Upside risks have increased in toss-up US election

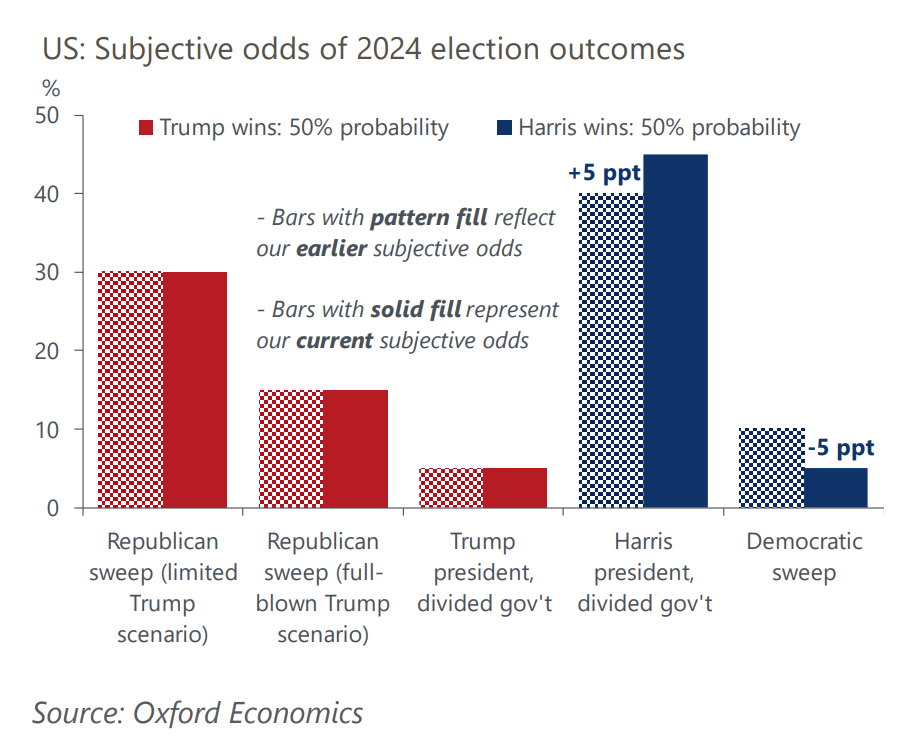

We still see the presidential election as a coin flip, but our updated scenarios suggest that upside risks to our baseline forecast of growth and inflation during the next presidential term are larger than we estimated in our last update.

What you will learn:

- In the event of a Donald Trump victory, the upside risk to the baseline GDP forecast during the next presidential term is twice as great as before, primarily because of the tax cuts the former president recently proposed. The upside risk to the baseline inflation forecast is 0.1ppt higher than we estimated.

- If Kamala Harris wins, the upside risk to our baseline GDP forecast during the next four years is lower than before. This is due to a reduced probability of a Democratic sweep and increased odds of a Harris presidency and divided government.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More