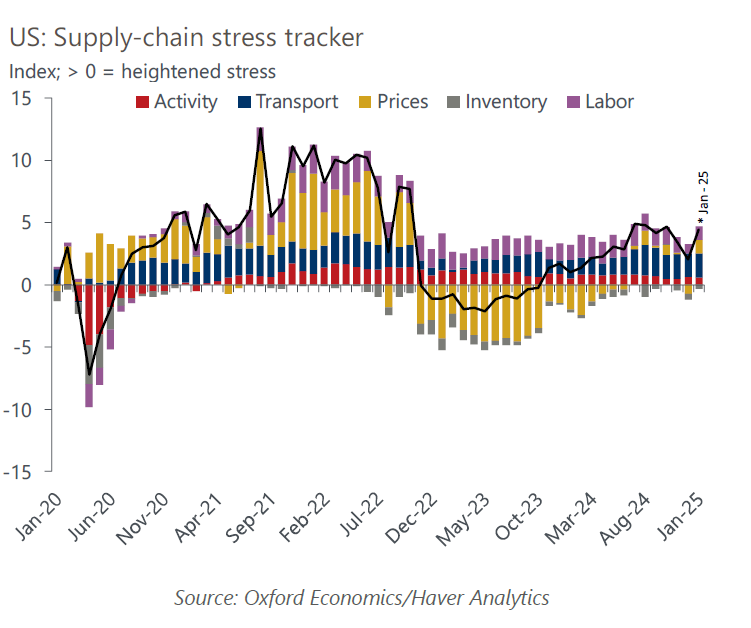

Tariff whiplash starting to cause US supply-chain stress

Tariff threats and heightened trade policy uncertainty began causing stress in supply chains. A massive increase in imports because of front-loading ahead of tariffs caused port congestion to rise, kept air freight prices elevated, and increased manufacturing overtime hours worked.

What you will learn:

- Front-loading will keep upward pressure on air freight rates in the near term, but rates are still considerably lower than they were in 2021-2022. Although supply-chain stress is unlikely to cause inflationary pressure, we expect tariffs to lift core inflation to average above 3% in 2025.

- The front-loading of imports is not likely over, due to the on-again, off-again approach to tariffs from the Trump administration. We expect inventory stocking to contribute 0.25ppts-0.4ppts to GDP growth each quarter this year.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

Megatrends Scenarios

Unlock uncertainty and understand key risks to the global economy in the long term

Find Out More