Tariff impacts expose vulnerabilities in Ireland and CEE

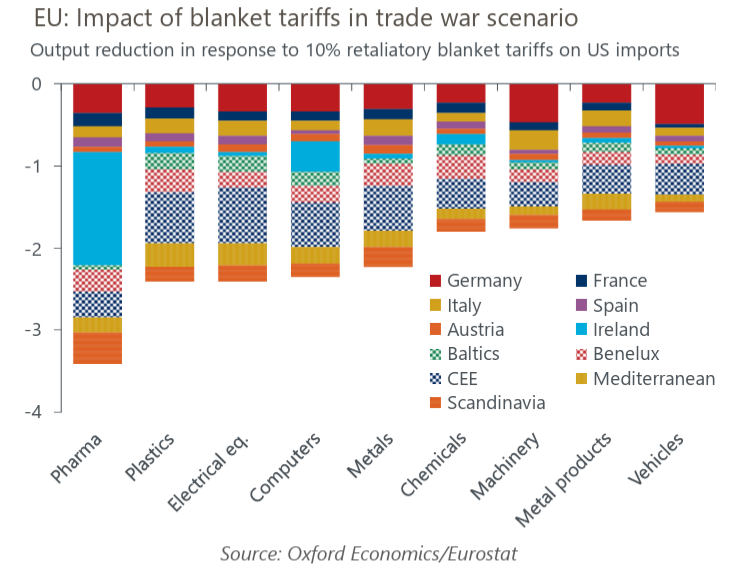

Blanket 10% tariffs on EU exports to the US, now part of our baseline, will have a significant but uneven sectoral impact. Our industry-level modelling suggests that the pharmaceutical and high-tech industries would be the most affected. Similarly, smaller, less diversified economies are more exposed. We estimate that Ireland and Central and Eastern European (CEE) economies will experience the largest hit.

What you will learn:

- Notably, it’s not countries with the highest direct exposure to the US suffering the most, but those indirectly impacted via integrated EU supply chains. This is particularly pronounced in the automotive sector, where Germany’s large support industry located in parts of CEE and Austria faces a more significant reduction in output than that of the German industry itself.

- Declines in industrial electricity prices through 2025 should reduce cost pressures in highly energy-intensive sectors where output remains weak, allowing for a partial output recovery.

- Opting for targeted tariffs instead of blanket tariffs could exacerbate the impact on some EU industries. We simulated a scenario with 25% tariffs only on metals, cars, and pharmaceuticals. We found similar results to our blanket tariffs scenario but with stronger effects for Ireland and Denmark due to pharma, and for Germany and Slovakia due to automotive.

- The risks around our estimates are balanced. We assume a strong pass-through of tariffs to prices and uniform price elasticity across products and countries. However, we exclude potential competitiveness boosts from a weaker euro and assume limited substitution towards alternative suppliers. At the margin, we anticipate larger effects in sectors with a higher share of exports directed towards final demand, due to stronger price elasticities.

Tags:

Related Content

China coastal tech exporters vulnerable to new Trump tariff

The United States has introduced an additional 10% levy on Chinese imports as part of the opening round of the Trump 2.0 tariff regime. While certainly not as severe as some of the tariff threats made against China by President Trump in the run up to his inauguration, we nevertheless expect the additional tariffs to affect the country’s economic performance—with coastal tech manufacturing hubs particularly vulnerable.

Find Out More

Trump tariffs to shake up Asian manufacturing in 2025

The new US tariffs add an additional layer of drag on Asian manufacturing activities. India will be one of the least affected countries.

Find Out More

The risks to Asia from Trump’s tariff plans so far

We think the immediate tariffs on China will have spillovers to some other Asian economies, while the threat of reciprocal tariffs has raised the odds that of the rest of Asia will also be slapped with higher tariffs.

Find Out More

Reciprocal tariffs another tool to extract policy concessions

US President Donald Trump has announced or threatened a range of fresh tariffs in recent weeks. While we expect the overall macro impact to our global forecasts to be modest, the impacts for specific countries and industries will be meaningful.

Find Out More