TradePrism

Understand global trade flows for over 1200 product and commodities across 46 economies.

Request a demoOverview

TradePrism empowers businesses with data-driven insights into the future of global trade flows, helping them optimise strategy and mitigate risks.

Our services provide businesses, government, and industry association planners with in-depth analysis, historical data, and world-leading forecasts, covering 1,200 HS4-level commodities across 46 major economies.

By identifying key trends and evolving trade dynamics, we enable businesses to make smarter, forward-looking decisions in an increasingly complex global market.

TradePrism

TradePrism empowers organisations with data-driven insights into the future of global trade flows, helping them optimise strategy and mitigate risks.

By identifying key trends and evolving trade dynamics, we enable businesses to make smarter, forward-looking decisions in an increasingly complex global market.

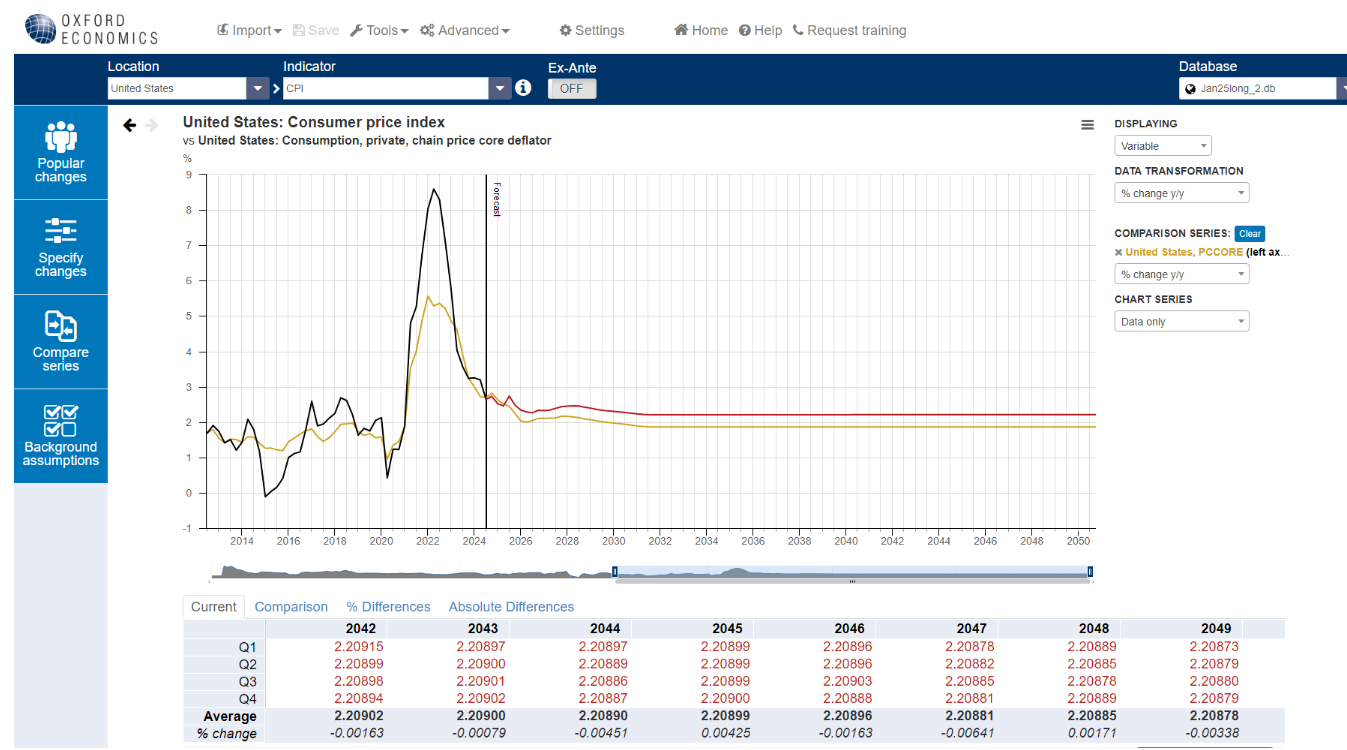

Integrated Forecast

The forecasting model integrates seamlessly with the Global Economic and Industry Models, ensuring alignment with the broader global outlook. By interconnecting country models through critical variables such as trade, pricing, competitiveness, capital flows, interest rates, and commodities, it delivers cohesive, data-driven forecasts. This approach empowers you with reliable insights for strategic decision-making and long-term planning.

