Research Briefing

| Feb 29, 2024

US Office real estate is the bad gift that keeps on giving

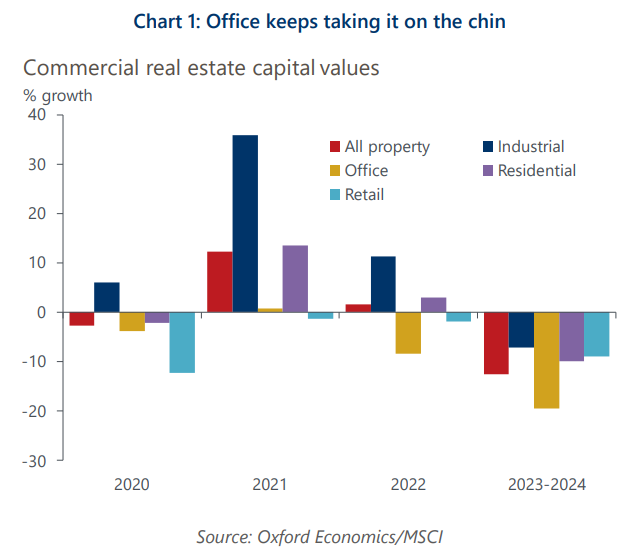

Our view remains that the most severe risks in commercial real estate are concentrated in the office sector, as it continues to deal with the pandemic-induced structural shift of increased remote and hybrid work.

What you will learn:

- In aggregate, commercial banks should be able to absorb losses on their portfolios because of lower CRE prices for offices. The risk is that the stress caused by CRE hits smaller banks, which have come under significant pressure.

- Today’s environment features flighty deposits, a high concentration of real estate loans among small institutions, and sizable property price declines. Odds are that the bank stress from offices is far from over because a significant number of loans are due this year and interest rates will decline more slowly than anticipated.

- The increased use of nonbanks as a source for credit has cushioned the blow to the economy from tighter lending standards among banks, but this poses a downside risk. Increased competition by nonbanks could put additional pressure on small regional banks to consolidate.

- Small banks are feeling the blunt of the stress in the office market. However, the regional economic implications also vary. Markets with a higher concentration of office properties are more likely to feel the effects from rising vacancy and falling values.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights