US inflation expectations are key to the Fed’s outlook this year

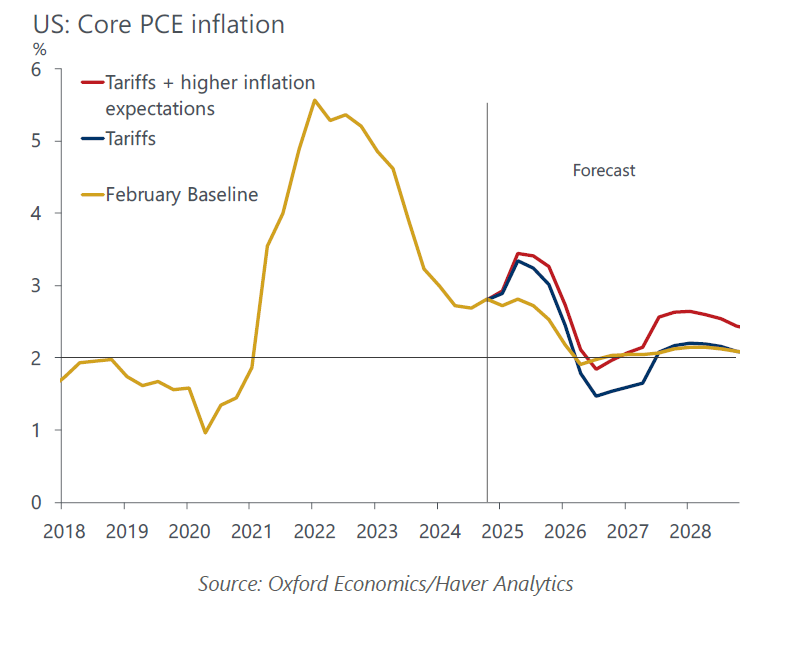

Tariffs typically result in a one-off rise in the level of prices. However, a rise in inflation expectations is a key channel through which they can boost future inflation. Therefore, signs that inflation expectations are becoming unanchored would push the Federal Reserve to leave policy at restrictive levels for longer, even if the economy shows signs of weakening.

What you will learn:

- The Fed’s ability to fight inflation is rooted in its credibility as an inflation fighter, and anchored inflation expectations are critical. A scenario exists where the Fed may tolerate, or possibly need, the economy to weaken to offset the upward pressure on inflation and inflation expectations.

- A range of survey and market measures of inflation expectations have moved higher recently, though the extent of the increase varies. Survey responses make it clear that expectations around tariffs are the key driver.

- Our modeling shows higher inflation expectations worsen the dilemma facing the Fed this year. If the spike in February inflation expectations sticks, we think the Fed could delay rate cuts through the middle of next year, rather than resuming them later this year.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More

Service

Megatrends Scenarios

Unlock uncertainty and understand key risks to the global economy in the long term

Find Out More