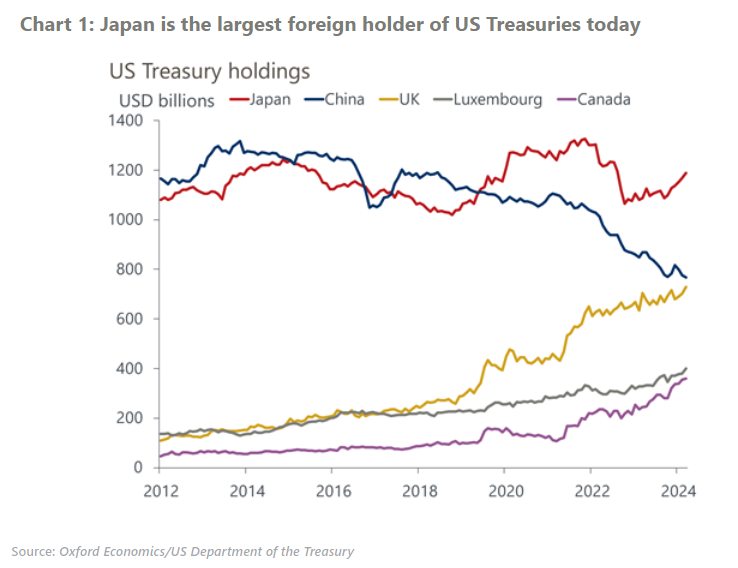

The enduring appeal of US Treasuries to Japan’s investors

Some market participants are raising concerns over a fall in demand for US Treasuries from Japanese investors amid higher domestic yields. But we think that there will continue to be a large and stable investor base in Japan for US Treasuries due to the still-large yield gap. Also, uncertainty over the Bank of Japan’s monetary policy is dissuading investors from increasing their holdings of Japanese government bonds.

What you will learn:

- After a sharp drop in Japan’s US Treasuries holdings in 2022 as US yields rose, commercial banks restored their foreign bond portfolios in 2023. Pension funds have also maintained steady purchases in foreign bonds following their mid-term asset allocation. Life insurers are the only group to have continued to reduce foreign bond holdings as hedging costs have been elevated.

- We expect Japanese investors will increase their US Treasuries holdings gradually, following a turn in bond market trends and backed by persistent yen weakness. Even life insurers will likely resume their investments in US Treasuries without FX hedges probably in Q4 2024, while steering away from hedged bonds.

- We don’t think Japanese investors will shift their portfolio allocations to domestic assets any time soon, notwithstanding the recent pick-up in domestic yields. The expected total return of JGBs is still considerably lower than US Treasuries in yen terms. For lifer insurers in particular, the current 30-year JGB yield level is only slightly above average procurement interest rates of around 2%. In addition, expectations of a continued rise in yields fuelled by uncertainty in Japan’s monetary policy over the mid-term is precluding a swift return to JGBs by domestic investors.

Tags:

Related Posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

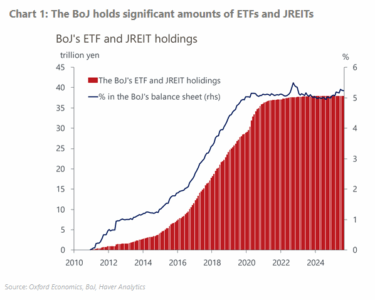

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More