Industry Forecast Highlights: The low point for global industrial growth is firming

Our conviction that 2023 was the low point for global industrial growth is firming. We expect that value-added industrial growth across the world will accelerate to 2.6% in 2024, up from 1.8% last year.

What you will learn:

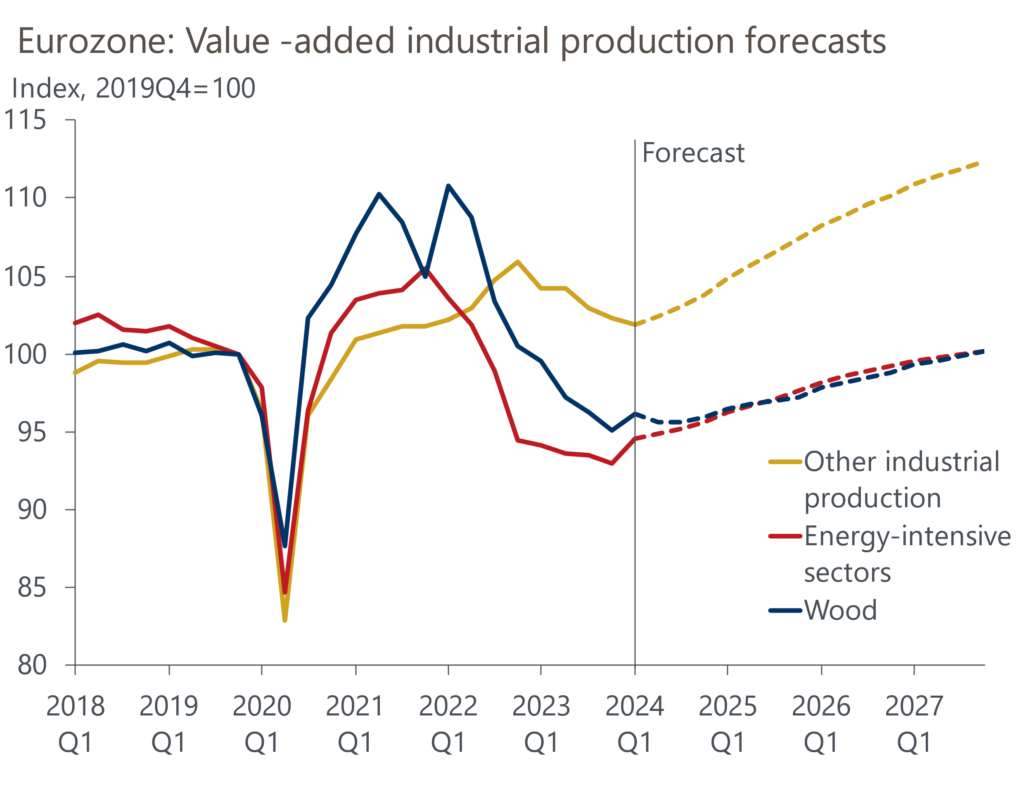

- We see several factors pointing to an imminent but gradual recovery in Europe. We expect some permanent damage to competitiveness in energy-intensive industries, but in the short-run we do expect some catch-up growth as lower energy prices and a turn in the inventory cycle feed through.

- US industrial output growth is expected to be relatively steady. The results of the US election could however have significant implications for industry.

- Industry in Asia remains largely stable as well. The biggest change with respect to our previous forecast in the region is in Japan, where the Daihatsu scandal-induced production shutdowns in Q1 were deeper than expected.

- Across the world we expect the rebound in consumer and certain intermediate goods will outpace more interest-sensitive sectors like automotive, furniture, investment goods, and construction inputs like wood.

Tags:

Related Reports

Post

The sector-by-sector consequences of mass deportations in the US

The sectors most exposed to mass deportations are construction, agriculture, parts of manufacturing and several service sectors.

Find Out More

Post

Trump tariffs will cut UK growth as global demand weakens

The imposition of larger-than-expected tariffs on US imports will lead us to cut our UK growth forecast. Our new baseline will likely put GDP growth at just below our current forecast of 1% for this year and close to 1% for 2026, from the previous 1.5%.

Find Out More

Post

‘Liberation Day’ impacts to prolong the EU industrial recession

The Trump administration's imposition of a blanket 20% tariff on EU imports, in addition to the wide-ranging tariff increases imposed elsewhere, is set to weigh on European manufacturing and prolong the industrial recession.

Find Out More