Emerging Markets Asset Management Service

Emerging markets insight and opportunity at your fingertips.

Try for free

Overview

We provide asset allocation and investment strategy analysis for multiple asset classes to long-term and tactical investors in emerging and frontier markets.

What do you get?

Comprehensive, independent analysis of the macroeconomic outlook and its implication for asset prices.

Tactical and strategic asset allocation

Reviews of our asset allocation views looking 12 and 36 months ahead respectively.

Access to proprietary risk tools

Tools to access the risk of sovereign crisis and sharp depreciation across 166 countries.

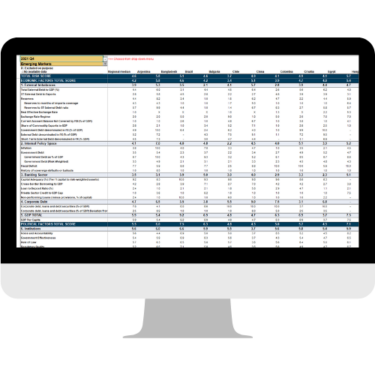

Forecast databases

Detailed macroeconomic baseline forecasts covering over 200 economies updated each month.

High quality macroeconomic research

Regular reports on how key macroeconomic developments could influence your portfolio.

Why do you need our help?

We help you uncover the investment opportunities in some of the fastest growing markets in the world.

Unlock investment opportunities

There are huge gains awaiting investors that can identify the right emerging market investment at the right time. And we are here to help you tap into them. From analysis of macroeconomic trends to investment recommendations on equities, bonds, credit and FX, we deliver key insights to your mailbox, enabling you to make better-informed decisions.

Move with confidence

While investing in emerging markets can generate higher reward, it also comes with higher volatility and an array of risks. We help you monitor and mitigate these risks by providing analysis and risk tools that allow easy comparison of sovereign and FX risk across 166 countries. Backed by our rigorous analytical approach, our service gives you the insight you need to have a high degree of confidence in your investment decisions.

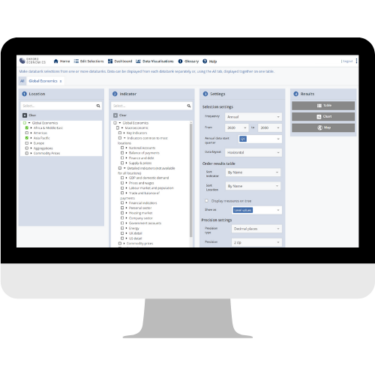

Insights at your fingertips

In addition to asset allocation views and risk tools, we further provide a wealth of information including Country Economic Forecasts reports, Forecast databases as well as high quality macroeconomic research. You can conveniently access all these insights via email, excel and online portal 24 hours a day.

Emerging Markets Asset Manager Service

Emerging Markets Asset Manager Service provides a comprehensive, independent analysis of the macroeconomic outlook and the implications for EM asset prices.

Subscribe to our asset management newsletter

Download now

Resources and events

Research Briefing

The five key challenges confronting the next Czech Republic government

Blog

Saudi Arabia’s PIF: Driving diversification through strategic investments

Research Briefing

Assessing China’s revamped services sector

Research Briefing

The relative winners and losers of tariffs

Event

AI boom, Deglobalisation and Fiscal Shifts

Event

Investment Strategy Conference

Event

Investment Strategy Conference

Event

Commercio globale, Debito USA, Fed e tassi

Page

Economics for Asset Managers

Featured

“The scope of data availability and ease of access, coupled with an expert team on hand to reference, means Oxford Economics is one of our trusted economic experts.”

Request a Free Trial

Complete the form and we will contact you to set up your free trial. Please note that trials are only available for qualified users.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will not share your personal information with other individuals or organisations without your permission.

Related services

Service

Global Asset Manager Service

A complete solution for asset managers who require convenient access to high quality, market-relevant analysis on key global markets.

Find Out More

Service

Global Macro Strategy Service

Global insight and opportunity at your fingertips.

Find Out More

Service

Sovereign Risk Tool

Measures and forecasts the vulnerability of 166 countries to a sovereign crisis or a sovereign distress.

Find Out More

Service

FX Risk Tool

A rigorous and transparent framework to measure the risk of a sharp currency depreciation.

Find Out MoreTrusted By