Trump tariff turbulence threatens global industrial landscape

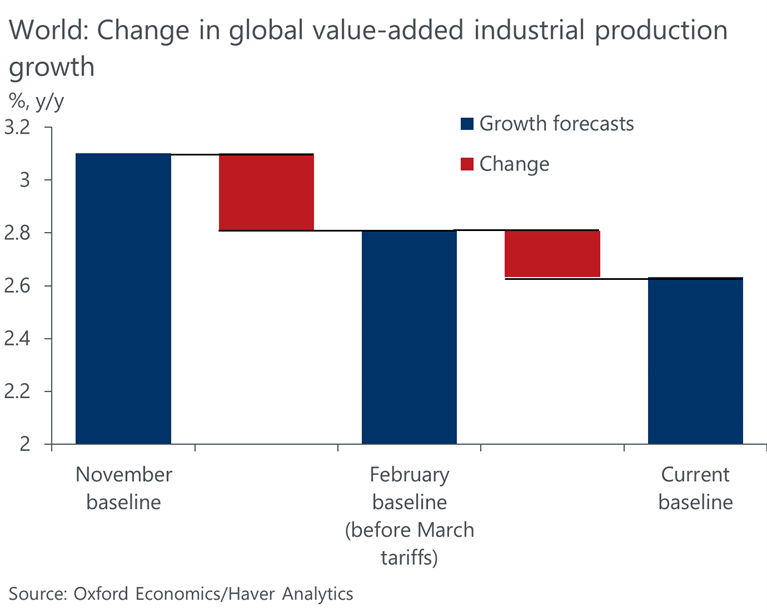

A whirlwind of announcements and threats by the Trump administration to impose tariffs against allied and hostile countries alike has led us to downgrade our global industrial growth forecast for 2025 by 0.5 percentage points since our last update just three months ago.

The President has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign and goes quite a bit further than what we had assumed in our Q4 2024 industry update. This will have a major impact on global industrial prospects.

This change is not just a minor adjustment: it reflects the broader impact of global tariffs, persistent policy uncertainty, and the expectation of higher interest rates for an extended period. While not all of this downgrade can be pinned solely on the President’s trade agenda, it certainly plays a substantial role.

The next pinch point for global industry will come on 2 April—the so-called “Liberation Day”—when the exemptions on tariffs from Canada and Mexico are due to expire. Donald Trump has also promised additional tariff announcements on this date, including potential reciprocal tariffs. But more recently, he has said he may give “a lot” of tariff breaks. We will be monitoring the situation closely.

Tariff assumptions since the US election

| Forecast vintage | Assumptions (cumulative) |

|---|---|

| Q4 2024 | Targeted tariffs in strategic or politically-favoured sectors (metals, cars, Chinese industrials, Canadian dairy) |

| February 2025 | 10% blanket tariffs on China, 10% blanket tariffs on the EU |

| Current | 25% blanket tariffs on Mexico & Canada [10% for Canadian oil, 0% for automotive], additional 10% blanket tariff on China |

