US recession fears are misled by noisy soft data

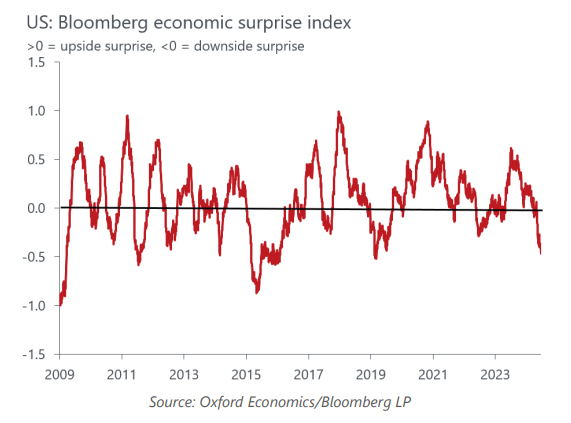

Recession fears are overdone and premature. The economic data has generally come in weaker than expected, but this is not the first time, nor will it be the last, that this occurs without the economy falling into a recession. Not all economic data surprises are equal and the hard data, which matters, has held up; it is the survey-based, or soft, data that has been a disappointment.

What you will learn:

- Recessionists are basing their case on the survey data, which has not tracked the economy well at all over the past few years. In fact, the soft data can be more noise than signal. We lean on our nowcasting estimate of GDP to gauge the risks to our forecast for GDP; it shows the economy is growing around its short-run potential growth rate, which does not justify recession concerns.

- When the economy moderates, it naturally raises concerns that a gradual downshift can turn into something worse. The economy is transitioning into a more sustainable pace of expansion but there are downside risks to our forecast, including the labor market and the consumer.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More