World Economic Prospects

Each month Oxford Economics’ team of 300 economists updates our baseline forecast for 200 countries using our Global Economic Model, the only fully integrated economic forecasting framework of its kind. Below is a summary of our analysis on the latest economic developments, and headline forecasts. To access the full report (and much more), request a free trial today.

Request a free trial

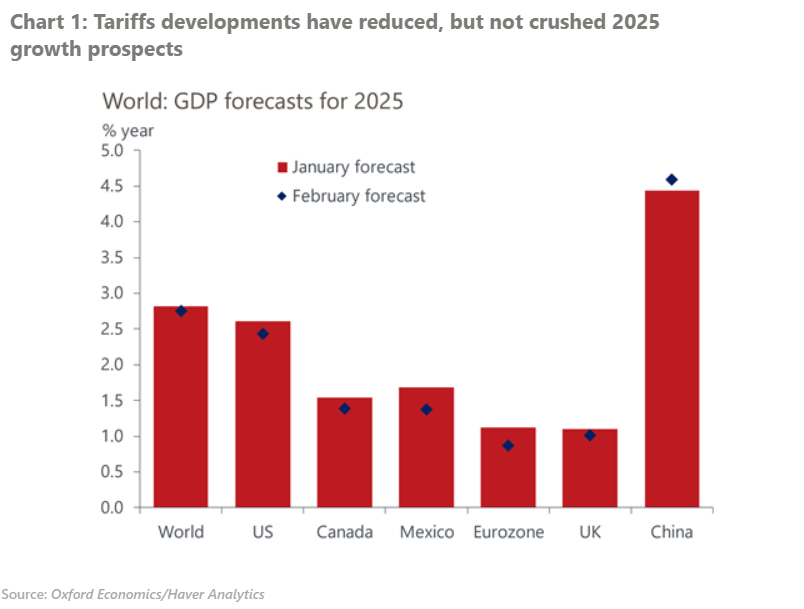

Tariff developments don’t change the broad growth story

- We’ve only made relatively small downward adjustments to our global GDP growth forecasts for this year and next despite the considerable tariff drama at the start of February. We’ve lowered our world GDP growth forecasts by 0.1ppt to 2.8% in both 2025 and 2026. We’ve made only small downward revisions for two key reasons.

- First, global GDP growth in Q4 2024 was revised up, most notably due to China’s strong end to last year. This strength mechanically helped to push up China’s calendar year forecast for 2025 by 0.2ppts to 4.6%, countering some of the dampening effects from tariffs elsewhere.

- Second, we expect the US to hike tariffs by less than Trump has threatened. We still think Trump sees tariffs mainly as leverage in negotiations and that deals can be made to prevent or limit US tariff action. Indeed, Mexico and Canada won one-month reprieves on major tariff increases by making concessions that will incur only small costs relative to the disruption from sudden and dramatic tariff hikes. Despite the volatility in early February, it’s not clear that the risks surrounding tariffs have taken a dramatic turn for the worse.

- Overall, we’ve brought forward the likely timing of US tariff hikes by a couple of quarters. For Canada, we now expect broader tariff increases than assumed a month ago, but we think the measures still fall short of what Trump threatened to impose at the start of this year. We have also assumed a blanket 10% tariff will be imposed on the EU towards the end of Q1 as Trump broadens his focus from China and the US’ neighbours.

- Trump’s pledge to raise tariffs on steel and aluminium imports to 25% doesn’t affect our baseline forecast at this point. We had already incorporated a watered-down version in our baseline, assuming at least 10% tariffs on metals from many key US import markets, including the EU, China, Canada, and Mexico. This is consistent with the use of tariffs as a negotiating tool. While the announcement will have key repercussions for metals producers and US firms that use metals as a key production input, the marginal effects of specific metals tariffs on overall GDP and inflation will be small.

- We now anticipate slightly higher US inflation and a more cautious pace of cuts by the Federal Reserve. But the squeeze on real household incomes won’t undermine existing strong fundamentals. The adverse effects would have been far worse if Trump had carried out his February 1 tariff threats – we have produced new scenarios to measure the likely consequences if tariffs on imports from Mexico and Canada rise to 25%.

- We’ve lowered our US GDP growth forecast for 2025, but the reduction of 0.2ppts to 2.4% leaves the US exceptionalism story still intact. We’ve downgraded our eurozone GDP growth forecast for 2025 by 0.3ppts to 0.9%. Despite our assumption that the US will impose a 10% tariff rate on the EU and that the bloc retaliates, US trade as a share of GDP is too small for this to have substantial impact, at least at a macro level. Some of the eurozone cut reflects the weak growth outturn in Q4 2024.

Request a Free Trial

Complete the form below and we will contact you to set up your free trial. Please note that trials are only available for qualified users.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will not share your personal information with other individuals or organisations without your permission.

Find out how Oxford Economics can help you

Talk to us