Blog | 28 Sep 2023

US renewables industry already reaping benefits from the Inflation Reduction Act

Andy Logan

Director of Industry Consulting

The Inflation Reduction Act (IRA) that came into force in the US at the beginning of 2023 is a game-changer both in terms of its size and its reach. Our research study with Energy UK (the trade association for the UK energy industry) shows it has already had a triple-whammy effect, increasing the number of new clean energy plants under construction, expanding shipments of equipment, and raising stock market valuations of low-carbon technology firms.

With a planned budget of $369 bn from 2023 to 2031, the IRA is one of the world’s largest-scale investment incentive regimes. More than half of the funds will be used for corporate tax credits that will cover a wide range of energy sources and technologies.

To determine the extent to which these schemes are likely to stimulate growth in the renewables sector we analysed the preliminary evidence on its potential impact on boosting investment in clean technology in the US. Although the act only came into force on 1 January 2023, there has already been some positive anecdotal evidence. For example, Bloomberg NEF reported in April that since the passage of the IRA, automotive and battery sectors had announced $52 billion in planned new factories—more than 20 times the amount announced in 2021.

We examined three sources of high frequency data. The first were US Census Bureau figures on manufacturers’ shipments of power transmission equipment and batteries. This showed a strong uptick, especially of batteries. This alone isn’t a clear signal, however, as other factors such as the post-pandemic recovery and the easing of supply chain bottlenecks may have been at play.

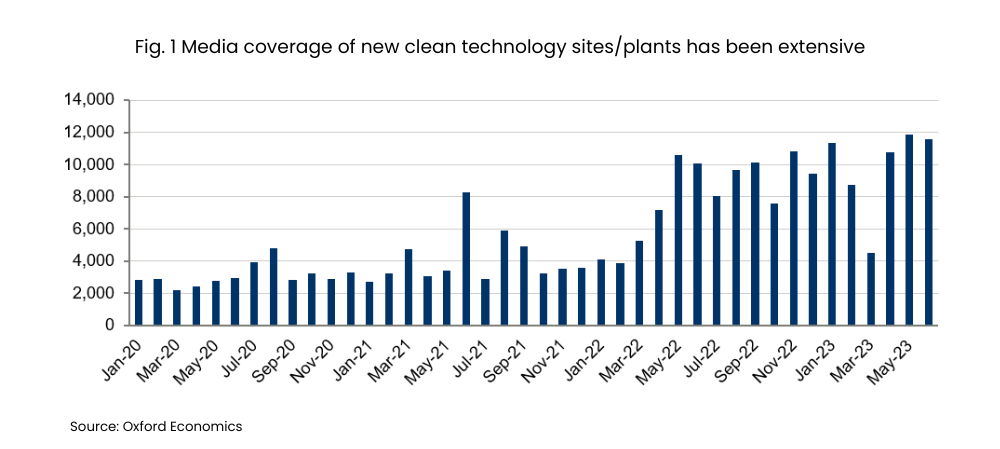

Next we carried out a search of US media mentions of new low-carbon technology sites such as solar, batteries, electric vehicles, nuclear, and offshore and onshore wind. These have nearly doubled since the act was announced, with average monthly media mentions for new clean technology sites/plants in the US more than doubling to 9,700 between August 2022 and June 2023 from 4,400 between January 2020 and July 2022 (Fig. 1).