Extended Forecast Horizon

The forecasts extend to 2050, providing a long-term outlook that is critical for strategic planning and investment. By capturing structural shifts in trade, energy, and infrastructure, the analysis offers deeper insights into future trends. This approach integrates short-term economic scenarios with a robust long-term trade model, enabling customers to make informed, forward-looking decisions with confidence.

Flexibility & Integration

TradePrism delivers tailored insights by allowing users to purchase data by country or product type. Its customisable access and permission levels ensure businesses get the precise information they need.

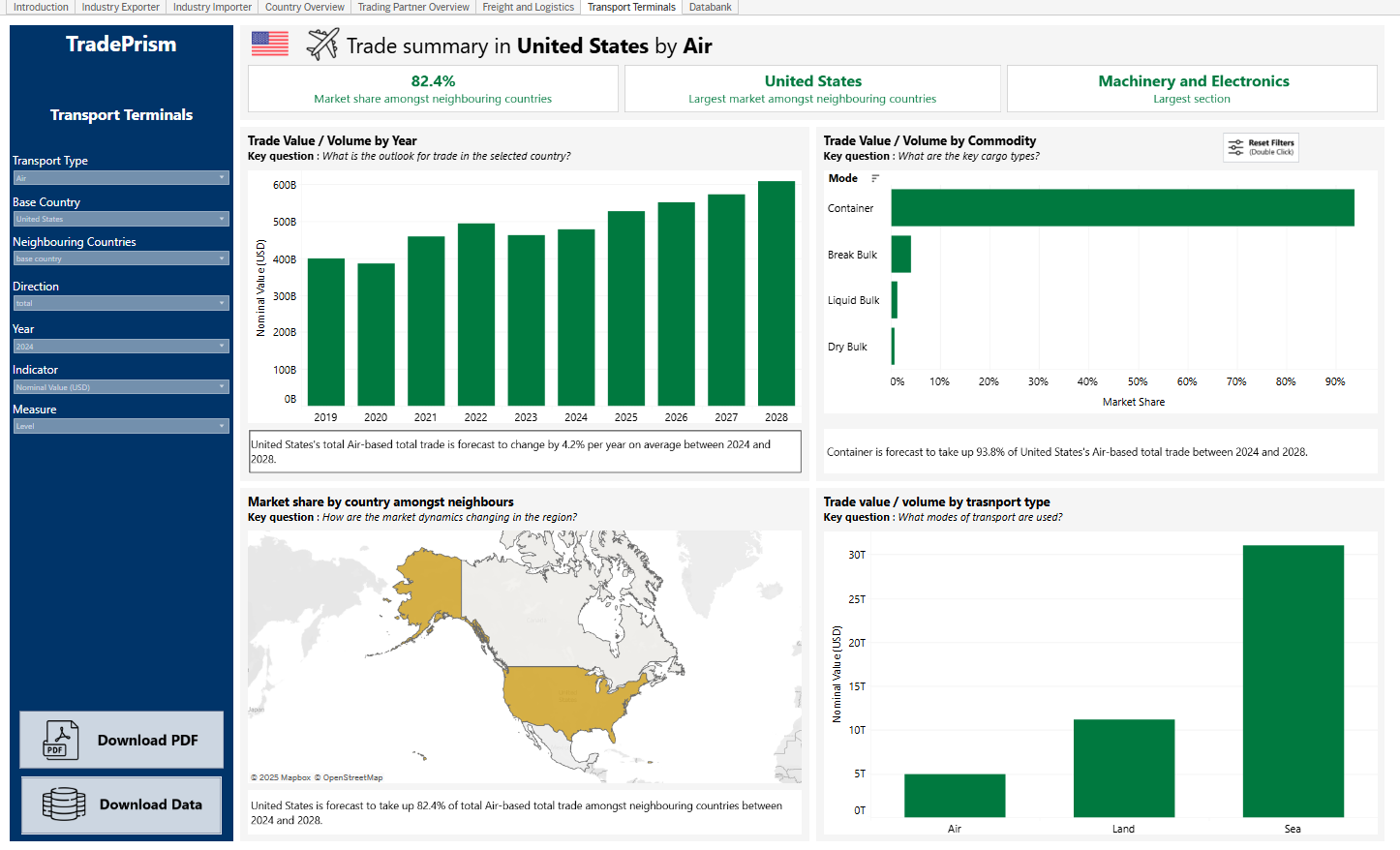

Insights & Interactive Interface

Hosted on Tableau, TradePrism offers interactive visualisations and seamless navigation across 350 million data points. Quarterly updates and Research Briefings provide timely insights, while geographic data highlights evolving trade relationships. Analysis of key commodity groupings ensures a comprehensive, data-driven perspective for ports, shipping, and economic trends.

