Blog | 05 Oct 2023

Understanding the gaps in the US STEM labor market

Dan Martin

Senior Economist, Economic Impact

In the context of an accelerated expansion of the tech industry, and the implementation of policies like the CHIPS and Science Act, US firms are expected to demand more STEM (science, technology, engineering and mathematics) trained professionals, at a pace that the American higher educational system will have trouble matching. While this is good news for the US economy and for STEM graduates, who are already perceiving higher wages, it also leads to gaps between the supply of and the demand for STEM trained workers. To explore these questions, we focus on three categories of STEM occupations and degrees: science, engineering, and computer science (CS, including mathematics).

STEM Supply & demand

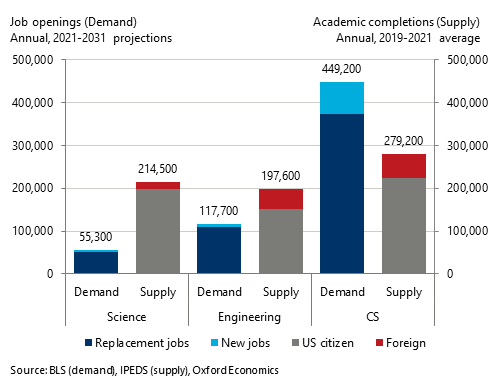

In order to identify the emerging gaps in the labor market for college-educated STEM workers, we compared the projected annual demand for the three groups of STEM workers from the Bureau of Labor Statistics’ employment projections with the recent annual supply of new graduates in these fields, based on IPEDS data.

What we see is that the supply of new graduates in engineering and science far exceeds the demand for new workers in closely matched occupations—by about 160,000 annually in the case of science, and by about 80,000 annually in the case of engineering. This is not terribly surprising—science and engineering degrees prepare their graduates for many occupations that aren’t specifically in science or engineering themselves—notably medical, educational, and managerial occupations. However, the reverse is the case of computer science (CS) occupations; the demand for new CS workers exceeds the supply of new CS degrees by about 170,000, or about 38% of the forecast demand.

One point to observe about this figure is that supply and demand are measured on two different scales, albeit with the same numerical values.

- Demand, on the lefthand scale, is measured in job openings, which come in two types: new job openings (an expansion in the total number of workers in the occupational group) and replacement job openings (replacing workers who exit the labor force or transition to another major occupational group). However, not all job openings will be filled by a new college graduate; some will be filled by workers returning to the labor force or transitioning from other occupations.

- Supply, on the righthand scale, is measured by the number of academic completions, which is greater than the number of graduates because some individuals earn multiple degrees (a Bachelor’s and a Master’s, for example). Additionally, completions include degrees earned by foreign citizens at US institutions, many of whom will not remain in the US after graduation.

Both the demand and supply measures will tend to overstate the number of college graduates being hired into the labor force. However, these discrepancies will tend to cancel one another out, and should not differ systematically between the three groups of STEM workers, meaning that comparisons between the three remain valid.

The current STEM workforce

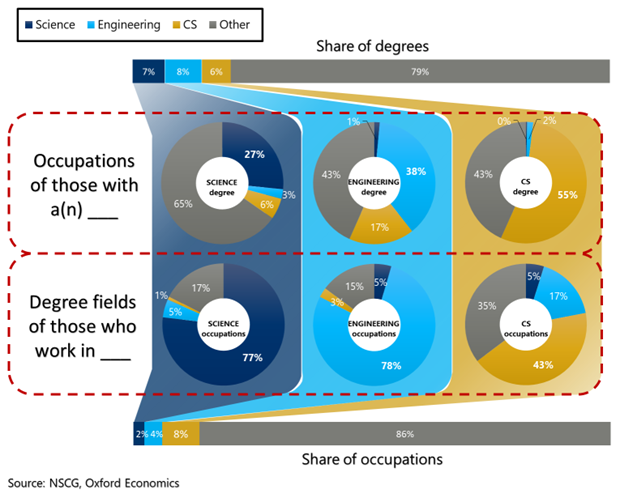

For another window on labor market dynamics for STEM workers, we turn to data from the National Survey of College Graduates (NSCG) on the relationship between current college-educated workers’ occupation and the field of their highest academic degree. In the figure below, the top row shows the occupations of those whose highest degree is in science, engineering, and CS; while the bottom row shows the highest degree fields of those working in CS, engineering, and science occupations.

