US wealth effects are packing a larger punch than ever

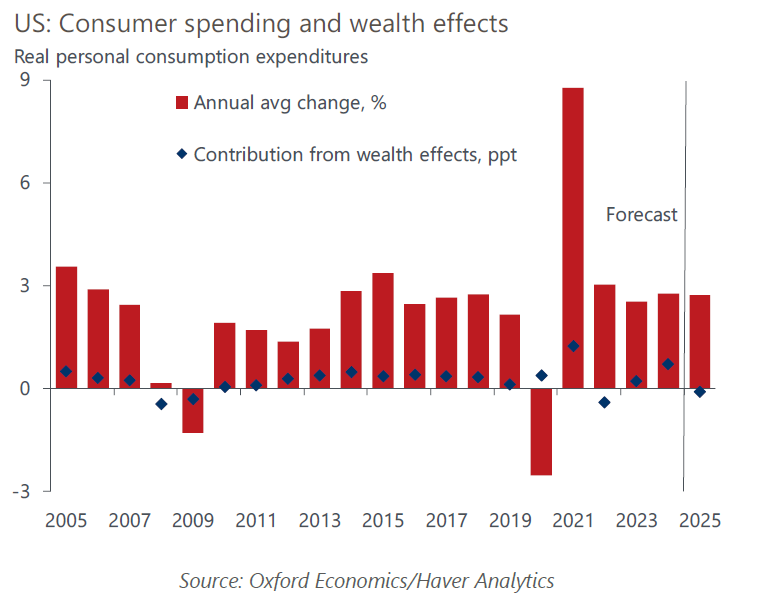

Wealth effects proved to be a quite reliable tailwind to consumer spending this cycle. Consumer spending is estimated to change by $0.14 for every dollar fluctuation in financial wealth, and it changes by $0.09 for every dollar difference in housing wealth.

What you will learn:

- Wealth effects contributed a fifth of the total increase in consumer spending since Q4 2019, adding an average of 0.3ppts to annual GDP growth this cycle.

- The baseline has stock prices heading lower this year because of stretched valuations and uncertainty around policymaking. This implies a modest 0.1ppt drag on consumer spending in 2025, a sharp reversal from the 0.7ppt boost that consumption got from wealth gains last year.

- A bear market would ding consumer spending by 0.3ppts this year. While this may not be too worrisome in the aggregate, some consumer goods and services would hurt much more than others – discretionary outlays on recreation, transportation, and restaurants and hotels.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More