The UK’s fiscal adjustment is at risk of failure

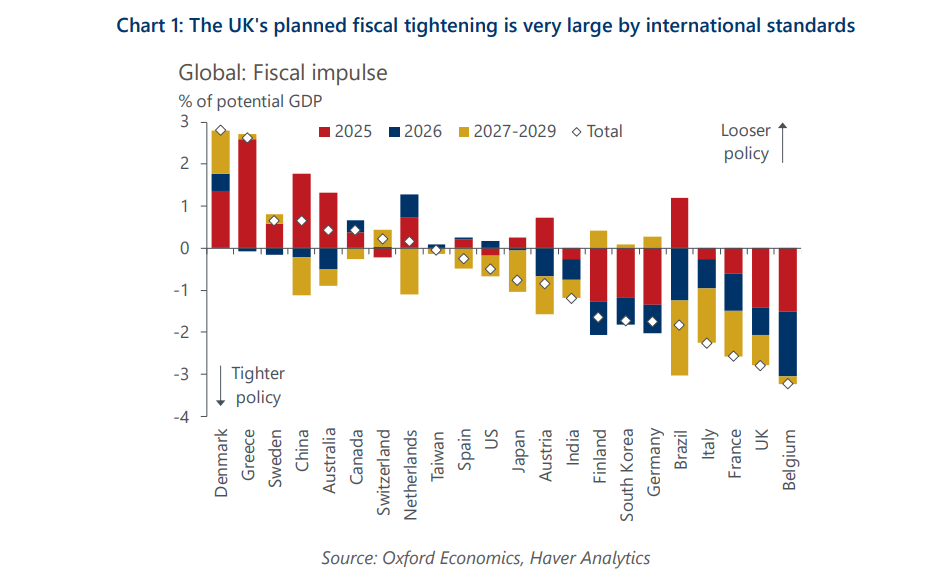

The UK is planning one of the largest fiscal consolidations of any advanced economy over the next two years. We expect it to result in much weaker GDP growth than the Office for Budget Responsibility forecasts and think the government’s balance sheet is still likely to deteriorate.

What you will learn:

- The evidence suggests consolidations need to be carefully designed to succeed, especially if the global economic climate is uncertain. Around half of fiscal adjustments fail, and even successful ones often rely on policies like expansionary monetary policy, structural reforms, the compression of large risk premia, and boosts to private sector confidence via ‘credibility effects’. Consolidations based on cutting government spending are more likely to reduce deficits and are associated with better growth outcomes. The failure rate for adjustments based on revenue raising is high, given the risk of dampening growth prospects without yielding material improvements to the public finances.

- We believe the design of the UK’s fiscal adjustment looks out of line with these historical lessons. Roughly 80% of the planned cut in the structural primary deficit is based on revenue-raising measures – a policy mix that is similar to that seen in unsuccessful adjustments. Accompanying policies don’t appear particularly supportive of successful adjustment either – growth-boosting structural reforms look minor, monetary policy conditions are likely to remain restrictive for a prolonged period, and trade policy uncertainty is set to rise.

- Yet, with current plans already involving real terms spending cuts for unprotected government departments, there’s limited scope for the Chancellor to pursue a path that more closely aligns with international best practice. This serves to highlight the need for the current government to make tangible progress towards improving public sector productivity in order to lower future spending requirements.

Tags:

Related Services

Post

Eurozone: Surveys have become less predictive; what can plug the gap?

Surveys are a staple of high-frequency economic indicators, but they have become less reliable in predicting hard economic data like GDP growth. This feeds macro volatility – markets still interpret surveys such as PMIs essentially as reliable growth signals. The disconnect between survey and hard data can lead to mispricing.

Find Out More

Post

Euro-dollar has hit the floor, but don’t expect a bounce

We expect the euro to stabilise against the dollar and trade around its current levels over the next year. Economic fundamentals point to some support to the currency after the sharp, recent depreciation, but heightened uncertainty continues to pose a key downside risk.

Find Out More

Post

Eurozone: How to set policy in an era of frequent supply shocks

Oxford Economics' new proprietary business cycle indicator shows that real US construction spending is firmly in a decelerating growth phase.

Find Out More

Post

Eurozone: Pension system sustainability hinges on unpopular reforms

Increased spending to meet the needs of an ageing population jeopardises the sustainability of Europe's public pension systems, based on current legislated measures.

Find Out More