Source: Oxford Economics

The impact of tariffs on US industry

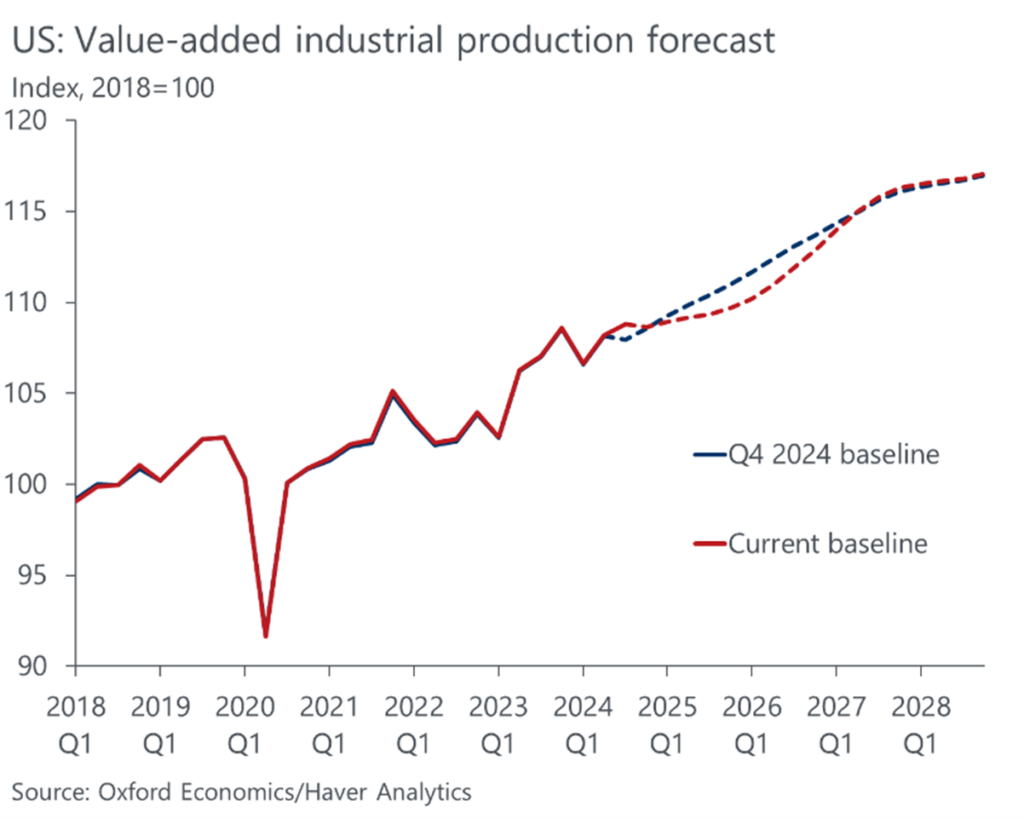

The largest impacts of the tariffs will be felt in North America. The US itself is somewhat insulated from the worst effects of tariffs. Thanks to its large domestic market, it is less interconnected with its North American trade partners. However, the real challenge lies in the impact that a prolonged period of economic uncertainty will have on business investment.

Industries like energy and motor vehicles may escape the worst of the tariffs—indeed we expect the Trump administration to tariff energy at reduced rates and motor vehicles to be exempt, consistent with announcements in February and March. The largest downside impact to the US will come via heightened uncertainty, with firms holding off on investment, and via a slower interest rate loosening cycle than we had previously anticipated. This has led us to almost halve our US industrial growth forecast for 2025, from 2.1% to just 1.1%.

Unlock exclusive economic and business insights—sign up for our newsletter today

Canada and Mexico to enter an industrial recession

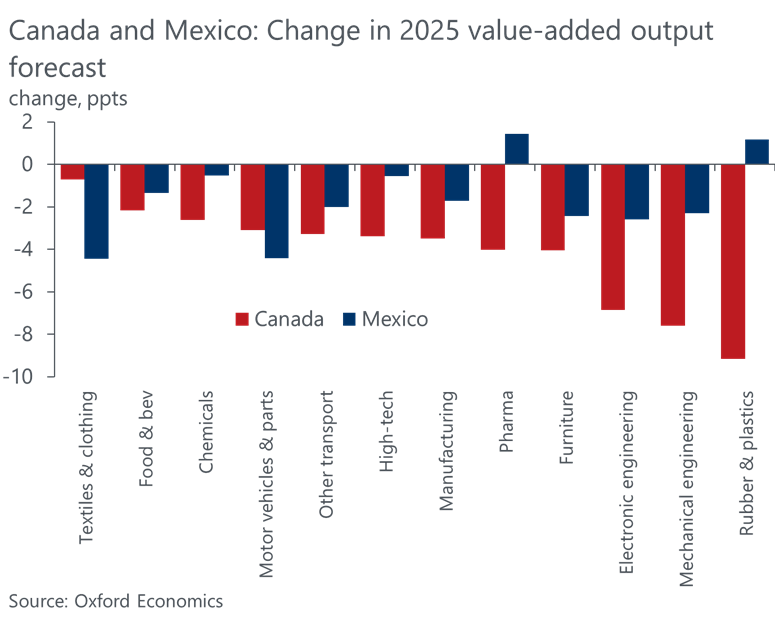

Unfortunately, the US’s neighbours to the north and south aren’t as fortunate. Canada and Mexico are heavily reliant on the US as an export market. The broad tariffs set are likely to push both countries into an industrial recession.

While there are some differences across the two countries, there are also key similarities. Sectors like mechanical engineering, electricals, and furniture are expected to be at the forefront of this downturn. Canada’s manufacturing output is projected to shrink by 1.9% in 2025, while Mexico will see a decline of 0.8%. However, we anticipate a recovery to take hold by mid- to end-2026, assuming that tariffs are largely removed under a renegotiated USMCA trade agreement.

