Winter weather will have a chilling effect on US Q1 GDP

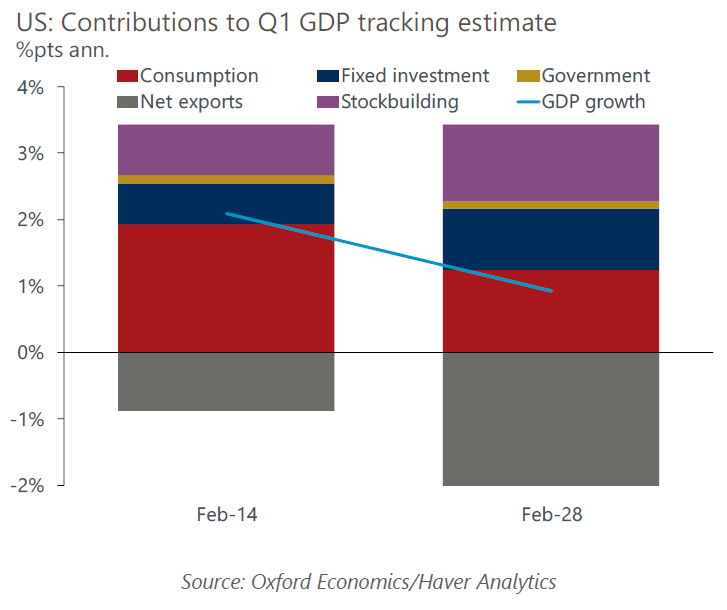

First-quarter GDP is tracking weakly at 1% annualized, but we think a lot of the swings in the data are driven by temporary factors, including the unseasonably cold weather in January and the front-loading of imports ahead of tariffs.

What you will learn:

- The on again, off again tariffs are fanning uncertainty. If they were to be implemented as proposed, it will cumulatively raise the US effective tariff rate above 10%, a level not seen since the 1930s. The new tariffs would shave 0.4ppts off GDP growth this year and lead the core PCE deflator to average 3.1% in 2025.

- Tariff proposals put the Federal Reserve in a bind as they will ding the economy while putting upward pressure on inflation. The Fed’s reaction function currently puts a greater weight on inflation; therefore, the tariffs will cause the Fed to stay on the sidelines, consistent with our forecast for the next rate cut to occur in December.

- We will regularly update our tariff monitor to track which goods are subject to tariffs, the economic implications, and how the Trump administration’s trade policy is unfolding relative to the assumptions in the baseline forecast.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More

Service

Megatrends Scenarios

Unlock uncertainty and understand key risks to the global economy in the long term

Find Out More