Why rate cuts will do less than rate hikes

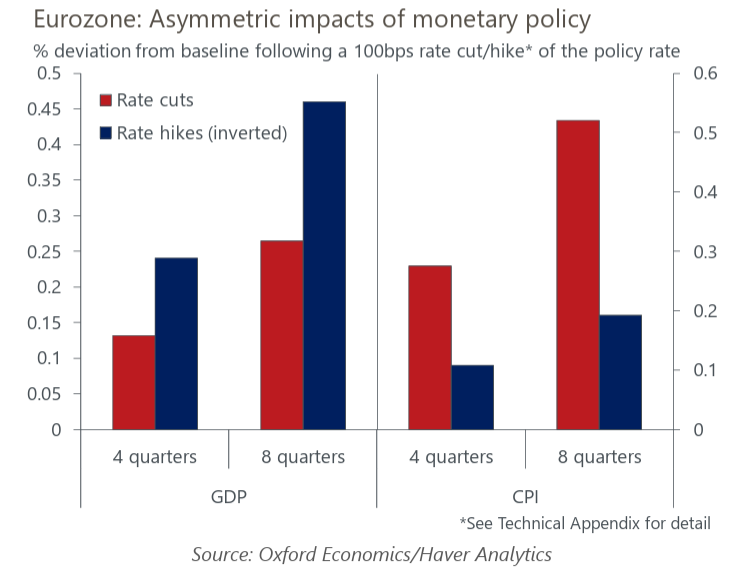

Rate cuts by the European Central Bank over the course of 2025 may not boost growth to the same degree that the central bank’s aggressive rate-hiking cycle in the wake of the pandemic constrained it. This reinforces our view that quarterly eurozone growth will remain broadly stable at last year’s humble pace.

What you will learn:

- Our modelling shows rate cuts generate a weaker growth response than rate hikes. But there are also cyclical factors and structural changes to monetary policy transmission in the eurozone that may further dampen the growth boost. Geopolitical and supply-side risks that are keeping term premia elevated will also limit the passthrough of lower nominal rates to financing conditions.

- We also think higher savings since June 2022 won’t be unwound as fast as they were accumulated. Longer maturities on household liabilities mean some of the impact of past rate hikes will likely keep savings elevated. It’s also possible the savings rate could settle higher than the pre-pandemic average. In a post-pandemic era of more adverse supply shocks, consumers are likely to be more risk averse and structurally raise savings over time, dampening the key easing channel of disincentivising savings by lowering rates of return.

- Industrial demand is highly sensitive to interest rates in recessions – rate cuts will provide a much-needed boost. But structural constraints that inhibit profitability, such as labour shortages and higher energy prices, risk subduing investment appetite.

- There may be some upside risks, too. Strong house price growth that bolsters household collateral could deliver a more front-loaded pick-up in durables consumption, which then further supports the beleaguered manufacturing sector.

Tags:

Related Content

China coastal tech exporters vulnerable to new Trump tariff

The United States has introduced an additional 10% levy on Chinese imports as part of the opening round of the Trump 2.0 tariff regime. While certainly not as severe as some of the tariff threats made against China by President Trump in the run up to his inauguration, we nevertheless expect the additional tariffs to affect the country’s economic performance—with coastal tech manufacturing hubs particularly vulnerable.

Find Out More

Trump tariffs to shake up Asian manufacturing in 2025

The new US tariffs add an additional layer of drag on Asian manufacturing activities. India will be one of the least affected countries.

Find Out More

The risks to Asia from Trump’s tariff plans so far

We think the immediate tariffs on China will have spillovers to some other Asian economies, while the threat of reciprocal tariffs has raised the odds that of the rest of Asia will also be slapped with higher tariffs.

Find Out More

Reciprocal tariffs another tool to extract policy concessions

US President Donald Trump has announced or threatened a range of fresh tariffs in recent weeks. While we expect the overall macro impact to our global forecasts to be modest, the impacts for specific countries and industries will be meaningful.

Find Out More