Research Briefing

| Aug 2, 2024

Weak US jobs data adds to markets’ recession fears

The smaller-than-anticipated gain in July and the rise in the unemployment rate will give the perception that the Federal Reserve is behind the curve, but monthly employment is volatile and we don’t want to overreact to a single report.

What you will learn:

- The July employment report comes on the heels of a weaker-than-expected ISM manufacturing survey, adding fuel to financial markets’ recession concerns. Although we see things differently than the markets, investors’ view of reality has caused equity prices to drop. However, even a garden-variety correction wouldn’t be enough to undermine the economic expansion.

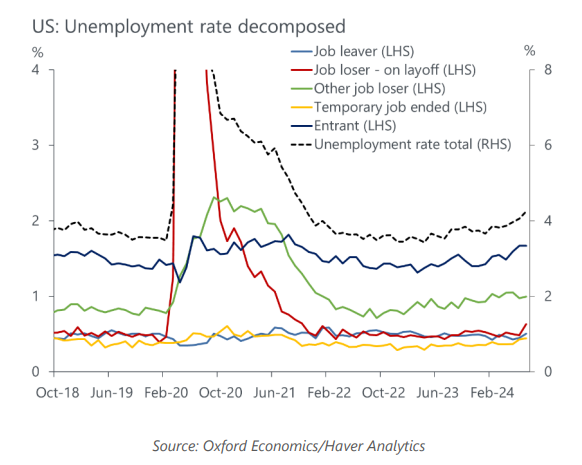

- The rise in the unemployment rate in July will fan concerns because it triggered the so-called Sahm rule, which uses the jobless rate to signal a coming recession. We’re skeptical of this because the rule only correlates with a recession when the increase in the unemployment rate is primarily due to layoffs, which is not the case now.

- A 25bp rate cut in September is basically a done deal. Risks are shifting toward three rate cuts, instead of the current two in our baseline, but our subjective odds of a cut in November are not high enough to add it to our forecast.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More[autopilot_shortcode]