In both science and engineering occupations (bottom row), most workers’ highest degree is in the same field as their occupation (77% and 78% respectively), whereas only 43% of those in CS occupations have their highest degree in CS. Conversely, the majority of CS graduates (55%) work in CS occupations, while only 38% of engineering graduates work in engineering occupations and only 27% of science graduates work in science occupations. One of the biggest draws for these graduates, especially the engineering graduates, is CS—17% of engineering graduates work in CS occupations, nearly half as many as those who have engineering occupations.

Conclusion

While a simple comparison of the demand and supply for these three groups of workers shows a large labor market gap for computer scientists coupled with surpluses for engineers and scientists, the NSCG data shows how these imbalances play out in the actual labor market. The demand for CS occupations is large—nearly four times that for engineering occupations and eight times that for science occupations—and it pulls in graduates from other STEM and non-STEM fields. By contrast, there are more engineering and science graduates than job openings specifically in these occupations, but graduates in these fields find employment in other occupations, including CS.

As demand for STEM graduates increases and gaps in specific STEM fields arise, policy makers should ensure they close gaps in the STEM labor market to maintain national competitiveness and prevent labor shortages in critical strategic industries. At the policy level, this includes boosting student interest in STEM fields, and making it easier for foreign-born STEM graduates who wish to work in the US to do so. At the same time, employers should prepare for STEM labor shortages and invest in their workers’ education and training, promote programs in high school and universities, explore opportunities for apprenticeship and similar programs, and work to retain critical STEM talent. For an application of this type of analysis to the semiconductor industry, please see our recent publication Chipping Away.

Author

Dan Martin

Senior Economist, Economic Impact

+1 646 503 3056

Dan Martin

Senior Economist, Economic Impact

New York, United States

Dan Martin is a Lead Economist on the Economic Impact Consulting team. During his eleven years at Oxford Economics, Dan has worked on a wide range of topics, including economic footprint analyses in industries such as petroleum refining, air transportation, nuclear energy, consumer goods, and industrial trucks.

Much of his work has focused on labor markets, on topics such as overtime regulation, career progression, retirement savings, and gap analyses relating occupational demand to educational supply. He has also worked on topics such as energy efficiency, international trade, and the economics of warehousing.

Dan has a PhD in economics from Clark University, an MA from NYU, and a BS from Stanford, and previously worked at the Environmental Protection Agency.

Fabian Juarez Padilla

Assistant Economist, Economic Impact

+1 (646) 503-3054

Fabian Juarez Padilla

Assistant Economist, Economic Impact

New York, United States

Fabian joined our Economic Impact team in 2023, bringing over five years of experience in economic research in both Spanish and English. He holds a master’s degree from NYU and has a proven track record of managing large-scale projects in partnership with the World Bank and other international development institutions. At Oxford, Fabian has specialized in survey analysis for economic impact and consumer valuation projects, leveraging his background to deliver insightful and actionable results for our clients.

Contact us to find out how we can help you quantify the social, environmental and economic impact of your organisation’s activities, innovations and investments.

Tags:

You may be interested in

Post

Japan’s small firms’ profitability will help determine further rate hikes

Rising wage costs have been increasingly squeezing the already low profitability of small firms in Japan, thereby raising concerns about the sustainability of the wage-driven inflation dynamics. The evolution of these dynamics will be key in determining how far the Bank of Japan can raise its policy rate in the coming years

Find Out More

Post

US forecasters’ mailbag – Post-election edition

We received many questions, including during our recent webinar, about the changes to the forecast following the election along with key assumptions.

Find Out More

Post

EV shift could pose a big challenge to Japanese economy

Amid the fast-progressing electric vehicle (EV) shift, maintaining high competitiveness in auto-related sectors and ensuring a smooth labour transition across industries are crucial for the growth of the Japanese economy. As auto production shifts towards EVs, which require different inputs from traditional internal combustion engine cars, parts suppliers will need to adapt to avoid losing market share to foreign players. Change in automotive supply chains would also require workers to move across different industries, a task particularly challenging for Japan.

Find Out More