Comprehensive Coverage & Harmonized Data

TradePrism provides extensive coverage of 1200 commodities, ensuring businesses have access to detailed trade insights across a wide range of sectors for informed decision-making.

Additionally, TradePrism ensures global trade consistency, where exports from Country A always match imports recorded by Country B.

Understand global trade flows for over 1200 product and commodities across 46 economies

Request a demoBenefits

- Strategic Planning – Identify expansion opportunities, new revenue streams, and market repositioning strategies in response to evolving trade dynamics.

- Demand Forecasting – Gain insights into where demand will be strong or weak and capitalise on future trade shifts.

- Investment Decision-Making – Determine where to allocate capital for maximum long-term returns based on projected demand changes.

- Competitive Analysis – Understand market size and its evolution to stay ahead of competitors.

- Comprehensive Trade Forecasting & Volume Analysis – Gain long-term insights and a granular view of global trade movements with the world’s most extensive forecasting service, measuring flows in nominal/real USD, tonnes, and transport modes.

- Bilateral Trade Projections – Forecasts to 2050 covering 46 economies and up to 1,200 products, accounting for 88% of global trade, plus total bilateral trade flows for 125 additional countries.

- Intuitive Data Visualisation – A user-friendly interface with powerful search capabilities, enabling quick access to trade data by source, destination, or product.

What’s included?

Dashboard

The newly launched dashboards are designed to meet user needs, each tailored to specific requirements, including industry, country, and transport-focused users.

These dashboards answer key questions, including:

- What is the export outlook for the industry?

- Which countries represent the largest or fastest-growing demand for product exports?

- How is bilateral trade between two countries expected to grow?

- How vulnerable are certain countries or industries to tariffs?