European defence spending insufficient to overcome competitive challenges

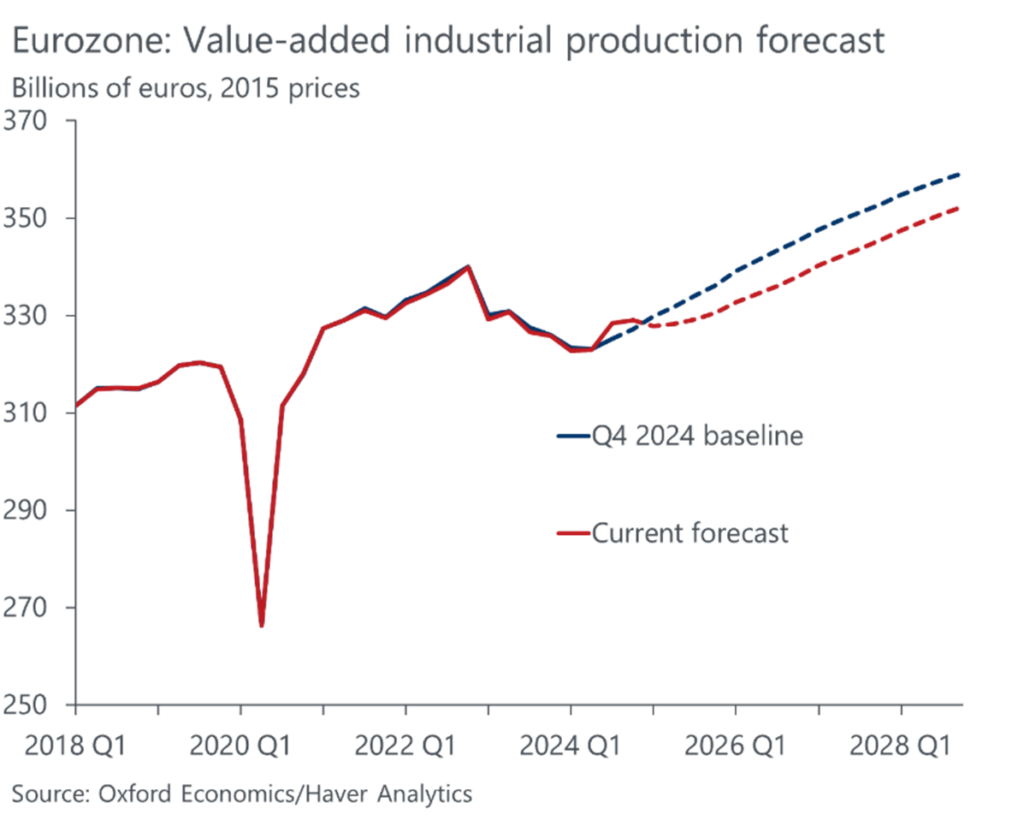

Turning our gaze to Europe, we expect the US to impose a blanket 10% tariff on all goods imported from the EU. While European export exposure to the US is relatively small compared to its North American neighbours, the tariffs add a further headwind to a region that has already endured a two-year industrial recession. Pharmaceuticals, high-tech, and machinery have the biggest dependence on the US export market.

We still expect that European industry will begin its recovery later this year, driven primarily by a rebound in domestic demand, a normalisation of inventories, and a partial recovery for energy-intensive industries amid lower energy prices. Yet, we have become more pessimistic about European industrial competitiveness and have therefore pushed back the speed and magnitude of the recovery: we now expect industrial value-added growth of just 0.6% in 2025 and 2.1% in 2026.

Growth in Europe’s defence spending will provide some boost in a few targeted sectors such as aerospace and fabricated metal products. However, these are relatively small segments, and this tailwind to growth will be most strongly felt in 2027–28.

External pressures mount on Chinese industry

China, another major target of US tariffs, is likely to experience a notable slowdown in industrial growth. Despite a strong performance at the end of last year, we expect that momentum to fade. Strong momentum going into the year has led us to revise up our industrial value-added growth forecast in 2025. But sequential growth is expected to slow considerably through the course of the year, and we have also downgraded our 2026 growth forecast.

The Trump administration has increased tariffs on Chinese imports by a cumulative 20ppts since taking office. While this rise had largely already been factored into our baseline forecast last quarter, a new development is the removal of the de minimis exemption, which had allowed low-cost items from China to enter the US without incurring an import duty. This could dampen demand for goods from e-commerce sites like Temu and Shein and weaken demand for textiles and other low value goods.

Chinese exports surged to record highs in 2024, but with global growth slowing, there is a limited scope for other countries to take a greater share of displaced US exports. Moreover, other nations are increasingly unwilling to accept ever-growing Chinese trade surpluses. For example, Russia, one of China’s closest allies, has moved to impose curbs on Chinese car imports.

Download our report

The landscape of global industry is shifting rapidly, and understanding these changes is crucial for businesses and investors alike. Download our latest global industry update for a deeper dive into these trends and what they mean for the future of industrial production worldwide.

Request a trial

Request a trial to see firsthand how we help you: better understand key global sector developments and risks affecting your markets and supply chains; support you in benchmarking global sector performance; and quantify market potential.

Please note that trials are only available for qualified users.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will not share your personal information with other individuals or organisations without your permission.

Tags:

Related Reports

Key take-aways from COP30

COP 30’s agenda had placed a strong emphasis on countries’ implementation of their emissions reduction target and, for the first time, several workstreams included discussions on unilateral trade policies.

Find Out More

COP 30 in focus: How to stay the course on the path to Net Zero

EMDEs are projected to account for 70% of global CO₂ emissions by 2050, making accelerated emissions reductions in these economies essential. Yet gaps in AE leadership—such as US policy rollbacks and insufficient climate finance—risk slowing the global transition.

Find Out More

Advanced economy leadership is key to the low-carbon transition

We modelled how advanced-economy leadership in innovation and finance could accelerate a global low-carbon transition.

Find Out More

The changing energy order

To understand how the G20 countries are progressing in the energy transition, Oxford Economics PwC collaborated with PwC to create the Changing Energy Order Index. The index combines data from international economic organizations like the OECD and World Bank with with Oxford's own forecasts to evaluate each country's progress across five key pillars.

Find Out More