to raise effective rate above 1930s levels.

Find Out More

Japan’s on course for July rate hike, but risk of June increases

The Bank of Japan (BoJ) kept its policy rate at 0.50% at Wednesday's meeting, as expected. Despite a marginally higher increase in pay than last year at the first round of the spring wage negotiations, our baseline view is for the BoJ to hike its policy rate only gradually due to concerns about the capacity of small firms to raise wages and the lacklustre rate of consumption.

Find Out More

Japan’s supply-driven food inflation to persist longer than expected

We have revised our CPI forecast upwards for this year and next, due to more persistent supply side-driven food inflation, led by soaring prices of rice. Despite the significant revision to the short-term inflation path, we don't expect the Bank of Japan (BoJ) to react with a rate hike.

Find Out More

Don’t write the Eurozone consumer off just yet

Eurozone growth in 2025 will rely on consumers. There were positive signs in H2 last year, with consumers starting to deploy their real income gains and the impact of lower rates feeding through. However, we don't think solid H2 outturns signal a sustained increase in momentum. Instead, we expect spending growth to stabilise around the current pace, totalling 1.5% in 2025.

Find Out More