Blog | 27 Sep 2023

Semiconductor upturn offers hope amid transatlantic industrial recession

Sean Metcalfe

Associate Director

The United States and Europe are both set to fall into a shallow industrial recession this year, thanks to a cocktail of higher interest rates and energy prices and weak global demand.

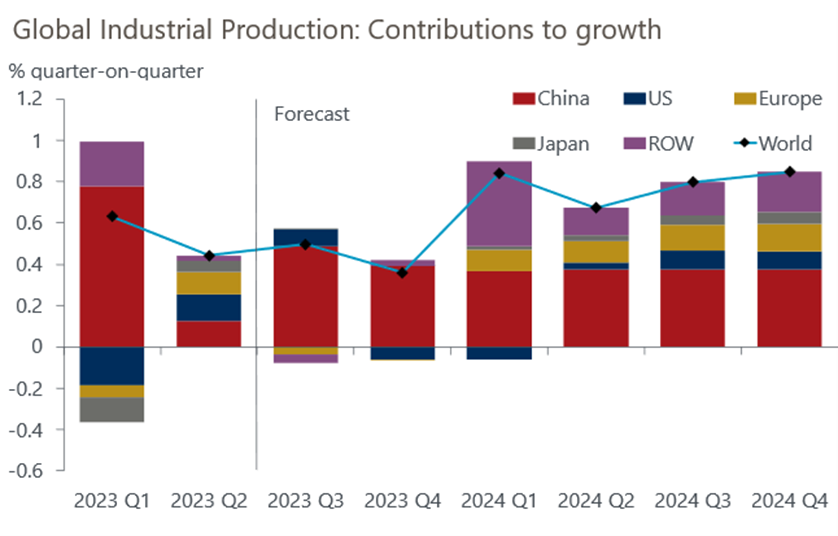

In our latest Global Industry forecast update we have cut our forecast for global industrial production for 2023 to 1.4% from our previous estimate of 1.6%, a steeper slowdown from the 2.2% recorded in last year and the 7.1% posted in 2021.

However, the gloom is offset by some bright spots within industry, including signs of a trough in the semiconductor downturn and an end to the fractures in global supply chains that hit production in the wake of the Covid-19 pandemic.

In Europe, we now anticipate that industrial production will contract by 0.1% over the second half of the year. The series of hikes in interest rates has weighed on demand, while the sharp reversal of the post-pandemic inventory cycle has dented production for intermediate goods. Additionally, structurally higher energy prices have kept production in energy-intensive upstream manufacturing sectors significantly below year-ago levels, as firms have resorted to importing cheaper intermediate inputs.

The industrial recession in the US will kick in the final quarter of the year, which we forecast will suffer a 0.7% contraction in output. Manufacturing will be held back by a shift away from goods spending, the depletion of excess savings, weak global demand, and a strong dollar.

No China crisis

However China, the largest emerging economy, will escape a recession in industrial output as the economic policy measures taken by the government will lead to it posting growth in the third and fourth quarters of the year. Its industrial production is forecast to increase by 2.9% in 2023H2. Nonetheless, growth in industrial production is still being constrained heavily by weak export demand, sluggish consumer spending, a sharper-than-anticipated correction in the property sector and industrial destocking.

Our forecasts give some reasons for optimism. The semiconductor downturn appears to have reached a trough. We expect a 13% decline in global semiconductor sales in 2023 followed by a rebound in growth of 7.4% in 2024. Supply chains have normalised to a large degree, which is contributing to recovering production in backlog-affected sectors, like aerospace and automotives. However, momentum in the automotive sector is starting to wane as backlogs are beginning to clear and high interest rates are weighing on demand.

Source: Oxford Economics/Haver Analytics

Author

Sean Metcalfe

Associate Director

+44 (0) 203 910 8111

Sean Metcalfe

Associate Director

London, United Kingdom

Sean is an Associate Director on the Industry team, where he forecasts the utility sector, helps shape the team’s views on the Global Industrial outlook and oversees the climate-related enhancements being made to the Global Industry Model.

Prior to joining Oxford Economics, Sean spent two years working for RBB Economics as a competition economist. At RBB he was involved in the economic assessment of competition cases across a range of industries, including antitrust investigations in the telecommunications sector.

Sean holds an MSc in Economics from the London School of Economics and a BSc in Economics from the University of York.

Tags:

You may be interested in

Post

The sector-by-sector consequences of mass deportations in the US

The sectors most exposed to mass deportations are construction, agriculture, parts of manufacturing and several service sectors.

Find Out More

Post

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More

Post

Europe’s defence splurge will help industry – but by how much?

Our baseline forecast now assumes that European defence spending will rise to 3% of GDP by the end of the decade. This could give a growth boost to Europe's ailing industrial sector.

Find Out More