Research Briefing

| Feb 13, 2024

US presidential election – Much ado about nothing

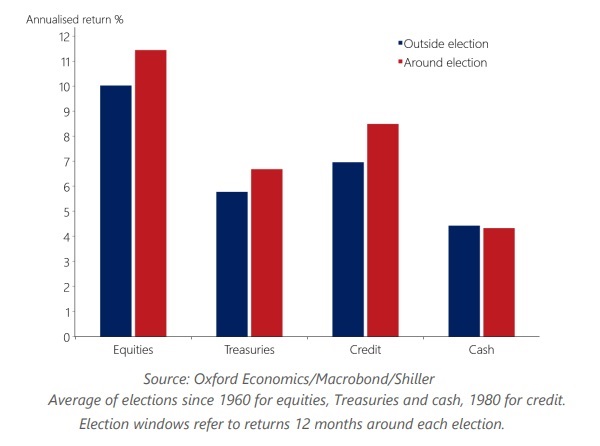

History suggests that presidential elections are not a significant driver of asset returns. That is, asset returns around elections are, on average, the same as returns outside of election windows. We expect this year to be no different.

What you will learn:

- Outcomes in which control of the presidency, House and Senate are divided are generally associated with higher returns for risk assets, while unified control favours defensive assets.

- Assets outperform when the incumbent president wins the election, and underperform when the incumbent loses the election.

- However, we find that these discrepancies fade once the economy is controlled for.

Tags:

Related Services

Service

Emerging Markets Asset Manager Service

Emerging markets insight and opportunity at your fingertips.

Find Out More

Service

Global Macro Strategy Service

Global insight and opportunity at your fingertips.

Find Out More

Service

Global Asset Manager Service

A complete solution for asset managers who require convenient access to high quality, market-relevant analysis on key global markets.

Find Out More