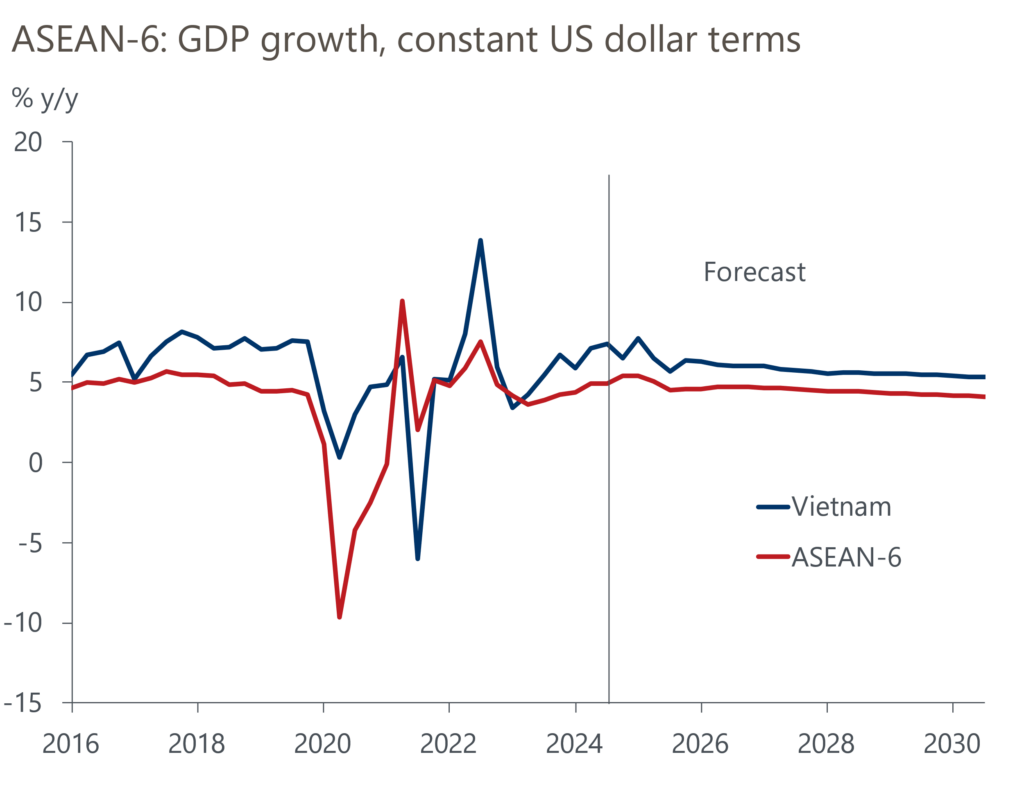

Vietnam: Growth will be ahead of regional peers in 2025

Vietnam’s economy has been the region’s outperformer in 2024, with full-year growth likely at 6.7% y/y. In 2025, we think Vietnam will continue to outperform its peers, growing by 6.5%.

What you will learn:

- Vietnam’s economy will be the standout among the ASEAN-6, growing at a faster pace relative to its peers during the next few years. We think growth in 2025 will be 6.5% y/y, led by manufacturing, with contributions from machinery and textiles. Upside risks are present, with a possible boost from the front-loading of orders driven by US tariff fears.

- Manufacturing fundamentals remain strong. Vietnam is a hub for assembly, packaging, and testing for semiconductor chips, and the chip-led tailwind will continue next year, though the boost will be weaker than in 2024. We expect some softness in the near-term.

- The domestic sector outlook remains bright. Solid wage growth, driven by FDI job creation, should support private consumption. With the number of operating enterprises still growing in annual terms, asset accumulation will likely be stronger in 2025, though FDI inflows may see a temporary slowdown in early 2025 while awaiting possible US tariff announcements on Vietnam.

- Credit growth should be better in 2025. Recent changes to credit controls and a better domestic business sector should provide some support to credit growth. However, the drag from real estate will likely last until end-2025, and offloading bad debt will take some time.

Tags:

Research Briefing

Post

Trump’s tariffs will likely exacerbate the slowbalisation globally

We expect Trump's tariffs will reduce global trade values by more than 7% by 2030 compared to our pre-election forecasts.

Find Out More

Post

Growth forecasts trimmed on review of Trump 2.0 impact

We have revised down our global economic forecasts slightly from our snap post-election assessment. The broad picture is little changed, though: a Trump presidency should have a mild impact on topline macro variables, while the effects on individual sectors and financial markets will likely be larger.

Find Out More

Post

Global: Revisiting the global impact from a slowing China

China's economy looks to have entered a marked downturn. Cyclical trends in China are always tricky to assess given the 'smoothing' of official data, but one clear signal that the economy is struggling is the recent stimulus package announced by the authorities – policy moves can often be revealing about underlying trends in China.

Find Out More