Six lessons from the US-China trade war as the next phase looms

With further tariff increases on US imports from China effective from August 1st, 2024 and potentially more to come after November’s US presidential election, we take this opportunity to examine the implications and outlook of the US-China trade war.

What you will learn:

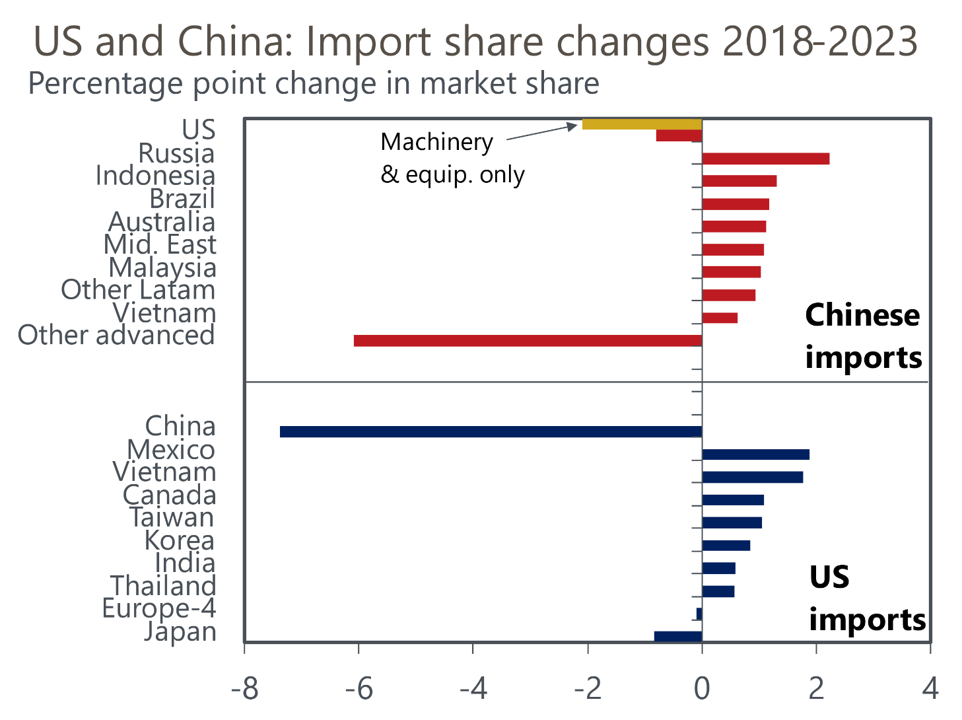

- US tariffs have cut imports from China by 35%-40% relative to plausible counterfactual paths, and the impact has risen over time. We estimate a 1ppt rise in US tariffs cuts imports from China by 2.5% in the long term, meaning the high tariffs now being discussed in the US would be prohibitive.

- Suppliers in NAFTA and other Asian economies have stepped into the gaps left by China. This may encourage additional US protectionism versus China. Evidence of some Chinese goods being re-routed into the US to evade tariffs, meanwhile, may see third countries being targeted as well.

- US tariffs have not shrunk its overall trade deficit even if the deficit with China has shrunk. Trade conflict has cut US GDP by an estimated 0.2%-0.4% and raised prices by 0.1%-0.3%.

*Europe 4: Germany, France, UK, and Italy

Tags:

Related Resources

Post

A reality check on the status of RMB internationalisation

The recent geopolitical shocks and abrupt US policy shifts have heightened concerns about the stability of the dollar-centric global financial system and strengthened the perceived need for diversification.

Find Out More

Post

China and AI underpin stronger global trade outlook

Global trade is set for a stronger-than-expected rebound, supported by lower US tariffs, continued AI-driven investment, and China’s renewed export push. Our latest forecasts show upgrades to both nominal and volume trade growth in 2025–26, even as legal uncertainty surrounding US tariff mechanisms and evolving geopolitical dynamics pose risks to the outlook.

Find Out More

Post

Tariffs take a toll despite easing trade hostilities

Global tradeflows remain under pressure despite easing tariff tensions. Recent US–China agreements reduce select import taxes and support China’s 2026 outlook, yet US imports continue to fall and supply chains pivot toward Asia and Europe. Containerised trade is set to expand, while bulk shipments soften alongside weaker industrial demand.

Find Out More