US PCE nowcast shows no slowdown in price pressures

Despite weaker-than-expected gains in headline consumer and producer prices in February, the source data that feed into the PCE deflator show few signs of a slowdown, something that won’t sit well with the Federal Reserve as the boost from tariffs is still to come.

What you will learn:

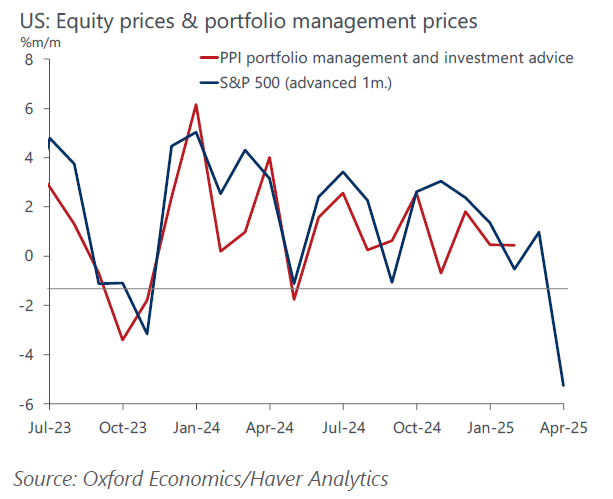

- We estimate headline PCE rose 0.32% m/m while the core index increased 0.36%, stronger than the gains in core CPI and PPI. Some of the big downward surprises in CPI were in components that don’t feed through to the PCE estimate, such as airfares. Meanwhile, the parts of CPI and PPI that rose strongly, including hospital prices, have a larger weight in the PCE index.

- Our estimates imply an increase in core PCE inflation to 2.8% in February from 2.6% y/y in January. Increases in tariffs are likely to begin showing up in consumer prices as soon as March, and, over the coming months, we expect core inflation to climb above 3%.

- We doubt recent fears about the health of the economy will be enough to prompt the Fed to resume cutting interest rates soon, with the Committee likely to focus on the uncertain inflation outlook and rise in various measures of inflation expectations. An extended pause is the path of least resistance.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

Megatrends Scenarios

Unlock uncertainty and understand key risks to the global economy in the long term

Find Out More

Service

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More