Blog | 10 Jan 2024

Weakness in construction and its related sectors show the impact of interest rate hikes

Nico Palesch

Senior Economist

Ever since the onset of advanced economies’ campaign of interest rate hikes in December 2021 there has been a lively debate about the impact and efficacy of tighter monetary policy in terms of reducing inflation and slowing growth. While inflation has indeed fallen across the world, the relative economic resilience in the United States in particular, which has raised interest rates significantly more than the eurozone, has raised questions about if and how much interest rates are actually depressing activity.

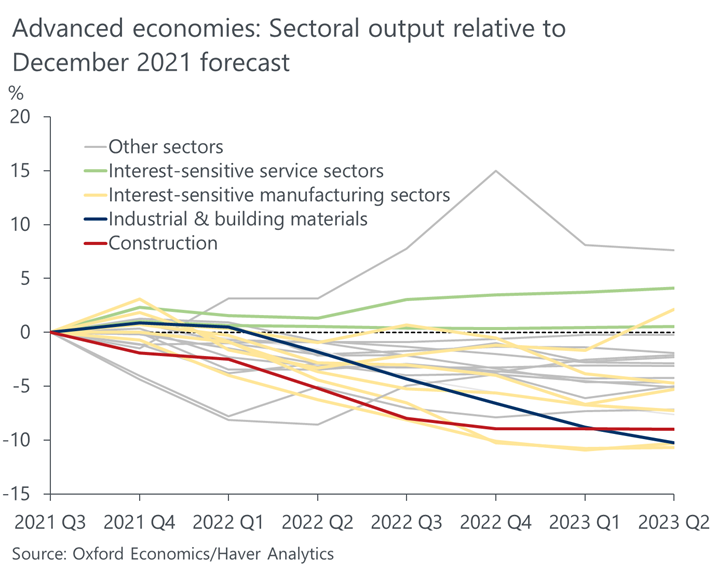

A look under the sectoral hood however shows that while interest rate hikes may not yet have had a large impact on consumer spending, output has been substantially underperforming in interest-sensitive sectors. Most prominently, the construction and industrial & building materials sectors are two of the worst-performing sectors in advanced economies relative to our December 2021 forecast, which represents our view before the onset of the interest-rate shock (see Fig. 1). Output in both sectors is around 10% below the pre-rate hike forecast level in Q2 2023, and both have undergone significant output contractions in recent quarters. This is substantially worse than the performance of GDP, services, and manufacturing output in that same time horizon, which are -1.5%, +0.2%, and -3.7% relative to the pre-interest rate hike baseline.

Fig. 1. Construction and industrial & building materials underperform

A large part of this can be traced back to falling residential construction. Higher interest rates affect demand for housing on both the demand and supply side, by making mortgages more expensive for consumers and credit more expensive for builders. We have already seen significant weakness in residential construction activity in economies where interest rates have gone up significantly. Japan, which has not seen monetary tightening anywhere on the scale of the US, UK, or eurozone, is a notable exception, seeing growth in the first half of the year relative to the first half of 2022, unlike in the US and much of western Europe.

Other construction, including private non-residential investment in structures and civil engineering projects, has helped bolster activity in recent quarters. This includes the boom in US factory construction, spurred on in large part by subsidies embedded in the Inflation Reduction and CHIPS Acts, and in Europe various public investment projects in the wake of Covid-19. However, these growth impulses are likely to moderate next year, which, combined with low levels of residential investment, will extend construction weakness into next year. This outlook is reinforced by data showing low levels of building starts and housing permits in the US, UK, and Europe. Again, Japan stands out as the exception, with steady building starts and construction orders.

Nonetheless, the prospect the prospect of recovery in construction and its related sectors is not hopeless. We expect that growth will pick up in the second half of 2024 as the peak of the negative impacts of interest rate hikes pass, sentiment picks up, and the prospect of interest rate cuts begins to take centre stage.

Find out more about how interest-sensitive sectors are faring in the current environment and download the full research briefing here.

Authors

Nico Palesch

Senior Economist

Nico Palesch

Senior Economist

London, United Kingdom

Nico is a Senior Economist within Oxford Economics’ Global Industry Service where he is responsible for monitoring and forecasting developments in the transportation & logistics sector, writing industry-related reports and research notes on sector-specific and cross-sector themes and issues, overseeing and expressing the house-view on industrial developments in our monthly publications, and working on bespoke consulting projects.

Nico holds a BSc Joint Honours Political Science and Economics from the University of Ottawa and an MSc Economics from the London School of Economics and Political Science, achieved with distinction.

Tags:

You may be interested in

Post

Australia’s Infrastructure Outlook: Big Shifts, Bigger Challenges

Australia’s infrastructure landscape is shifting fast, driven by new investment trends, emerging asset classes and growing capacity constraints. This outlook explores the major changes ahead and what industry and government must do to navigate the decade effectively.

Find Out More

Post

Construction labour shortages remain an entrenched challenge across Europe

Labour shortages remain an ongoing challenge across Europe, limiting firms’ ability to deliver a strong pipeline of work. 28% of construction firms are reporting that lack of personnel is limiting their output and 14% are intending to hoard labour in the next three months to minimise future risk.

Find Out More

Post

The hydrogen divide: a future fuel or a flawed fantasy in Australia?

Australia is poised to become a global leader in green hydrogen, leveraging renewables and innovation to unlock major export and investment potential.

Find Out More