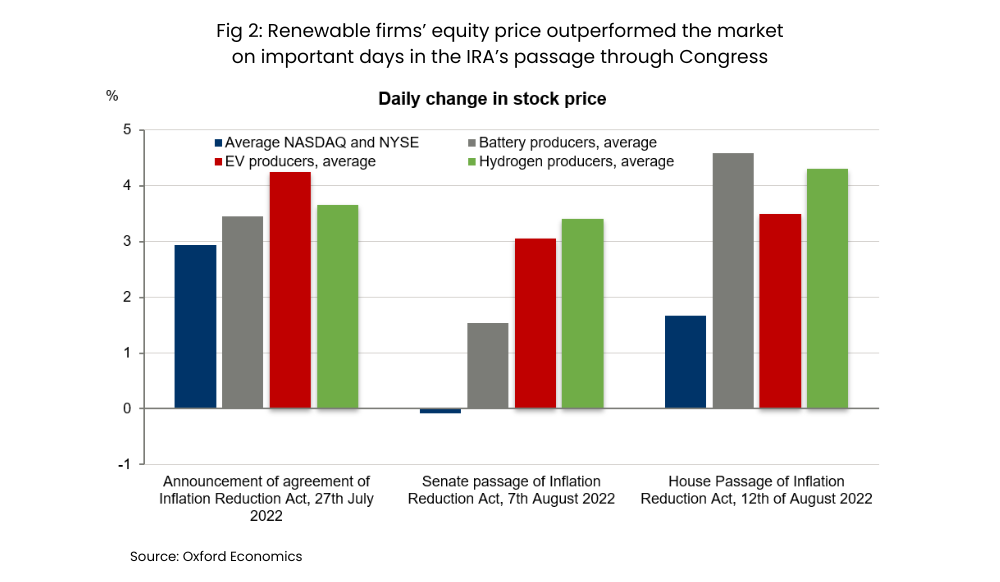

The third piece of evidence was based on share price data analysis for US-based companies specialising in low-carbon technologies, which reflect how profitable investors believe these companies will be in the future. We found that US clean technology companies listed on NASDAQ or the New York Stock Exchange reported higher daily percentage changes in their share price than the average of the host indices on three key days:

- 27 July 2022, the day of the bipartisan announcement on the content of IRA. The stock market rose 2.9%, EV producers enjoyed a 4.2% rise, hydrogen producers 3.7%, and battery producers 3.5%.

- 7 August 2022, when the US Senate passed IRA. Hydrogen firms jumped 3.4%, EV makers 3.1%, and battery producers 1.5%, compared with a 0.1% fall in the NASDAQ and NYSE.

- 12 August 2022, when the US House of Representatives passed the act. Battery producers’ shares jumped 4.6%, hydrogen producers’ 4.3%, and battery producers’ 3.5%—outstripping a 1.7% rise in the US market.

Our analysis suggests that even at this early stage investors see the act as a positive stimulus for clean technology companies’ future profits. This is likely to give the US a competitive advantage in the development and commercialisation of hydrogen and other new clean technologies, and may fuel long-term growth for companies in many associated sectors.

Authors

Andy Logan

Director of Industry Consulting

Andy Logan

Director of Industry Consulting

London, United States

Andy Logan leads our Consultancy offer on different industries for clients. He undertakes studies forecasting the demand for company’s products, analysing the drivers of different industries growth, and assessing the size of different markets and industries. He also investigates the competitive pressures and opportunities facing industries now and in the future. Another area, where he has a keen interest is in studies assessing the demand and supply of labour for different industries and occupations, identifying potential skill shortages and implications for migration.

He has worked with clients in most industries, and in many countries of the world.

Prior to joining Oxford Economics, Andy worked in a variety of economist roles at the Bank of England for 15 years. His research focused on the labour market, commodity and producer prices, UK trade flows, and the performance of UK banks. He holds an MSc. and BA. degrees from the universities of London and Leicester.

Emily Gladstone

Lead Economist

Emily Gladstone

Lead Economist

London, United Kingdom

Emily is a Senior Economist on the Industry team where she supports bespoke industry projects in areas such as renewable energy, construction and insurance. She is also involved in other projects like economic impact studies.

Prior to joining Oxford Economics, Emily worked for 5 years as a government economist for the UK Civil Service, working in the Department for International Trade (DIT) and the Department for Business, Energy and Industrial Strategy (BEIS). In DIT she worked on assessing the socio-economic impact of Free Trade Agreements (FTAs) and Freeports. She also worked in a crisis covid-19 analytical team, providing supply chain analysis and reporting of critical goods to ministers. In BEIS, she used economic analysis to develop policy positions for manufactured goods for both Free Trade Agreements, the Northern Ireland Protocol and the UK’s Global Tariff Schedule. Emily holds a Bsc in Economics from the University of St Andrews.

Contact us to find out more about our industry consulting services.

Tags:

You may be interested in

Post

The changing energy order

To understand how the G20 countries are progressing in the energy transition, Oxford Economics PwC collaborated with PwC to create the Changing Energy Order Index. The index combines data from international economic organizations like the OECD and World Bank with with Oxford's own forecasts to evaluate each country's progress across five key pillars.

Find Out More

Post

Poland: Climate transition presents regional challenges

After falling behind the climate policy progress of other European nations, the transition to renewable energy sources has become increasingly important for Poland in recent years.

Find Out More

Post

Euro-dollar has hit the floor, but don’t expect a bounce

We expect the euro to stabilise against the dollar and trade around its current levels over the next year. Economic fundamentals point to some support to the currency after the sharp, recent depreciation, but heightened uncertainty continues to pose a key downside risk.

Find Out More