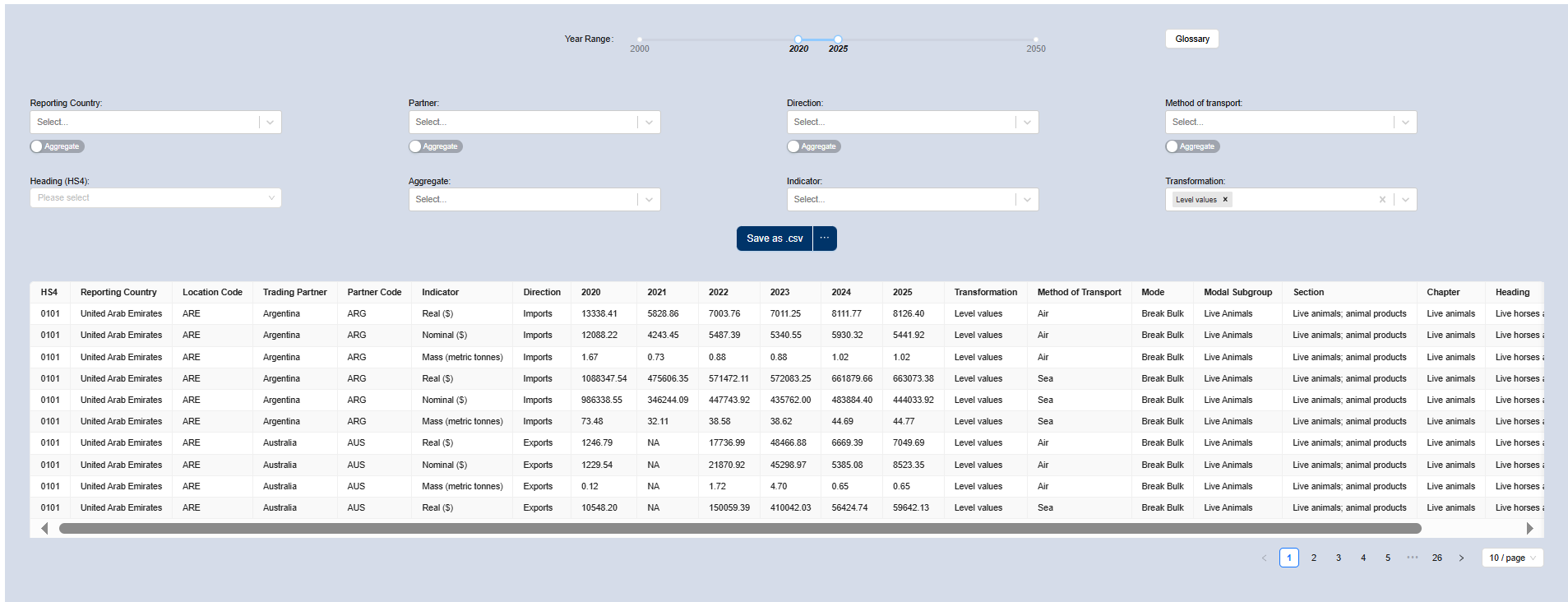

Databank

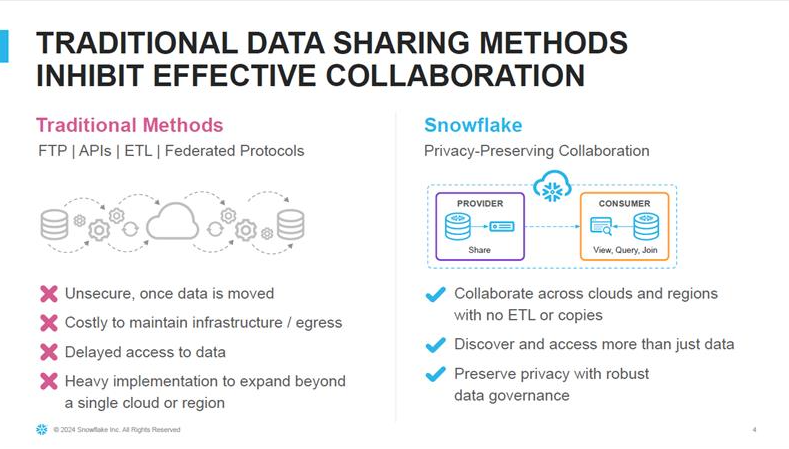

TradePrism databank offers unparalleled insights into global trade dynamics with its comprehensive Bilateral Trade Projections, forecasting trends up to 2050. Covering 46 key economies and over 1,200 products—representing 88% of global trade—our projections provide a detailed view of future trade flows. Additionally, we include total bilateral trade data for 125 more countries, with the flexibility to expand coverage based on client needs. To enhance accessibility and integration, all data and forecasts are now available through the Snowflake Marketplace, a universal data platform that seamlessly connects TradePrism with other datasets, empowering businesses to make data-driven decisions with confidence.

Trade Volume Analysis

- Nominal & Real USD value

- Volume / Mass

- Transport mode

Trade volume analysis in nominal and real USD, tonnes, and transport mode offers customers a comprehensive understanding of trade dynamics, helping them optimise supply chains, forecast demand, and make data-driven decisions with precision.

Connecting Trade Intelligence to Your Workflow: Access TradePrism Data via Snowflake Marketplace

To enhance accessibility and integration, all data and forecasts are now available through the Snowflake Marketplace, a universal data platform that seamlessly connects TradePrism with other datasets, empowering businesses to make data-driven decisions with confidence.

This integration enables faster, easier access to real-time trade intelligence, helping organizations uncover new opportunities, respond swiftly to market shifts, and optimize strategic planning with unparalleled accuracy. By seamlessly connecting TradePrism data with Snowflake’s powerful platform, businesses can integrate trade intelligence directly into their workflows, enhance forecasting models, and make smarter, forward-looking decisions in an increasingly complex global market.

Connecting Trade Intelligence to Your Workflow: Access TradePrism Data via Snowflake

To enhance accessibility and integration, all data and forecasts are now available through the Snowflake Marketplace, a universal data platform that seamlessly connects TradePrism with other datasets, empowering businesses to make data-driven decisions with confidence.

This integration enables faster, easier access to real-time trade intelligence, helping organizations uncover new opportunities, respond swiftly to market shifts, and optimize strategic planning with unparalleled accuracy.

Request a demo

Complete the form and we will contact you to set up your free trial. Please note that trials are only available for qualified users.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will not share your personal information with other individuals or organisations without your permission.

Related services

Tariff Monitor: Trump hits pause on Canada and Mexico

On March 4, President Trump placed 25% blanket tariffs on Canada and Mexico, except Canadian energy products that would be subject to 10% tariffs, and an additional 10% across-the-board tariff on China.

