Research Briefing

| Oct 16, 2024

US rates likely headed lower, but there are risks to the outlook

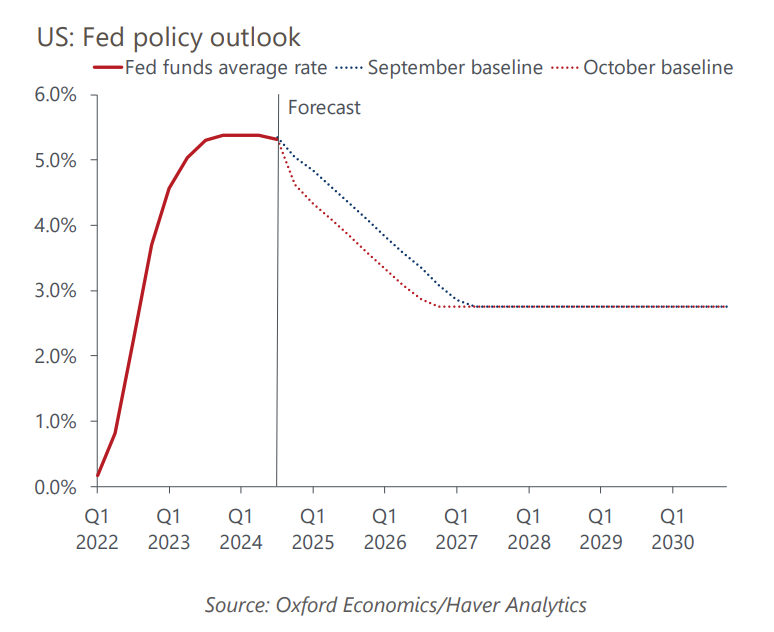

Treasuries have stumbled since the Federal Open Market Committee’s aggressive 50bp rate cut in September, but our baseline longer-term outlook remains bullish.

What you will learn:

- The path toward inflation declines may be bumpy, but the improving trend should continue, allowing the Federal Reserve to continue gradually cutting rates, keeping Treasuries supported through 2025.

- The forecast is not without risks, including the market’s ability to absorb increased Treasury supply, as proposals to cut taxes and boost spending by both presidential candidates would add to the deficit.

- A more aggressive pace of Fed rate cuts than we expect could drive momentum toward curve-steepening trades, weighing on long-end Treasury demand even as shorter-duration Treasury yields fall.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More