Will eurozone tariffs be the straw to break the labour market’s back?

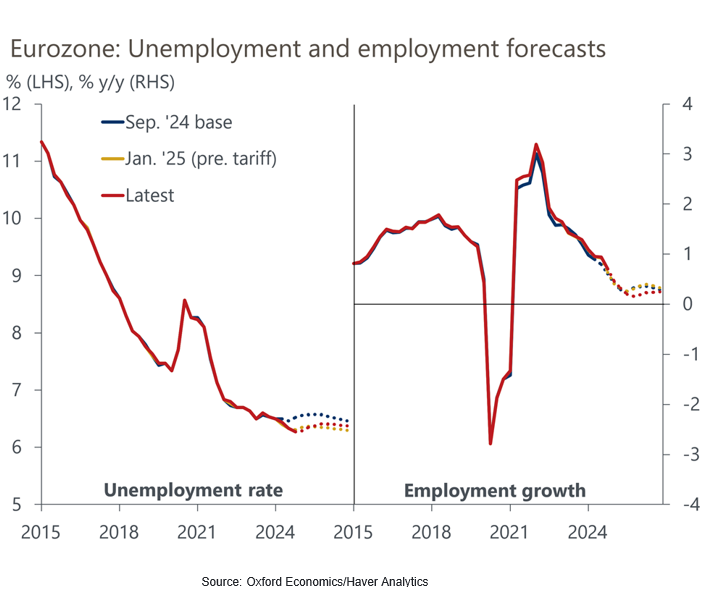

We have revised our Eurozone labour market forecasts to incorporate the impact of US tariffs, and now expect employment growth to come to a near standstill this year. Although risks to the labour market are tilted to the downside, various indicators continue to suggest that a serious downturn will be averted.

What you will learn:

- Hiring intentions point to employment gains slowing this quarter from the probable 0.2% rise in Q4. We expect employment will flatline as industry payroll cuts will accelerate. By end of 2025 we forecast employment will have grown by a meagre 0.2%, the weakest rise since 2013 outside the pandemic.

- Stark differences between countries and sectors make it difficult to discern an underlying pan-European trend. But we think solid expansions driven by strength in services and falling structural unemployment in Southern Europe are broadly offsetting the cyclical and structural headwinds faced by more industry-dependent countries, such as Germany and Finland.

- There are two immediate and interconnected downside risks. Firms could stop hoarding labour as they aim to increase profitability amid faltering hopes of a recovery in demand. And the recovery itself could disappoint as consumers remain stingy amid rising unemployment worries, particularly when tariffs start to bite or if interest rate cuts disappoint expectation.

Tags:

Related Content

Eurozone: Surveys have become less predictive; what can plug the gap?

Surveys are a staple of high-frequency economic indicators, but they have become less reliable in predicting hard economic data like GDP growth. This feeds macro volatility – markets still interpret surveys such as PMIs essentially as reliable growth signals. The disconnect between survey and hard data can lead to mispricing.

Find Out More

Euro-dollar has hit the floor, but don’t expect a bounce

We expect the euro to stabilise against the dollar and trade around its current levels over the next year. Economic fundamentals point to some support to the currency after the sharp, recent depreciation, but heightened uncertainty continues to pose a key downside risk.

Find Out More

Eurozone: How to set policy in an era of frequent supply shocks

Oxford Economics' new proprietary business cycle indicator shows that real US construction spending is firmly in a decelerating growth phase.

Find Out More

Eurozone: Pension system sustainability hinges on unpopular reforms

Increased spending to meet the needs of an ageing population jeopardises the sustainability of Europe's public pension systems, based on current legislated measures.

Find Out More