What the rise in NICs means for the UK labour market

The April increase in employers’ national insurance contributions will weaken the UK labour market, increasing unemployment. Sectors with the greatest reliance on lower paying roles, such as hospitality, art and recreation, and wholesale and retail, look highly vulnerable to job losses.

What you will learn:

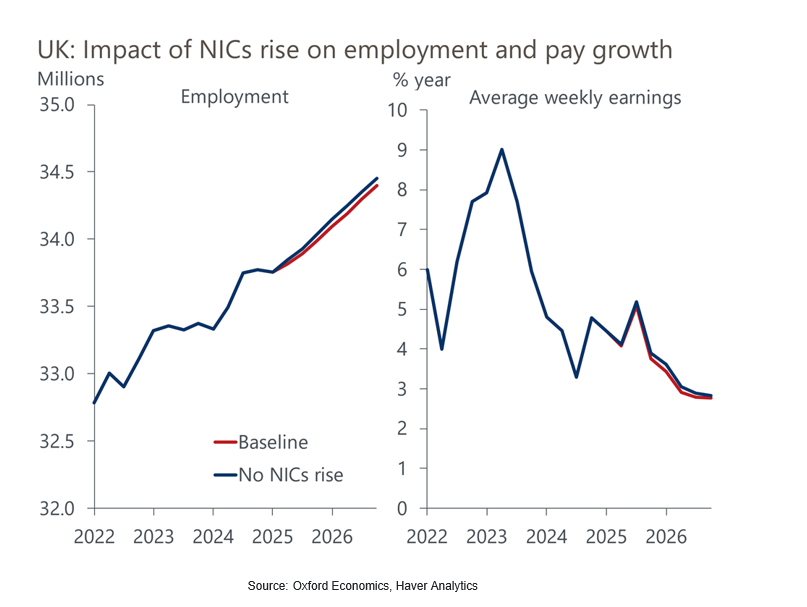

- To quantify the potential effects, we modelled the increase in employers’ NICs. The results suggest the hike will cut employment by 55,000 and pay growth by 0.2ppts, and raise the unemployment rate by 0.2ppts. But we think the secondary threshold cut and simultaneous increase in the national living wage, at a time when corporate profitability is already weak, could yield nonlinear results. So the impact on jobs could be bigger than our modelling indicates.

- This year’s large increase in labour costs is the latest in a series of cost pressures that have already pushed corporate profitability to a 23-year low. We’re concerned about the ability and willingness of firms to absorb extra cost rises, particularly against a backdrop of soft demand.

- The large cut in the point at which firms start paying NICs will raise the cost of lower paid roles significantly, particularly given the national living wage will also rise sharply. We calculate the total cost of salary and NICs for a full-time worker on the living wage will increase by 44% between 2021-2025.

Tags:

Related Content

The UK’s fiscal adjustment is at risk of failure

The UK is planning one of the largest fiscal consolidations of any advanced economy over the next two years. We expect it to result in much weaker GDP growth than the Office for Budget Responsibility forecasts and think the government's balance sheet is still likely to deteriorate.

Find Out More

UK Labour market data woes show the importance of nowcasts

We think that valid concerns about the quality of data from the UK's Labour Force Survey (LFS) make it virtually unusable at present. Considering it will likely take another two years to fix the problems, this poses a major headache for policymakers and economists alike.

Find Out More

Eurozone: tariff threat weighs on the outlook

The eurozone economy remains stuck in a low gear and we have recently cut our growth forecasts as a result of our expectation of US tariffs on European imports being imposed over the coming months. While we still think the Eurozone economy is more likely to continue to grow at weak pace rather than fall into recession, the list of risk factors – ranging from more cautious households and firms to a full-blown trade war – remains long. In this webinar, we will discuss both the recent changes to our baseline and the risks around it, as well as their consequences for the fiscal and monetary policy outlook.

Find Out More

Will eurozone tariffs be the straw to break the labour market’s back?

We have revised our Eurozone labour market forecasts to incorporate the impact of US tariffs, and now expect employment growth to come to a near standstill this year. Although risks to the labour market are tilted to the downside, various indicators continue to suggest that a serious downturn will be averted.

Find Out More