Find Out More

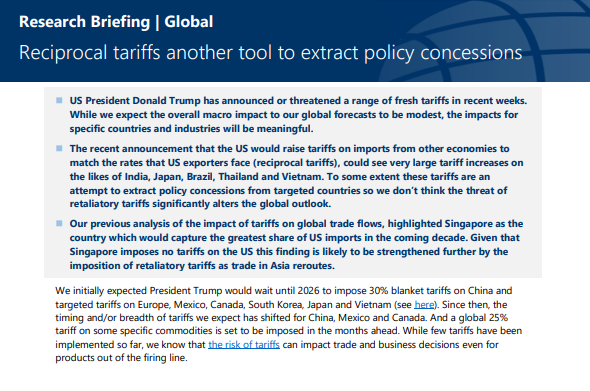

Reciprocal tariffs another tool to extract policy concessions

Find Out More

Trade war scenario threatens US travel sector

Research Briefing TradePrism International travel to the US is expected to decline.

Find Out More

Ignore US gold imports, net trade is weak but not disastrous

The nominal goods trade deficit was at its widest in January, signaling businesses had front-loaded goods shipments ahead of new and potential tariffs from the Trump administration.

Find Out More

Steady, Yet Slow: How Oxford Economics Sees Global Economic Growth in 2025

Oxford Economics set the stage for the year ahead, at our second Global Economic Outlook Conference, in London on Wednesday, 5 February.

Find Out More

The risks to Asia from Trump’s tariff plans so far

We think the immediate tariffs on China will have spillovers to some other Asian economies, while the threat of reciprocal tariffs has raised the odds that of the rest of Asia will also be slapped with higher tariffs.

Find Out More

European pharma, high-tech, and machinery most exposed to US trade war

European pharmaceuticals, machinery, and high-tech goods are heavily exported to the US, making them vulnerable to across-the-board US tariffs. However, European pharmaceuticals make up a sizeable share of total US consumption of this product, so the imposition of tariffs on the sector would be harmful to US households and businesses.

Find Out More

Calgary, Saint John, and Windsor are the Canadian metros most vulnerable to Trump’s tariffs

Tariff-induced price increases call into question tightly integrated supply chains across North America and make large swathes of exports less competitive.

Find Out More

Trump’s tariffs pose uneven subnational risks across the EU

Trade tensions between the EU and the US are escalating. Aggressive protectionist policies have been a key instrument for Trump in the opening months of 2025, and the president has indicated that both blanket and sector-specific levies on EU good exports could be imposed within the coming weeks.

Find Out More

Tariffs hurt, even if some are just threats

Tariffs don't have to be imposed to wreak economic harm – threats are enough. So the recent flurry of announcements by the US, followed in some cases by swift postponements, are already increasing trade uncertainty and making it less likely that companies will invest.

Find Out More

No reprieve on the US tariff front

The narrative surrounding policymaking and its near-term economic impact has shifted dramatically from the January to February baseline forecast.

Find Out More

Lower-income states and metros face the greatest burden from impending tariffs

Tariffs act as a regressive tax on households as they are applied to imported goods, many of which fall into the category of non-discretionary spending on such things as clothing, food, and energy—necessities most households cannot go without.

Find Out More

Autos and machineries in Japan are most vulnerable to US tariffs

Our analysis of industry and trade structure between the US and Japan reveals the auto and non-electrical machinery sectors are most vulnerable to tariffs by the US. For both sectors, the US accounts for a sizeable share of total exports as well as gross output, and particularly so for auto.

Find Out More

Eurozone is likely next in the tariff war

We have incorporated a 10% blanket tariff by the US and immediate retaliation by the EU in our forecast for Eurozone GDP growth, which is now 0.3ppts lower for 2025 and 2026.

Find Out More

Tariff developments don’t change the broad growth story

As Donald Trump's inauguration as US president approaches, there has been little additional clarity regarding the exact nature of the policies he will pursue in office.

Find Out More

Chinese policy is unlikely to shift due to announced tariffs

US President Donald Trump's announcement of an additional 10% tariff on imports from China was in line with our baseline expectation. But the immediacy of implementation, the blanket style of tariffs, and the inclusion of stronger language around retaliation in policy documents still add significant uncertainty to our forecasts.

Find Out More

US Tariff Monitor – Sooner rather than later

President Trump launched the first salvo in what will like turn into another global trade war. A 10% additional tariff on imports from China went into effect on February 4 and the Chinese responded with a series of retaliatory steps.

Find Out MoreTrusted By